Dave Weisberger, former chairman and co-founder of CoinRoutes and current president of BetterTrade.digital, used a November 11 video to restate Bitcoin’s long-term bull market, arguing that the market’s “sulky” sentiment and tech-driven downside demands are missing the ongoing structural changes in both fundamentals and market microstructure.

He structured his analysis into two parts: why Bitcoin is being bought and what the current market structure suggests, and argued that the theory for seven-digit pricing remains intact, even without an obvious near-term catalyst.

The road to $1 million per Bitcoin

Regarding fundamentals, he directly compared gold’s monetary role and size. Weisberger cited the above-ground market value of “approximately $28 trillion” and “known underground reserves of approximately $7 trillion,” and argued that approximately 80% of gold’s value is monetary, rather than industrial, using the price relationship between platinum and gold as a proxy.

“Currently, gold trades for about 2.5 times as much as platinum, but for most of my lifetime it was about twice as expensive as gold,” he said, adding that platinum is “30 times rarer and more valuable to women who make jewelry.” In terms of their relative value, he estimated that gold’s “fully diluted monetary value is approximately $28 trillion,” compared to Bitcoin’s “fully diluted market capitalization (…) of just over $2 trillion at today’s prices.”

Related books

He argued that if Bitcoin equals or exceeds gold in monetary characteristics, the gap would mean a transformative upside. He highlighted the benefits of Bitcoin, including its inherent digital finality, resistance to counterfeiting, divisibility, transparency, and programmatic supply schedules, which also avoid the friction of storing, analyzing, and transporting gold.

He suggested that even in a scenario where fiat currencies “retain their value,” the introduction of the network alone could cause prices to jump many times over. He said there would be more asymmetry in the downgrade regime, saying, “As the Bitcoin network grows and gains acceptance, it will probably rise by a factor of 10 or more.” Via X, he added that the “fundamental case” was $1 million in today’s dollars.

Weisberger reconsidered the “fastest horse” framework that became popular during the liquidity surge early in the COVID-19 era. He pointed to Paul Tudor Jones’ May 2020 paper, admitted he was wrong in his original statement, and reminded viewers that prices “did nothing” for several months from October until the subsequent euphoric leg rally and a gradual acceleration. His takeaway is that market momentum may lag fundamentals until positioning is reset and liquidity leadership returns to Bitcoin. “History doesn’t always repeat itself, but sometimes it rhymes,” he said.

Regarding market structure, Weisberger zeroed in on a four-year halving cycle as a predictive template. Historically, he said, the cyclical behavior has followed a pattern – six months of halving, doubts about miner incentives, followed by a rally from relief to euphoria, then a spill into altcoin rotation before a significant drop.

He argued that dynamics are becoming less important as changes in supply have become “irrelevant compared to the amount of demand that is going on,” while trends in network security tell a different story: “If you look at Bitcoin’s hash rate chart, it’s increasing at an exponential pace.” In his view, the variable that actually drives prices is the interaction between traditional supply and institutional demand. “Basically, it’s OG sellers and new buyers who are selling over 100,000 (BTC), whether it’s ETFs or MicroStrategy or whatever.”

Rather than surrender life-changing gains, he says, these early holders rationally diversified, implying a finite overhang. “Entrepreneurs typically don’t sell everything (…) they sell some at a level that will get them to where they need to be, and then (…) they sell at a later price.”

He emphasized that despite recent volatility, spot ETF investors appear to be patient. “Despite the carnage of the past few weeks since October 10th, less than 2% of Bitcoin ETFs have been leaked,” he said, characterizing the group as long-term allocators who “look for 10x returns” rather than trading around single-digit drawdowns.

He contrasted October’s deleveraging (“$20 billion was liquidated (…), but only $5 billion of the liquidation was in Bitcoin”) with the 2022 bankruptcy cascade, saying, “There is no Celsius in this cycle (…) there is no FTX. There will be no bankruptcy events that trigger forced sales as a result of the liquidation.”

He argued that without a credit-driven unwind, the technical analogy to 2022 is misguided, saying: “If there is no forced sale, why do we expect a sell-off of the magnitude that happened in 2022 (…)? They are trying to impose something without taking into account the actual situation.”

Related books

In his view, price leadership will return through “liquidity and modest growth” while “hot money” recovers from leverage-driven losses. He expects OG selling to “weaken” as the partial profit-taking winds down, setting the stage for the next buoyancy if a catalyst emerges.

Weisberger didn’t pretend to know which spark would ignite — “I’m no Nostradamus” — but listed plausible vectors consistent with previous cycles: “The catalyst could be sovereign accumulation. The catalyst could be Bitcoin used as collateral (…) It doesn’t really matter what the catalyst is.”

He suggested the main risk for would-be sellers is leaving the market during a market reversal. “I would be very hesitant to sell here unless it’s very nimble and quick, there are no tax consequences, and I’m not out of the market or on vacation during the couple of days when the euphoria first starts.”

My two-part Bitcoin analysis:

1) Basic case of $1 million Bitcoin in today’s dollar terms

2) Why the current depression is unwarranted and now is the best time to save Bitcoin for the long term

Bitcoin bull incident 11 11 https://t.co/0ACKrn3bgQ via @YouTube

— Dave W (@daveweisberger1) November 12, 2025

He concluded with a caveat acknowledging that the market could frustrate both bulls and bears. “Probably the euphoria will happen after a few more months or a depression, but it will happen at some point,” he says. He made his position clear, saying, “I have never sold a single satellite TV, and I have no intention of selling one,” and reiterated the discipline required of choppy tapes: “Stay safe. This market certainly looks interesting and will remain that way for a while.”

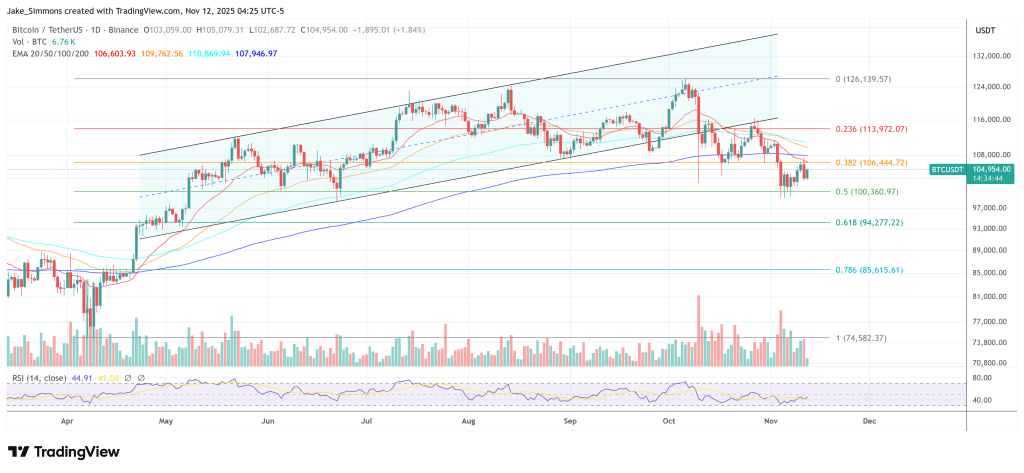

At the time of writing, BTC was trading at $104,954.

Featured image created with DALL.E, chart on TradingView.com