The US economy and the cryptocurrency market are closely linked. Therefore, it is really important for crypto traders to be aware of all the economic developments in the US.

The US market experienced a 1.21% increase the previous week. At one point in the week, the market slipped to a low of $6,284.37 when it closed, but was raised to $6,388.64. Over the same period, the crypto market fell by around 1.66%.

This week is expected to be an eventful week for the US market. The important events that crypto traders should be aware of are:

Major US economic indicators to watch this week

1. FOMC Meeting – July 29th-30th, 2025

The upcoming Federal Open Market Committee (FOMC) meeting will close on July 30th, with Federal Reserve Chairman Jerome Powell scheduled to hold a press conference soon thereafter.

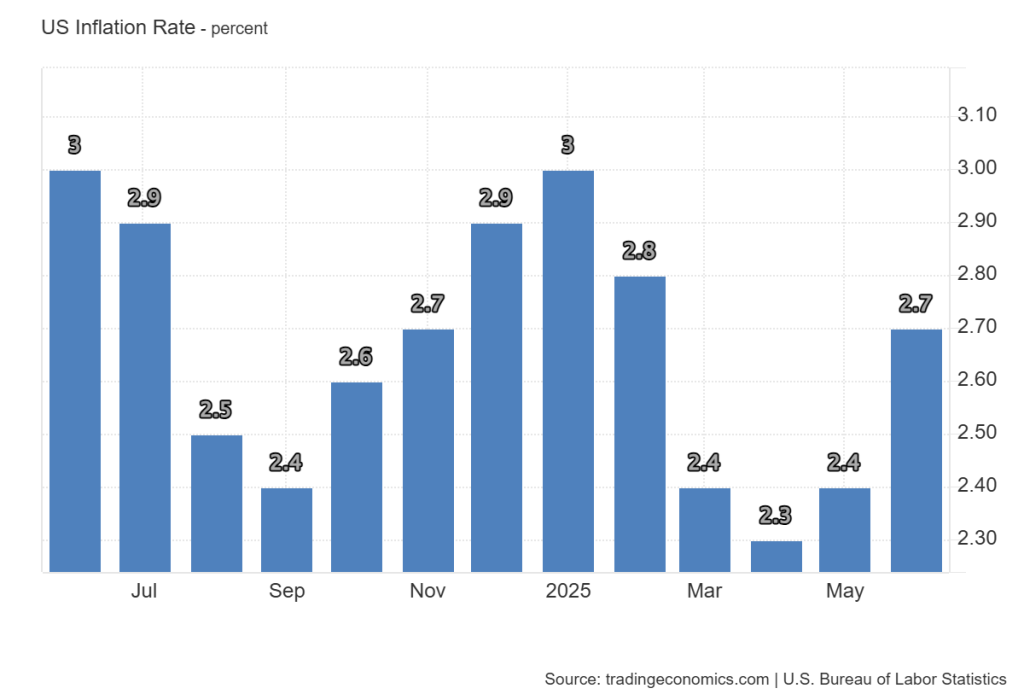

Market Expectations: Interest rates are expected to remain stable at 4.25%-4.50%. Key considerations accelerated for the second consecutive month, reaching 2.7% in June. Early unemployment claims fell to 221,000, marking the second decline this month.

Potential crypto market impact:

If the Fed maintains its data-dependent stance and does not immediately reduce its signal, cryptocurrencies could be able to curb upward movements. However, continued inflationary pressures could enhance Crypto’s appeal as a hedge against currency collapse.

2. Second Quarter Advance Estimates – July 30, 2025

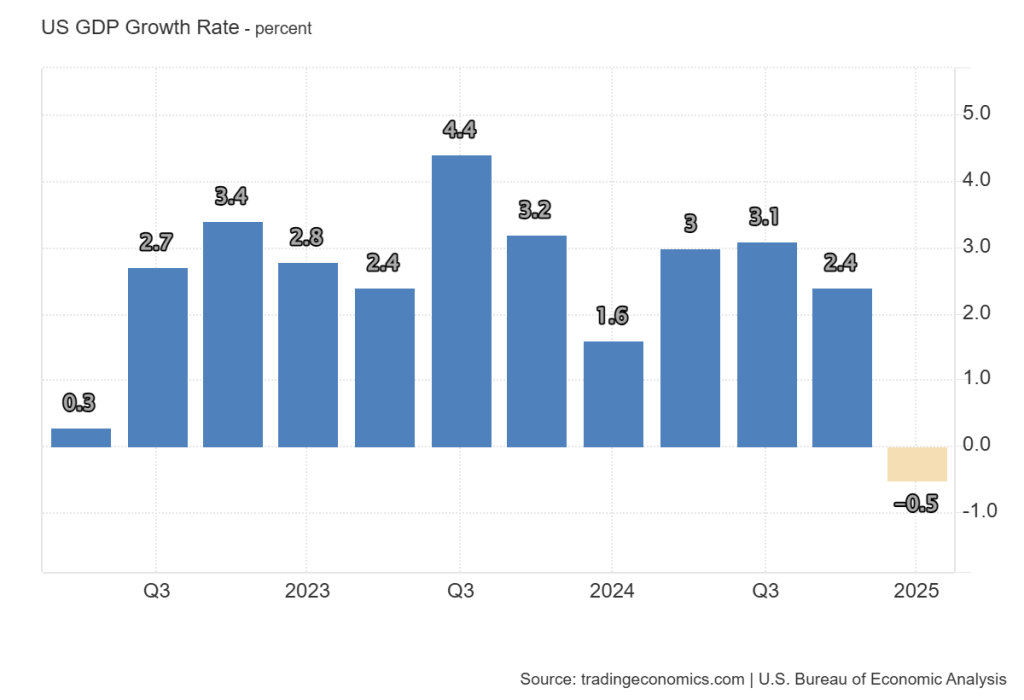

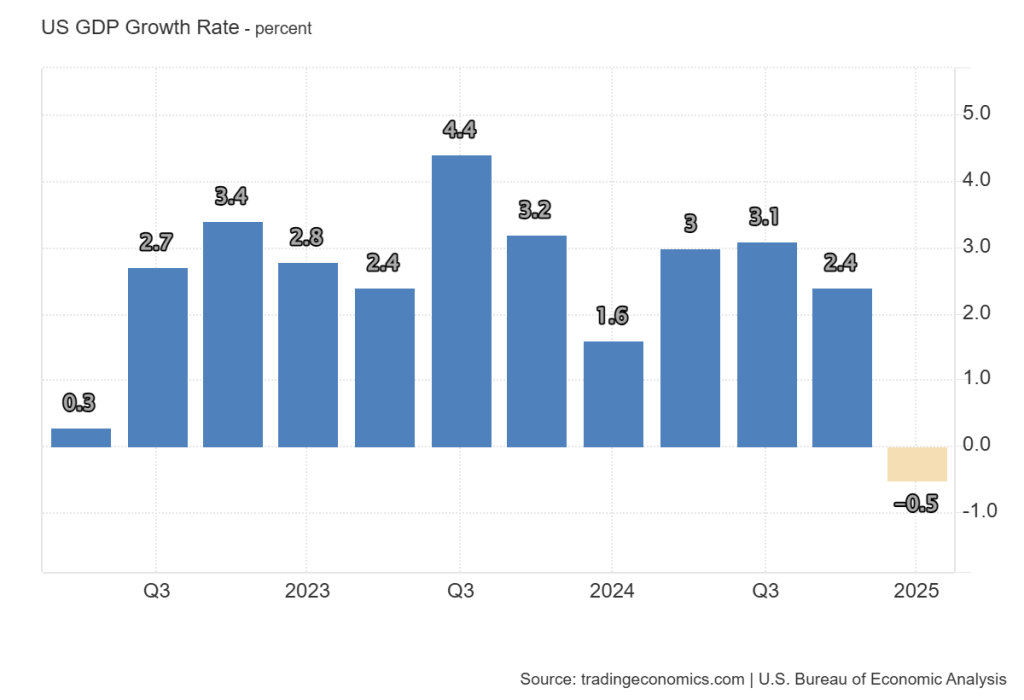

A preliminary estimate of the second quarter of US GDP will also be released on July 30th.

Previous (Q1 2025): -0.5% Consensus (Q2 2025): +2.5%

Potential crypto market impact:

Robust GDP rebounds could undermine expectations of near spawning mitigation, which could cause the code to temporarily limit the cap. Conversely, it could reduce the fear of a recession and support a broader risk appetite, including digital assets.

3. Non-farm salaries and unemployment rates – August 1, 2025

The July employment report, which includes non-farm payroll (NFP) and unemployment rates, is scheduled to be released on August 1st.

June NFP: July 147,000 Consensus: 102,000 June Unemployment rate: 4.1% Consensus: 4.2%

Potential crypto market impact:

A weaker employment growth and a modest increase in unemployment could strengthen expectations for financial easing later this year. Historically, such terms have supported the inflow of risky assets such as Bitcoin and Ethereum as investors relocate for actual yields.

Read again: Why is the crypto market rising today? BNB hits new ATH, XRP, ETH SURGE.

Strategic Implications for Crypto Traders

This week’s economic calendar presents multiple catalysts that can have a major impact on the direction of the short-term market. Traders and investors need to closely monitor changes in the tone of the Fed’s communications, the strength of economic production, and employment indicators.

Important takeouts:

Neutral to Hawkish’s Fed stance could temporarily limit cryptocurrency benefits. Higher than expected GDP could put pressure on digital asset valuations.

Conclusion

In a macro-sensitive trade environment, understanding the implications of the US key economic data has become essential for informed crypto investments. As the Fed balances inflation control and economic growth, digital assets could offer both risk and opportunity in response to changes in financial dynamics.

Get real-time updates on the latest trends such as Breaking News, Expert Analysis, Bitcoin, Altcoin, Defi, NFT and more.