$Bitcoin has never moved in a straight line. Every big rally comes with a painful correction, and deep bear markets ultimately set the stage for another expansion. As 2026 approaches, investors are once again asking the same question. Is Bitcoin rising in preparation for another major leg, or is there a long cooling period ahead?

To answer that, we need to take a step back and look at how Bitcoin has behaved over the years, especially across bull and bear cycles.

Bitcoin long-term price trend: a cycle-driven market

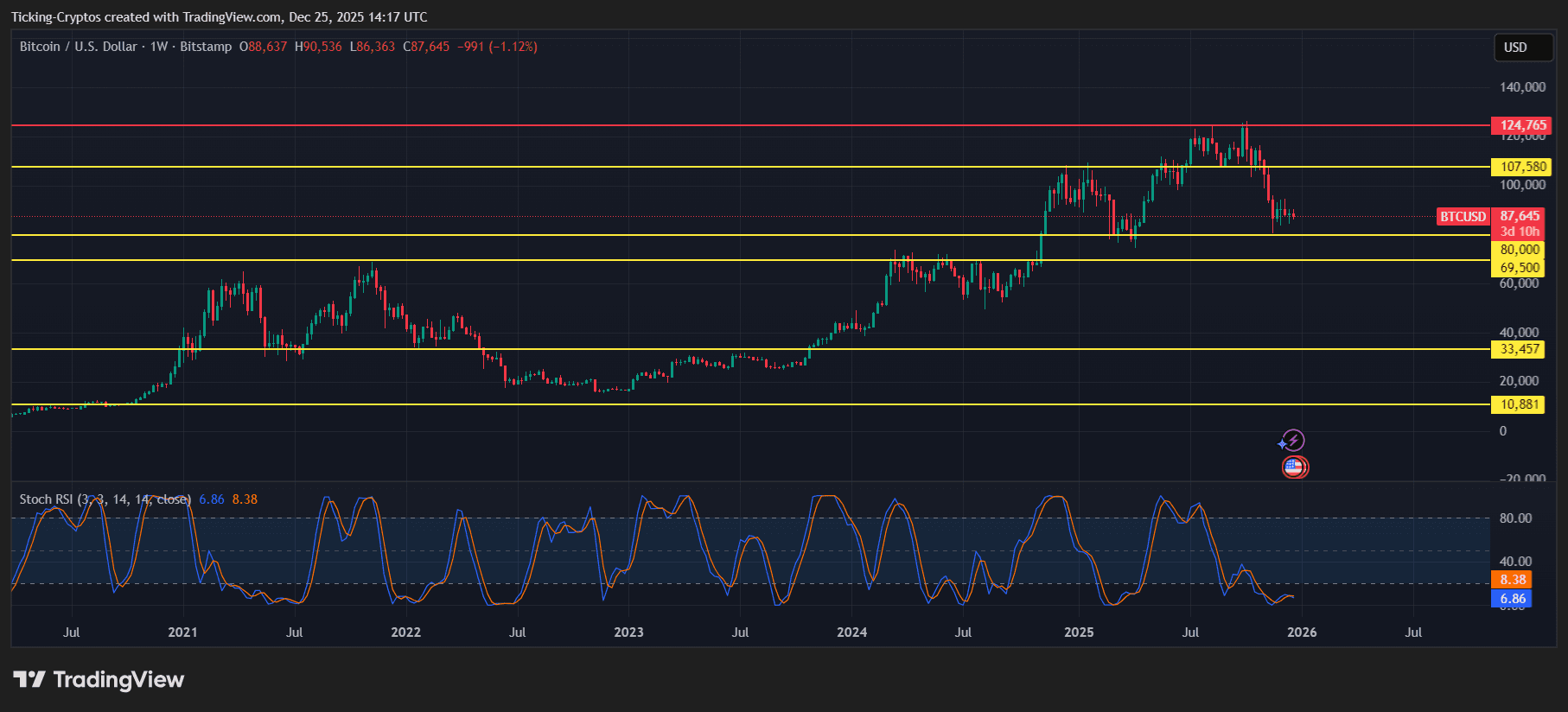

If you look at Bitcoin’s weekly chart, one thing becomes clear. Bitcoin moves cyclicallyit’s not a trend that will last forever.

BTC/USD 1W – TradingView

Historically, BTC has followed a rhythm related to liquidity, macro conditions, and halving events.

- Multi-year strong upward trend followed by sharp correction

- Explosive rises are often preceded by long periods of decline.

- Major support zones tend to hold for multiple cycles

On long-term charts, Bitcoin has respected important psychological levels for many years. Once these levels are breached, resistance often turns into long-term support, and this pattern continues to shape expectations for 2026.

Monthly revenue reveals clear patterns

The heatmap of Bitcoin’s monthly returns reinforces this cyclical nature.

Bitcoin monthly returns over the past few years – coin glass

Last 10 years:

- year of the bull Concentrations of strong green months, often stacking up double-digit gains

- bear year Characterized by an extended red period and a sharp drawdown

- While certain months, such as October and November, have historically produced significant gains, other months tend to be more mixed.

What stands out is that Even in a bullish year, Bitcoin experiences significant declinessometimes exceeding 20-30%. This is important when thinking about 2026. Volatility is a feature of Bitcoin, not a bug.

What will happen to Bitcoin in 2026?

From a technical perspective, Bitcoin enters 2026 after a massive expansion phase followed by a period of intense consolidation. Price action suggests:

- Long-term buyers still guard key support zones

- The momentum has slowed compared to the peak of the rally.

- Volatility is shrinking, which has historically preceded big moves

This kind of market structure is often seen mid cyclerather than absolute superiority or inferiority.

Bitcoin price prediction for 2026: bullish and bearish scenarios

bullish scenario

If liquidity conditions improve and risk appetite recovers:

- Bitcoin regains higher resistance zone and could push towards new cycle highs

- Long-term accumulation near key support levels could fuel further expansion phase

- New macro tailwinds could trigger a strong second leg of the bullish cycle

In this case, 2026 may resemble previous consecutive years rather than a complete market high.

bearish scenario

If macro pressures persist and liquidity becomes tight:

- Bitcoin could remain range bound or a more serious correction could occur

- Previous cycle support zones come back into focus

- Sideways price trends likely to dominate much of this year

Historically, Bitcoin has also spent years consolidating before resuming its long-term uptrend.

What history suggests about 2026

If we look at purely historical behavior, it looks like this:

- Bitcoin rarely reaches its peak and collapses quickly

- After a bull market, continuation and consolidation often occur alternately.

- Long-term holders tend to accumulate assets during uncertain times

This means that rather than following a parabola in 2026, Positioning, patience and risk management.