XRP traded around $2.06 on Friday as social buzz around the token turned sharply negative after a nearly 30% drop in two months, according to an analytical report.

Related books

Traders and data firms warned of a sudden increase in bearish messages, a reversal from the more mixed picture seen earlier this year. The mood surrounding virtual currencies is tense, and XRP is not immune.

The mood of the crowd turns to fear

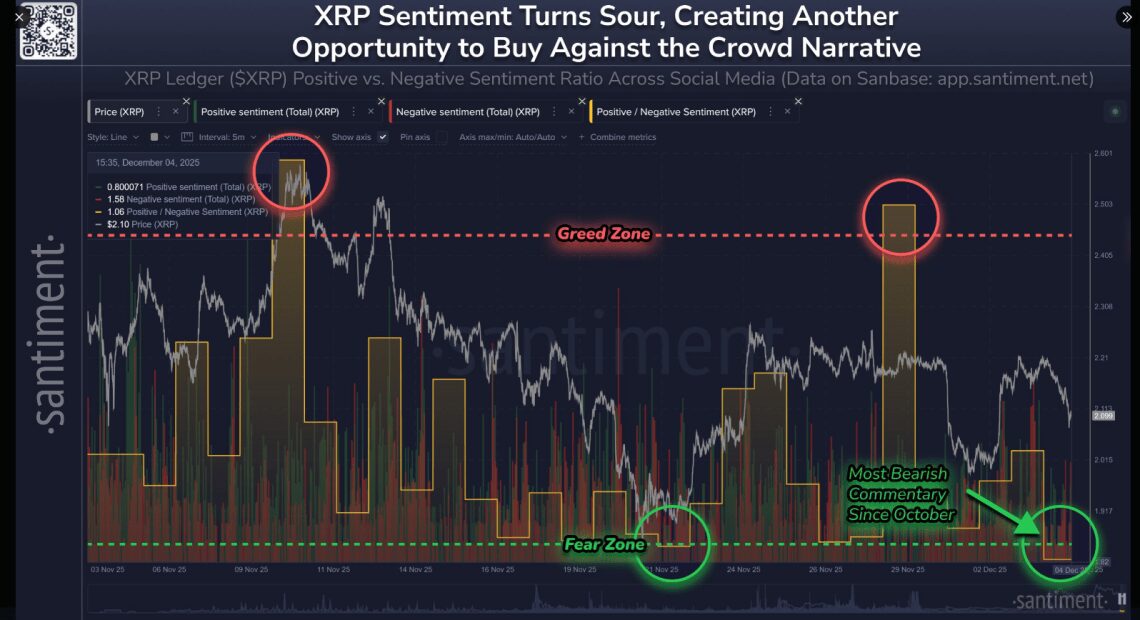

Based on a report from Santiment, its chart tracks the price of XRP against positive and negative comments, as well as a composite sentiment line aimed at gauging crowd sentiment.

In recent readings, the balance has entered what Santimento calls the fear zone, with negative stories outweighing optimism. In this same model, Santiment cited November 21 as a comparable moment.

At the time, XRP rose more than 20% in three days before the rally cooled down. This past movement is used as a reference point by traders who closely monitor social signals.

😨 According to our social data, XRP (-31% over the past two months), unlike Bitcoin, is seeing the most fear, uncertainty, and doubt (FUD) since October.

🔴 Circles indicate days when there are an abnormally large number of bullish comments on XRP (Greed Zone) compared to bearish comments… https://t.co/lJNW8zlRwK pic.twitter.com/ZoFmwrtw3h

— Santiment (@santimentfeed) December 4, 2025

Short aperture and reflex movement

Extreme pessimism can be a catalyst. If weak holders sell and short sales pile up, a quick reversal can squeeze out sellers and send prices skyrocketing. This is the scenario that many people are paying attention to. If buying pressure emerges, a severe bear market could pave the way for a reflexive rebound.

Santiment urged his followers to keep an eye on the same dashboard to spot rapid changes in sentiment, with some traders saying the mood of the crowd often drives prices in the very short term.

Price fluctuations and market background

XRP was last reported down about 4% at $2.04, extending last month’s losses by about 6%. On the same day, the total crypto market fell by about 1% to $3.22 trillion, a pullback that has dragged down many altcoins, even though liquidity remains concentrated in the largest tokens.

The order book for smaller pairs has become thinner, leveraged positions have been reduced, and there is less depth to absorb large moves. Traders also cited uncertainty surrounding future U.S. policy decisions as a factor in their cautious stance.

Organizational push and bookkeeping activities

Analysts following the token say the token still has room to rise towards $2.50 to $2.75 if cross-border liquidity flows accelerate and stablecoin projects on the XRP ledger gain traction. Reports have revealed that Ripple is moving to expand its reach to institutional investors.

Buy XRP. Stop focusing on other crypto coins

they don’t matter

— Cameron Scrubs (@imcameronscrubs) December 2, 2025

Last month, the company launched its digital asset spot prime brokerage service in the US after acquiring Hidden Road and integrating it into Ripple Prime, a combined trading and custody setup for professional clients. This boost is attracting attention as it has the potential to support demand in the long term.

Related books

Bullish voices and market signals

Despite the FUD surrounding XRP, Tradeship University founder Cameron Scrubs said other crypto assets “don’t matter” and called on his followers to “buy XRP” again. In a previous post, he also called for “selling everything and buying XRP.”

Traders are closely monitoring these statements as sentiment changes, while on-chain data and social signals are monitored for signs that the current negative buzz may be starting to ease.

Featured images from Gemini, charts from TradingView