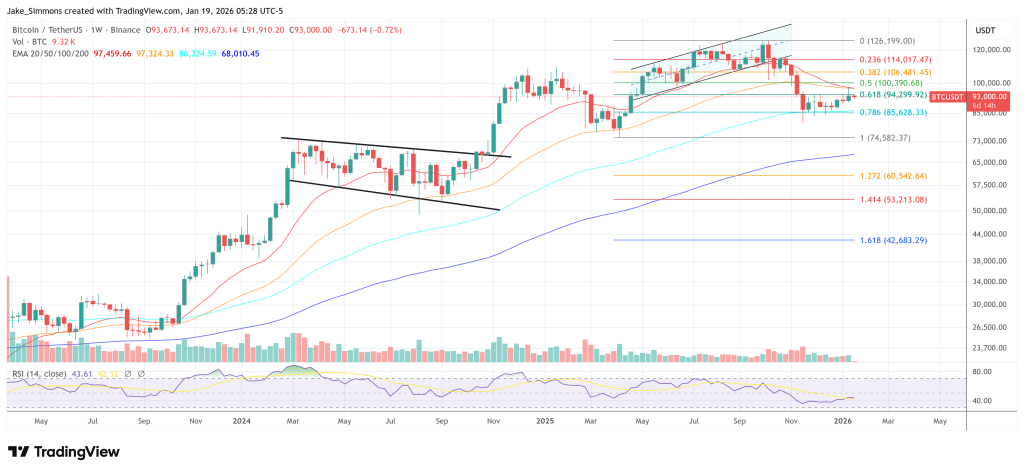

Bitcoin fell 3.8% from about $95,500 to $91,920 in New York late Sunday, as a sudden risk-off impulse hit the crypto market and quickly spilled into high-beta majors. Ether fell 5.3% to $3,177, while XRP and Solana underperformed with drawdowns of 10.4% at $1.847 and 9% at $130, respectively, due to forced termination of leveraged positioning.

Why are Bitcoin and cryptocurrencies falling today?

The immediate trigger was the geopolitical and trade headlines that jumped into the liquidity window over the weekend. President Donald Trump said the United States will impose a 10% tariff on imports from Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands and Finland starting February 1st, and will increase the tariff to 25% on June 1st unless the US reaches a deal to acquire Greenland.

Related books

European officials branded the move coercive and suggested a coordinated response. Dutch Foreign Minister David van Weel called the threat “blackmail” and added: “There is no need for it. It will not help the alliance (NATO).” Many of the targeted countries are NATO allies, and EU representatives have convened emergency talks on possible retaliation, saying the threat of tariffs “risks damaging transatlantic relations and sending them into a dangerous downward spiral.” French President Emmanuel Macron threatened EU “anti-coercive measures”.

BREAKING: French President Emmanuel Macron calls on the EU to use its “most powerful trade weapon” against the US after Trump’s tariff threat against Greenland.

President Macron is now calling for the use of the EU’s “anti-coercion instruments”.

If used against the US… pic.twitter.com/E47Bpe03lK

— Kobeissi Letter (@KobeissiLetter) January 18, 2026

For Bitcoin and the crypto market as a whole, it’s not the individual fee calculations that matter. It is a sudden return to global economic growth and policy risks. When macro traders hedge their risks towards headlines like this, liquidity markets tend to be the first to convey the shock, and cryptocurrencies with their 24/7 structures and rich derivatives footprints often become the pressure valve.

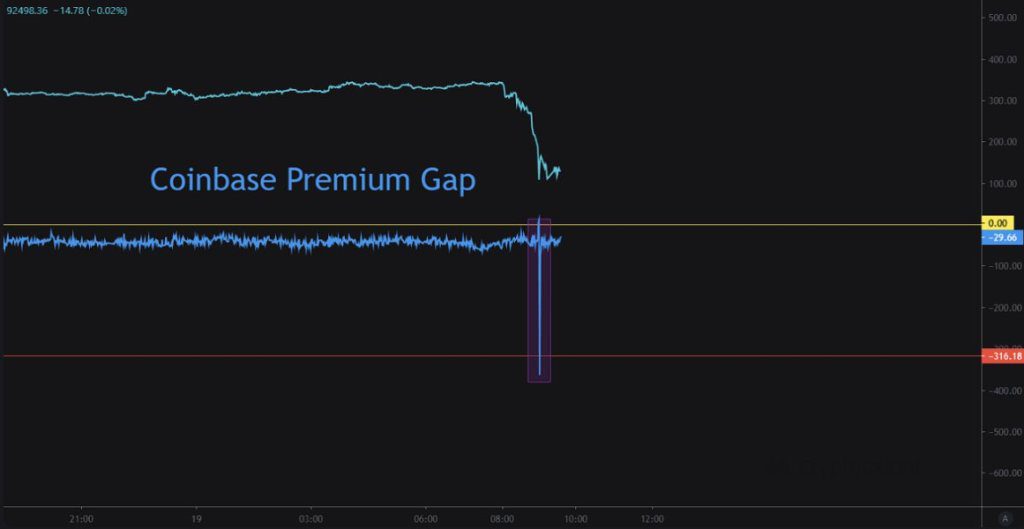

On-chain and venue-level indicators suggested that the selling pressure was not just an offshore flow. Mignolet, an analyst at CryptoQuant, pointed to the rise in “CPG” (Coinbase Premium Gap), an indicator that tracks the price gap between Coinbase’s USD market and Binance’s USDT market, and is often read as a proxy for US-led demand or supply.

“We are seeing the strongest selling premium (CPG) in recent periods. Since the ETF market was not open at the time, this selling pressure is coming from the US whales operating outside of the ETF. This is one of the traditional selling patterns that we have seen repeatedly in the past,” Mignolet wrote in a note on CryptoQuant.

This framework is important because it implies that this movement was not driven by ETF creations/redemptions, so marginal selling was active in the spot/OTC and derivatives channels that remained open throughout the weekend.

Related books

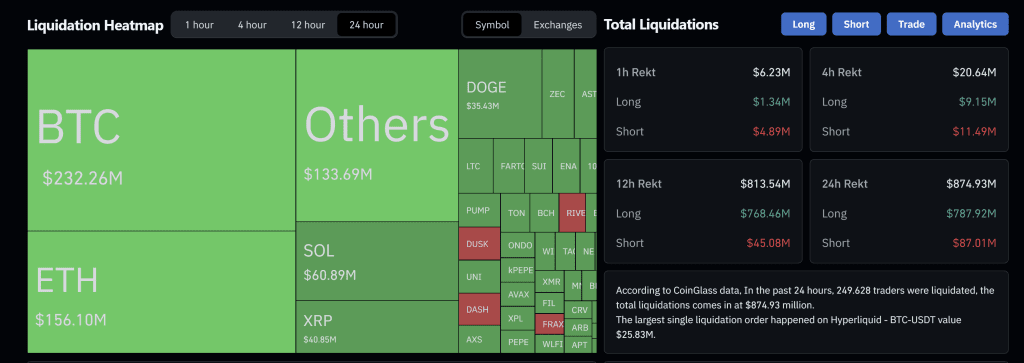

Once the spot price passed through a key level, futures traders did the rest. According to Coinglass data, 249,422 traders were liquidated, bringing the total liquidation amount to $874.93 million in the past 24 hours. Longs accounted for $787.92 million and shorts accounted for $87.01 million. This is typically an asymmetric wipeout that reflects a crowded long exposure being forced to close on a price decline.

At the time of writing, Bitcoin has recovered to $93,000.

Featured image created with DALL.E, chart on TradingView.com