Global markets are recalibrating expectations as the US Federal Reserve signals another rate cut in 2026. Stocks and bonds are reacting first, but Stella ($XLM) It may follow soon. Historically, interest rate cuts accelerate risk-on sentiment, but the crypto market reaction will still depend on liquidity, investor confidence, and real-world adoption. With XLM price trading around $0.20 and in an extended downtrend, the question is: can these macro changes trigger a sustainable bull market, or does the coin risk further decline before recovering?

Stunning price predictions: rate cuts may not be a silver bullet

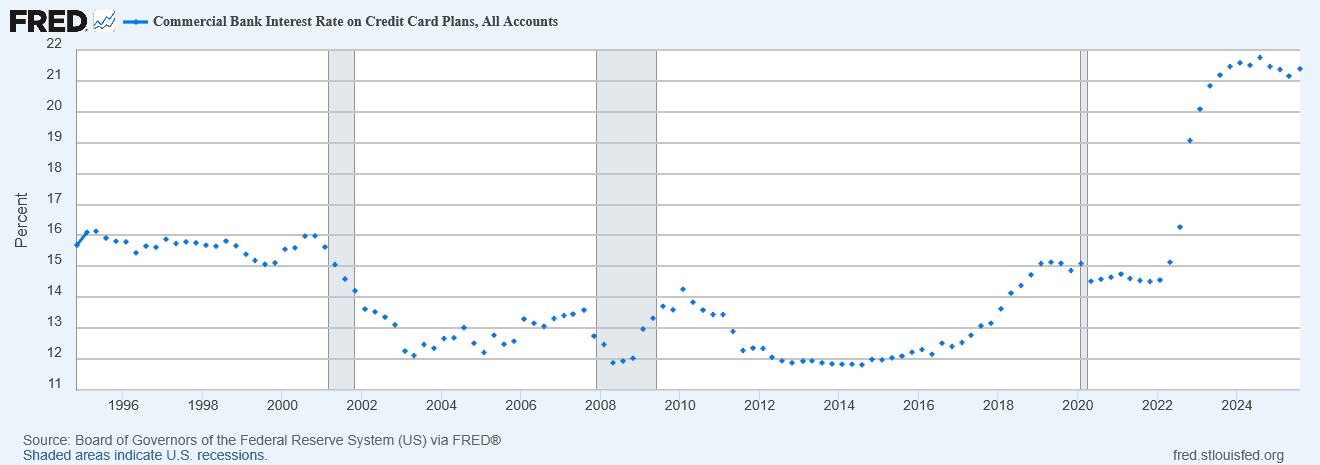

While the Fed’s gradual rate cut plan may seem bullish on paper, its impact is likely to be uneven. Interest rates on credit cards and savings accounts respond quickly Meanwhile, auto loans and long-term home loans remain sluggish due to inflation expectations. This uneven relief package could limit the short-term liquidity gains expected by crypto investors.

If consumer spending and credit growth remain weak, risk assets like XLM could continue to face headwinds. The key will depend on how much trust returns to the retail market. A dovish Fed typically signals a weaker U.S. dollar (positive for crypto), but sustained inflation could cap any gains.

Stellar Price Prediction: XLM Price Struggling Below Resistance

If you look at it, Daily TradingView ChartThe technical stance of Stellar prices reflects that the market remains under pressure.

- Stella price does not change $0.202below it 20-day SMA (0.217) And the Bollinger bands above $0.233suggesting sustained bearish momentum.

- The band remains moderately wide, indicating volatility with no clear breakout direction.

- Since October, XLM price has formed consistently lower highs and lower lowsindicating that buyers remain hesitant.

- The level of psychological support is $0.20 It has held up so far, but a drop below that could pave the way for the next direction. $0.17 or $0.15 — Next major support zone.

The market appears to be consolidating near the bottom of the range, which is often preceded by either a capitulation or reversal. For trend reversal, XLM price must decisively close above $0.23which is consistent with the mid-Bollinger band and the short-term moving average.

Sentiment and Correlation: Cryptocurrencies Awaiting Macro Confirmation

Bitcoin and Ethereum have stabilized after recent selloffs, but small-cap stocks like Stellar continue to struggle to attract inflows. Macro links are clear — Declining interest rates increase appetite for speculationHowever, traders are waiting for concrete action from the Fed before re-entering altcoins.

XLM is a payments-focused asset and reflects the broader liquidity cycle. Historically, its rise has been linked to the expansion of credit markets and an increase in the volume of stablecoin transfers. If the Fed’s rate cuts trigger credit easing by mid-2026, XLM prices could benefit from fresh capital inflows into risk assets.

Short-term stellar price forecast: bearish but near exhaustion

Momentum indicators (such as RSI and Bollinger Positioning) indicate oversold conditions but do not yet indicate a reversal signal. The bears are still in control, but the selling pressure is gradually easing. of flat lower bollinger bands This suggests that the downward momentum may be weakening. This can lead to lateral integration between: $0.19–$0.22 before attempting a breakout.

In other words, Stellar’s price isn’t ready to rise just yet, but the worst could be over once macro tailwinds start aligning.

Medium- to long-term XLM price forecast: Moderate recovery by 2026

If the Fed succeeds in easing financial conditions without reigniting inflation, Stellar could see a modest recovery through the second half of 2026. Potential targets are expected to be:

- Q2 2026: range boundary between $0.18 – $0.23volatility is limited.

- Q3 2026: Possibility of breakout above $0.25subject to Bitcoin stability and positive comments from the Fed.

- Q4 2026: Possibility of return towards $0.30–$0.35If risk-on sentiment fully returns and institutional investor liquidity expands.

The long-term recovery will depend on Stellar continuing to gain momentum in the core drivers behind its utility: cross-border payment networks and fintech integration.

conclusion

Right now, XLM prices are at a crossroads — Although technically weak, the macro environment is changing in its favor. The coming months will test whether dovish monetary policy can overcome the decline in investor enthusiasm. For traders, key zones remain Support at $0.20 and resistance at $0.23. A break above this range could confirm a reversal, but a break below $0.18 risks further decline.

In short, $XLM’s 2026 story hinges less on the rate cuts themselves and more on how well they restore confidence. To the risk market. If the Fed’s easing cycle coincides with improved liquidity and lower inflation, Stellar could be quietly poised for its next big rally.