Will Taylor, director of Crypto Insight UK, argued in a new video that XRP is “trading differently” this cycle, saying he sees a credible path for XRP to challenge Ethereum’s long-held No. 2 position and could even put pressure on Bitcoin if the right combination of narrative and market structure lands.

“XRP Curveball” Theory

Taylor underlined his thesis by highlighting comments from Mark Yusko, a prominent Bitcoin-focused investor, who warned of potential “curve balls” related to XRP and a future in which policymakers crack down on private stablecoins. Yusko speculated in Taylor’s talk that there could be a “CBDC version” where authorities effectively move users away from assets like USDT and USDC, a framework Taylor said resonates with what some in the XRP community have long predicted.

Mark Yusko said he is keeping an eye on potential policy curveballs, such as a future CBDC framework that could restrict private stablecoins like USDT and USDC, while noting that more $XRP activity could be happening behind the scenes. 🤯 https://t.co/ba4aqu2dLN pic.twitter.com/bpWBw7lGX2

— Xaif Crypto🇮🇳|🇺🇸 (@Xaif_Crypto) February 9, 2026

“Well, what have I been saying about XRP this cycle? I’ve been saying it looks different,” Taylor told viewers. “I said I think Bitcoin will challenge ETH for the number two spot. I also think it could challenge Bitcoin for the number one spot this cycle. And I know a lot of people don’t agree…but that’s actually what I think.”

Related books

Taylor was careful to frame this idea as a non-base scenario, emphasizing why he believes XRP is in a unique position if U.S. policy and institutional incentives change in its favor. He pointed to Ripple’s track record in the US, having weathered regulatory “trials and tribulations” and what he characterized as its closeness to political power in Washington. In his view, these factors could be important if the next phase of crypto adoption is shaped not only by ideology but also by compliance architecture.

He also referred to Ray Dalio’s comments mentioned in an interview that Taylor aired yesterday, in which Dalio talked about reduced transaction privacy in the future and the risk of being “shut out” if politically disfavored, a scenario that Taylor said tied into the broader CBDC discussion. Taylor emphasized that his point was not whether such an outcome is desirable, but that traders should take positions based on what is most likely to happen, not what they want to happen.

“If I could change my idea of what the world would be like, I would take my capital somewhere else and make the world a different place,” Taylor said. “But I’m not born into a world where I get to choose what happens in the future. But I’m born into a world where I see what I think will happen and bet accordingly. It’s the same as trading. You’re not trading or investing in something that you want to happen. You’re putting money in something that you think will happen.”

XRP vs. ETH vs. BTC

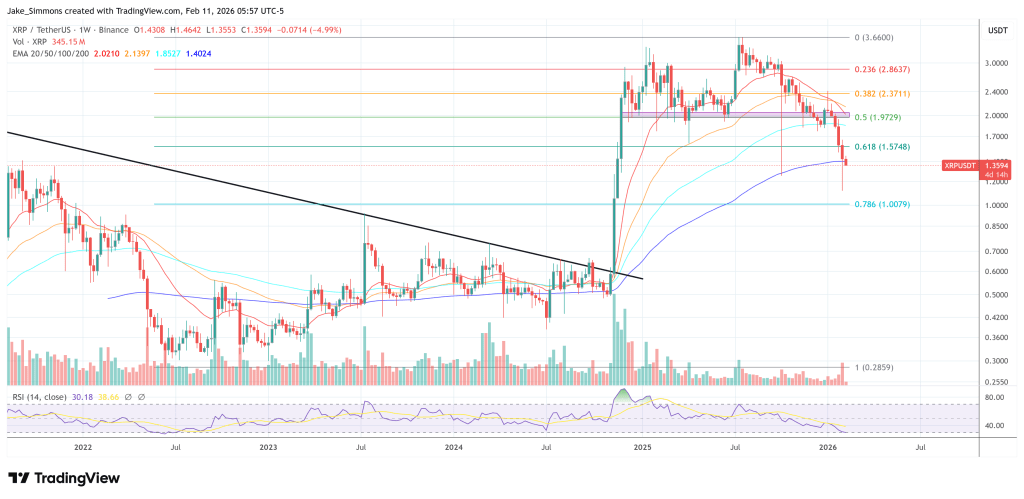

In terms of market structure, Taylor highlighted Bitcoin’s dominance, arguing that it is “very tight” in Bollinger Bands, conditions that he considers volatility settings. He revisited the historical example of an 11% Bitcoin decline before what he described as a 490% XRP surge, arguing that historically Bitcoin’s decline in dominance has tended to coincide with sharp XRP outperformance.

Taylor’s main argument is that the control compression has lasted for about six months and is now at a level compared to the earlier “pre-ETH and ICO” era, when the control dynamics looked structurally different. He is open to the opposite outcome where dominance increases further and Bitcoin “sucks liquidity,” but said that if a narrative catalyst arrives along with this move, XRP would be a potential beneficiary, increasingly favoring a downward dominance break that would mechanically strengthen the case for altcoin beta.

Related books

Relying on a three-day candlestick volume comparison on Binance, Taylor also argued that the amount of recovery in XRP appears to be more aggressive than the previous decline, while in the same framing, sellers appear to be more dominant in ETH and BTC. He linked that relative reading to XRP’s cross-chart against ETH and BTC, explained repeated attempts at range resistance, and suggested that triggering “positive price action” could accelerate XRP’s relative breakout.

He was wary of reflexively pumping, flagging short-term calendar items such as yesterday’s Clarity Act conference and today’s XRP Community Day. Still, Taylor’s broader point was about positioning for a regime change that he believes could be coming soon, noting that visible liquidity on the chart is concentrated above the spot level, stretching from about $1.50 to $4.30, with relatively little liquidity piling up below.

“People would be shocked if we started reversing and reversing quickly,” Taylor said, arguing that a rapid rally could force traders out of short-term positions. He then laid out the most bullish path forward: Bitcoin returning to new highs – he set a target of 150,000 and “180 Ishq plus” – while if Bitcoin’s dominance becomes “core” and XRP regains its share of that dominance, XRP will be unwound, setting up what he calls “crazy price action.”

At the time of writing, XRP was trading at $1.3594.

Featured image created with DALL.E, chart on TradingView.com