Bitcoin price started a new decline below $95,000. BTC is consolidating losses and remains at risk of further losses if it falls below $92,000.

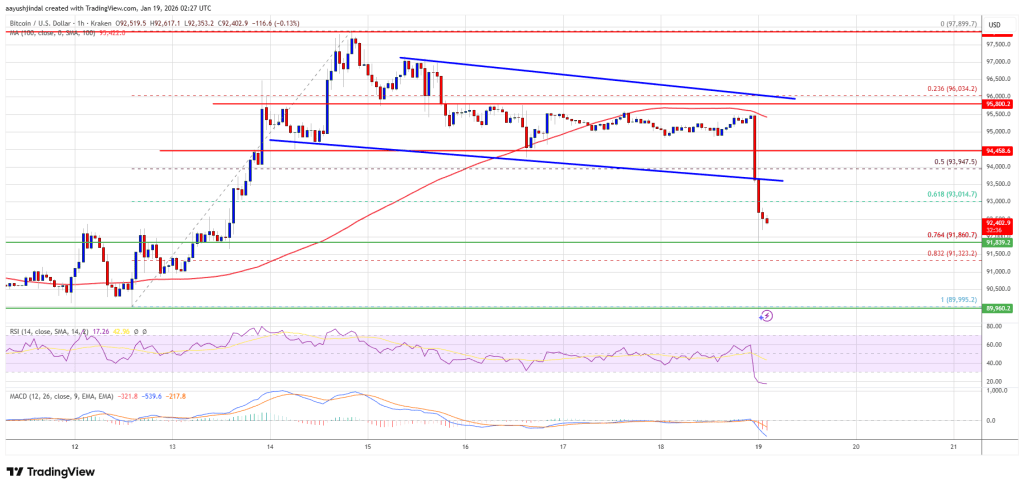

Bitcoin began a steep decline below $95,000 and $94,000. The price is trading below the 100-hour simple moving average at $93,500. On the hourly chart of the BTC/USD pair (data feed from Kraken), the pair broke below the descending channel with support at $93,550. If it remains below the $954,000 zone, the pair may continue to fall.

Bitcoin price plummets

Bitcoin price failed to break above the $94,500 support and a new decline began. BTC fell sharply below the $94,000 and $93,500 support levels.

From the swing low of $89,995 to the high of $97,898, there was a move below the 61.8% Fib retracement level of the recent wave. Furthermore, on the hourly chart of the BTC/USD pair, the pair broke below the descending channel with support at $93,550.

Prices soared to below $92,000. It tested the 76.4% Fib retracement level of the recent wave from a swing low of $89,995 to a high of $97,898. Bitcoin is currently trading below its 100-hourly simple moving average at $93,500.

If the price remains stable above $92,000, it could attempt a new rally. Immediate resistance is near the $93,000 level. The first major resistance level is near the $93,500 level.

The next resistance level could be at $94,000. If the price closes above the $94,000 resistance level, the price could move higher. In the above case, the price may rise and test the $95,000 resistance. Any further rise could push the price closer to the $95,500 level. The next hurdles for the bulls could be $96,200 and $96,400.

Will BTC continue to fall?

If Bitcoin fails to rise above the $93,500 resistance zone, further decline could begin. Immediate support is near the $92,000 level. The first major support is near the $91,800 level.

The next support is currently located near the $91,300 zone. Any further losses could send the price towards the $90,500 support in the short term. The main support lies at $90,000, below which BTC could accelerate its decline in the short term.

Technical indicators:

Hourly MACD – The MACD is currently losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – BTC/USD’s RSI is currently below the 50 level.

Major support level – $92,000, then $91,800.

Key resistance levels – $93,000 and $93,500.