XRP officially regained its top performer position in early 2026. After weeks of tough consolidation and tightening descending triangle This pattern kept traders nervous, but the bulls finally staged a massive breakout. This move signals a potential change in market structure that could pave the way for new all-time highs.

XRP Breakout: Breaking out of the descending triangle

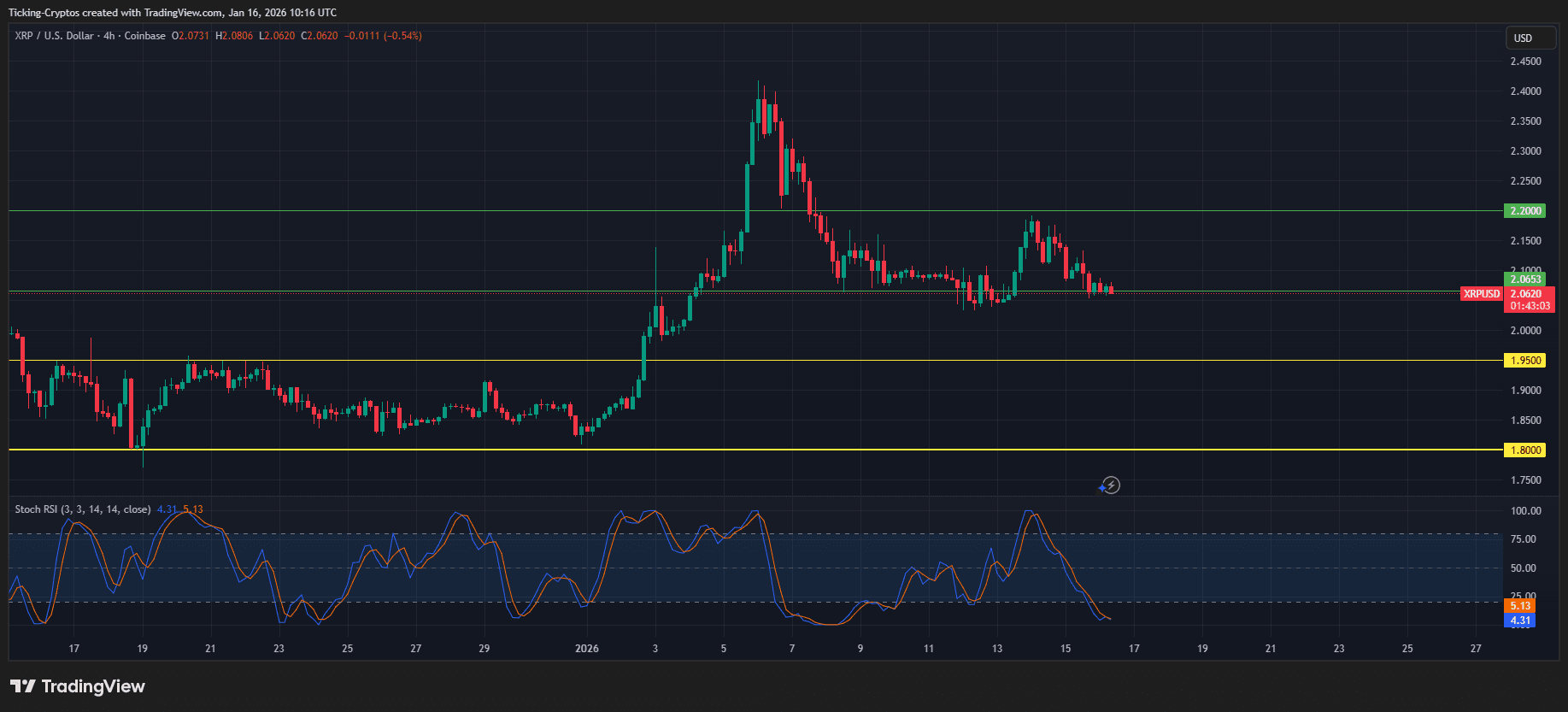

$XRP’s technical setup during the last months of 2025 was dominated by a large descending triangle. Although many were worried about a break towards the $1.25 level, XRP bulls held on to the psychological support at $2.00 with iron determination.

On January 14, 2026, XRP decisively broke above the upper resistance trend line of the triangle. This breakout was fueled by a surge in trading volume. 189% above daily average— confirming that this is not just a “fake” but a genuine influx of institutional and retail demand.

XRP/USD 4H – TradingView

Major technical indicators turn bullish

- Moving average: XRP has successfully switched to support at the 50-day and 100-day exponential moving averages (EMAs).

- RSI and MACD: The Relative Strength Index (RSI) has been steadily rising without being overbought, and the MACD has recorded a new bullish crossover on the daily time frame.

- Volume profile: The strong buying pressure around $2.14-$2.17 indicates that the previous resistance has become a solid bottom.

XRP Price Prediction: Next Bullish Target

With a descending triangle behind it, the path of least resistance appears to be upwards for XRP. Based on the triangle height and key Fibonacci extension levels, the main targets for the coming weeks are:

- Intermediate resistance ($2.30 – $2.42): This was a local peak reached on January 6, 2026. Recovering this zone is essential to reaching higher levels.

- Main target ($2.88): A successful hold above $2.42 opens the door to $2.88, a level that analysts perceive as the “last hurdle” before entering the true price discovery phase.

- Long term bull case ($3.66 – $5.00): If ETF inflows continue at the current pace, the total will already be exceeded. Net inflows of $1.2 billion—XRP will challenge its all-time high of $3.66 and could aim for $5.00 by mid-2026.

XRP/USD 1D – TradingView

Before participating in a trade, it is always wise to check exchange comparisons to ensure you are getting the best liquidity and lowest fees.

Bearish scenario: worst-case support level

In the volatile world of cryptocurrency news, even the strongest breakout can face a retest. Although sentiment is overwhelmingly bullish, traders must always be aware of downside risks.

- Immediate support ($2.00): This leaves a line in the sand. As long as XRP remains above $2.00, the bullish theory remains in place.

- “Safety Net” ($1.80): If a broader market correction occurs, XRP could fall and retest December lows near $1.80.

- Worst case scenario ($1.25): If institutional support fails and the Clarity Act faces further delays, a “flash crash” towards the $1.25 liquidity zone remains the ultimate bearish target.

Is it time to buy XRP?

A technical breakout from a descending triangle is a strong signal. With regulatory clarity following the SEC settlement and the growing success of the XRP Spot ETF, the fundamentals are finally aligning with the charts. However, like any other high-value asset, proper storage is important. If you plan to hold your XRP for the long term, consider using one of the top-rated hardware wallets to keep your assets safe.