Market overview: A strange year for risk assets

2025 has been one of the most turbulent market environments in recent history. Traditional assets proliferated and liquidity flooded the system; Cryptocurrency performance is poor.

$Silver posted triple-digit gains.

$Gold surged aggressively.

The Nasdaq rose significantly.

meanwhile:

- Bitcoin dollar ended the year in decline

- $Ethereum further underperformed

- Altcoins are generally struggling

Even more puzzling is that this discrepancy occurred Despite massive global liquidity injections From central banks and governments.

This contradiction is at the heart of today’s cryptocurrency debate.

The 2025 liquidity paradox

Throughout 2025, global liquidity expanded rapidly.

- huge purchase of government bonds

- Central bank balance sheets expand again

- China, US and other economies inject hundreds of billions of dollars into the market

Historically, this type of environment Very bullish on cryptocurrencies.

But this time, the cryptocurrency did not respond.

Instead of acting as liquidity sponges, Bitcoin and Ethereum have lagged behind traditional assets, raising serious questions about what has changed.

Why cryptocurrencies underperformed while everything else rose

1️⃣ Capital flows shift towards “safer” assets

After years of volatility, many large investors supported:

- Hard assets such as gold and silver

- Equity exposure through major indices

- A means of clarifying regulations

Cryptocurrencies are still perceived to be risky and politically sensitive, and are often last assignmentnot the first.

2️⃣ Structural selling pressure in virtual currencies

Unlike gold and stocks, cryptocurrencies faced internal pressures.

- minor sales

- ETF outflows during adjustment

- Unlocking and issuing tokens

- Forced sale from a leveraged position

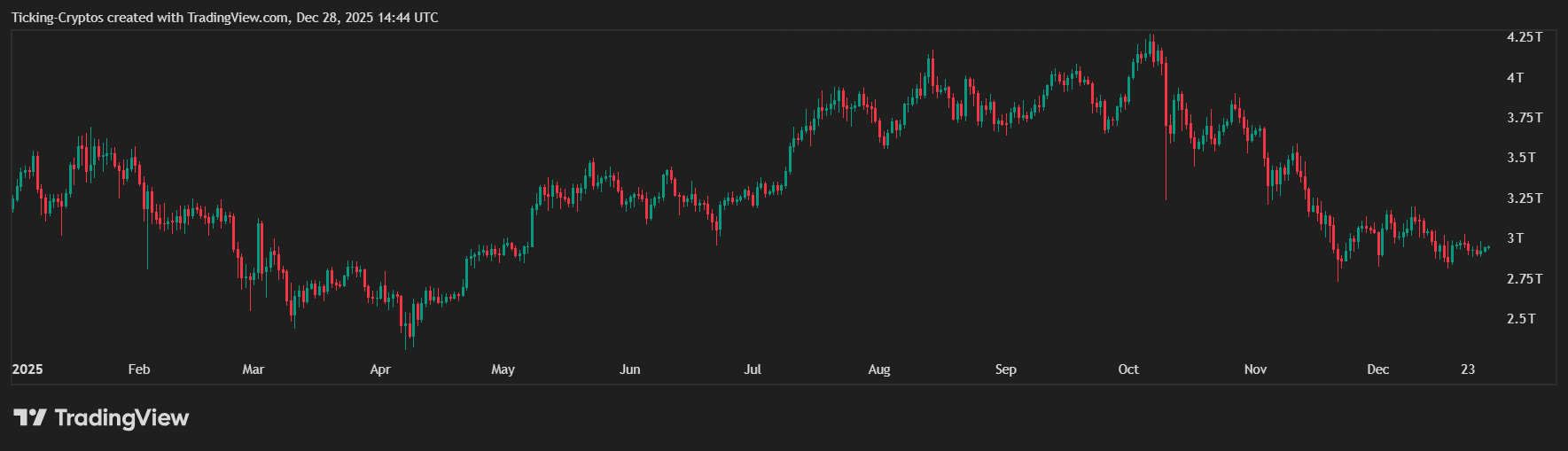

Cryptocurrency market capitalization in USD in 2025 – TradingView

Liquidity has flowed into the system, but Not all liquidity flows into cryptocurrencies equally.

3️⃣ Regulatory and political overreach

Despite progress, cryptocurrencies in 2025 remained:

- Ongoing regulatory investigation

- Political weaponization of stories

- Uncertainty regarding taxation and compliance

This discouraged short-term capital allocation, even in a bullish macro environment.

Two scenarios for 2026

As 2025 comes to a close, the following questions remain in the market: Two realistic scenarios.

Scenario 1: Something breaks in the structure of the cryptocurrency

In this scenario:

- Cryptocurrencies are no longer as responsive to global liquidity as they once were

- Capital permanently lowers the price of crypto risk

- Bitcoin and Ethereum lose their role as high-beta liquid assets

This means the future will be slower, more utility-driven, with subdued cycles and much less speculative upside room.

Scenario 2: Cryptocurrency is late – not a failure

Another view is simpler.

The code is slownot broken.

Historically:

- Cryptocurrencies often lag macro liquidity by several months

- Large gatherings tend to be fraught with dissatisfaction and distrust

- Underperformance often precedes a strong catch-up move.

If this pattern holds true, 2025 may be remembered as the next year. Year of establishmentis not a failure.

Cryptocurrency price prediction for 2026: catch up or capitulate?

If cryptocurrencies catch up in 2026, the ingredients are already in place.

- Expanding global liquidity

- The story of scarcity is back

- Bitcoin’s structural supply constraints

- Risk appetite returns as uncertainty fades

In that case, in 2026 we could see the following situation:

- Late but active virtual currency rally

- Bitcoin regains leadership among risk assets

- Ethereum and some altcoins outperform late in the cycle

Otherwise, the market will permanently shift to lower volatility and slower growth, ushering in a completely different era of cryptocurrencies.