MicroStrategy’s Bitcoin bet: High conviction, high risk

MicroStrategy has expanded from a traditional software company to bitcoin proxy. Over the past few years, the company has consistently purchased Bitcoin dollars, often using bonds, convertible notes, and equity issuances to do so.

As a result, Bitcoin currently dominates the MicroStrategy market balance sheet. Since the company holds hundreds of thousands of BTC, its valuation is highly sensitive to Bitcoin price fluctuations. While this strategy works very well during bull markets, it also creates structural risks during prolonged economic downturns.

At this point, MicroStrategy is no longer just “exposed” to Bitcoin. it is economically tied to it.

Bitcoin price outlook: volatility still dominates

Bitcoin continues to be a key variable in MicroStrategy’s future.

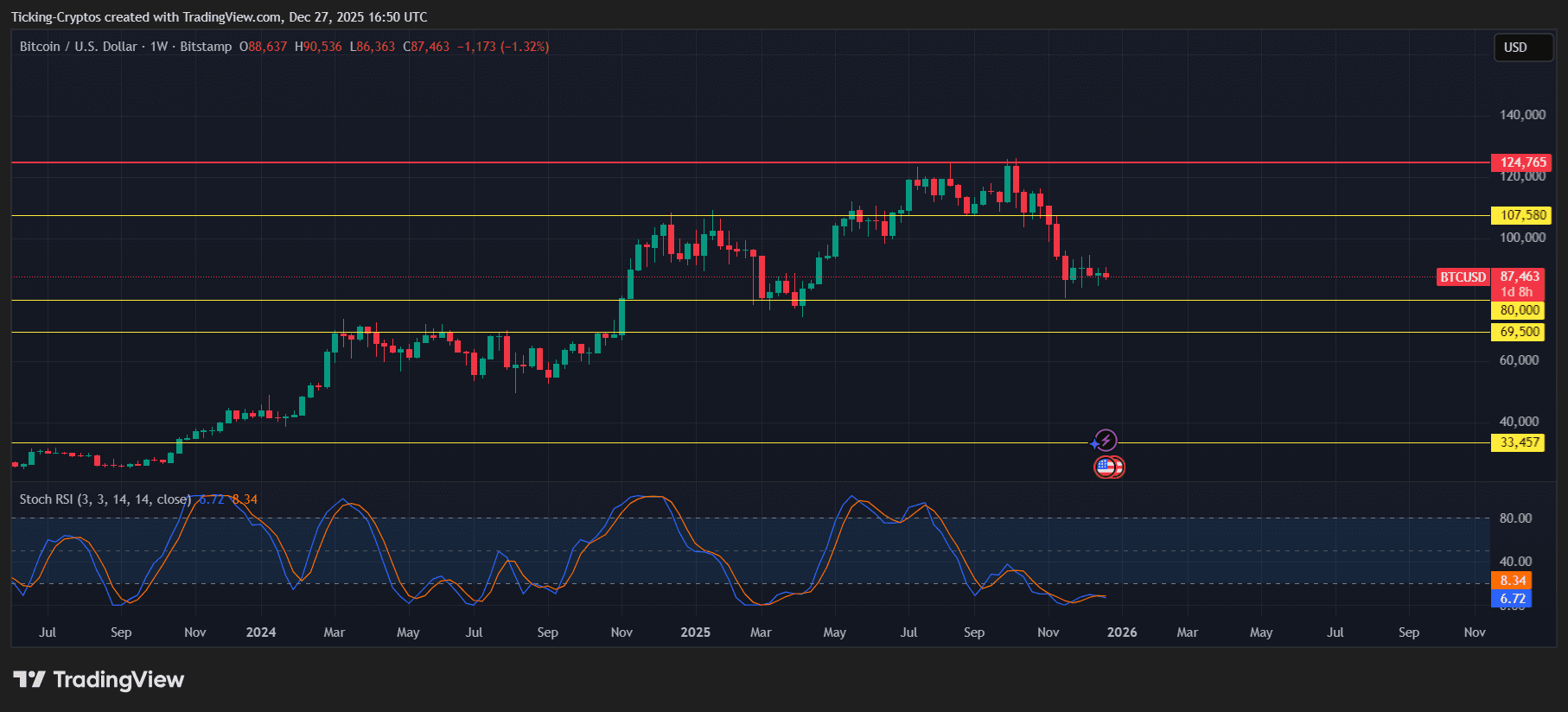

Please see the attached weekly $BTC chart.

- Bitcoin recently lost momentum after failing to break above key resistance levels.

- Current price trend is hovering around an important support zone

- Momentum indicators remain weak; Continued downside risk

BTC/USD 1W – TradingView

Bitcoin has historically recovered after severe bear markets, and those recoveries have often occurred after a long stagnation. In previous cycles, BTC would stay sideways or decline for 1-2 years before returning to an upward trend.

A scenario where Bitcoin plummets or even trades at levels that have been depressed for years cannot be ruled out.

MicroStrategy Stock Analysis: Bidirectional Leverage Cut

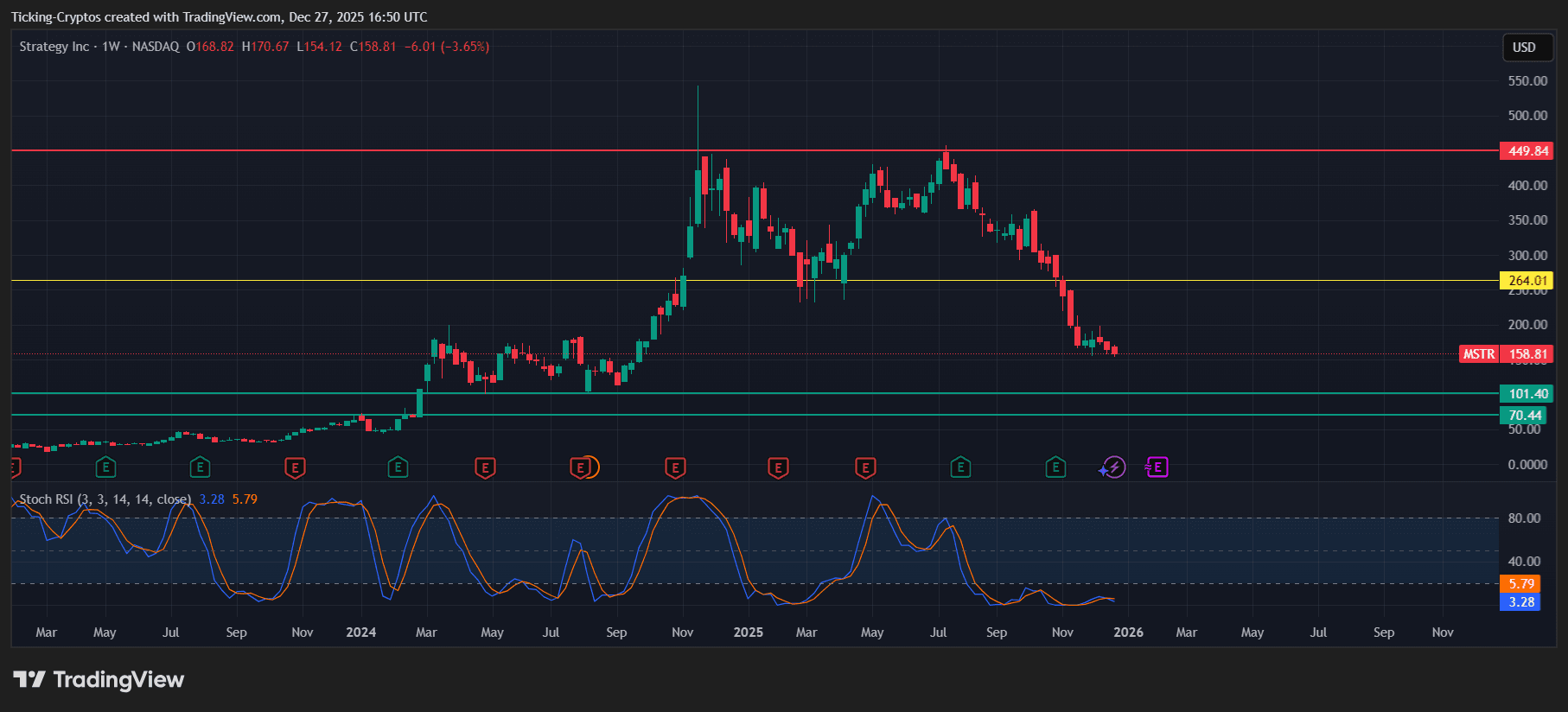

MicroStrategy’s charts clearly reflect this risk.

- MSTR peaked near the major resistance level and then entered a strong downtrend

- A major support level has already been lost

- Stocks are currently trading well below their highs, reflecting Bitcoin’s weakness.

MSTR 1W – TradingView

Although MicroStrategy does not run on Bitcoin, Correlation increases rapidly when markets are stressed. When BTC is actively sold, MSTR tends to underperform due to leverage, debt exposure, and investor anxiety.

In bull markets, MSTR often outperforms Bitcoin. In a bear market, typically fall harder.

Not quite, but close enough to the point.

Bitcoin determines:

- MicroStrategy Reserve Value

- Investor confidence in the strategy

- A company’s ability to raise capital cheaply

However, MicroStrategy also includes:

- Operating expenses

- employee salary

- debt repayment obligation

- Corporate expenses not related to Bitcoin price

Bitcoin can also “do nothing” for years.

The company cannot.

Structural problem: Time is working against companies

In theory, Bitcoin could crash towards zero, stay there for two years, and then recover. There are no salaries to pay, no debt payments to make, and no operational waste.

MicroStrategy does.

If Bitcoin were to:

- A state of deep depression lasts for several years

- Causing large unrealized losses on the balance sheet

- Restrict access to new financing

In that case, MicroStrategy may face serious sustainability issuesregardless of long-term Bitcoin optimism.

This isn’t about faith in Bitcoin; it’s important. Company viability under prolonged stress.

Will MicroStrategy collapse in 2026?

A crash is not guaranteedbut the risks are real.

The future of MicroStrategy is highly dependent on:

- Bitcoin retains long-term value

- Avoiding prolonged multi-year drawdowns

- Maintaining access to capital markets

If Bitcoin recovers quickly, MicroStrategy stands to benefit tremendously.

If Bitcoin goes into a long, deep winter, MicroStrategy is at far greater risk than Bitcoin itself.

In short:

- Bitcoin can wait

- MicroStrategy can’t wait forever

This asymmetry is a core risk that investors need to understand heading into 2026.