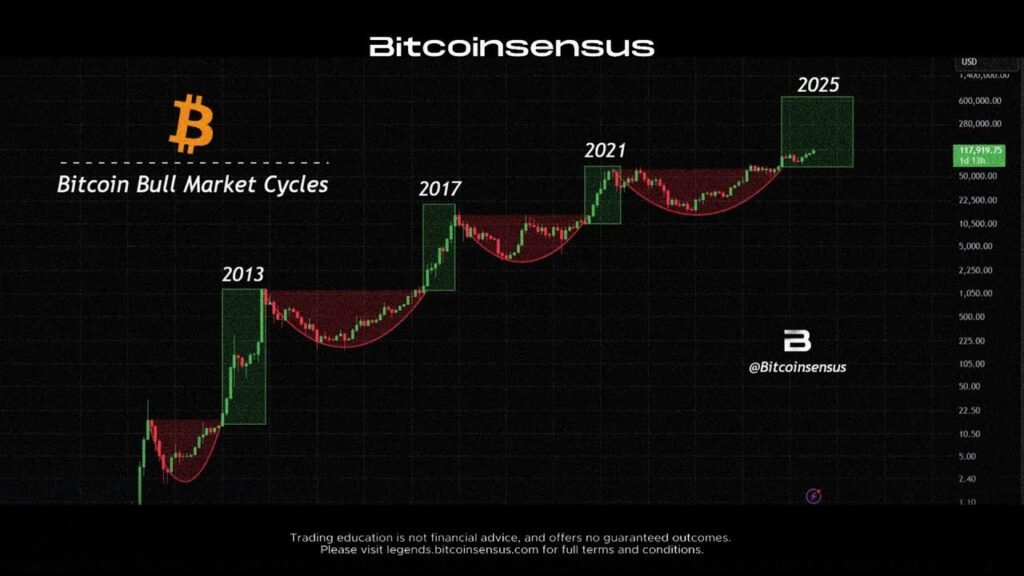

Let’s kick it off with the big picture. Bitcoin’s four-year blueprint is repeating almost perfectly. Historically, we’ve seen a three-year accumulation phase forming a rounded bottom followed by a one-year explosive bull run. We saw this play out in 2013, again in 2017, and most recently in 2021. Now, here in 2025, the structure looks eerily familiar. If history continues to rhyme, this could mean the real move is just getting started. A breakout like this could take Bitcoin into its next major parabolic phase. Next up, check out Bitcoin against the Turkish LRA. This chart is going parabolic. We’re seeing fiat currency drop like a rock while Bitcoin just keeps ripping higher. This is a perfect example of the opt out narrative. When local currencies struggle, people look to Bitcoin as a safe haven. Now, for the ETHBTC ratio, this one’s really interesting. The chart looks bottomed out and the next ratio target is around 080. Whenever Ethereum starts to gain strength against Bitcoin, it often signals that all coins are waking up and we could be entering a more risk-on phase for the broader market. Back to Bitcoin. On the daily time frame, we’re seeing something bullish under the surface. Price action is creeping higher while the RSI has been dropping sharply, forming a hidden bullish divergence. This is typically a continuation signal, suggesting that the bulls might not be done yet. And here’s where it gets exciting. The Ballinger bands on the daily are compressing massively. Periods of low volatility like this don’t last long. They usually lead to explosive breakouts, and the current setup favors the upside. It’s like a coiled spring and Bitcoin is loading energy for its next big move. Finally, let’s look at Cardono. ADA has been respecting a broadening channel and price action is holding strong. If this momentum continues, the next logical target is the upper channel line which sits around 2.4 to 2.5 for coin. Cardano might be gearing up for a significant swing if market conditions stay bullish. If you’re tired of trading alone, come hang out with us on Telegram. We chat about the market, share ideas, and have each other’s back when things get rough.