Delphi Digital is betting that Solana’s next major upgrade cycle will reposition the network as an “exchange-grade” environment that can support on-chain order books that can realistically compete with centralized exchanges in terms of latency, liquidity depth, and market structure. In a Jan. 20 post on X titled “2026 is the Year of Solana,” the research firm claimed that Solana’s 2026 roadmap is its “most aggressive upgrade cycle” to date, with “a complete overhaul of everything from consensus to infrastructure to become a decentralized Nasdaq.”

Why Delphi Digital is calling 2026 “The Year of Solana”

Delphi framed this roadmap as a capital markets driver rather than a grab bag of performance enhancements. “Solana’s roadmap aims to transform into an exchange-grade environment where native on-chain CLOBs can fully compete with CEX latency, liquidity depth, and fairness. All the upgrades are here to make this possible.” From that perspective, millisecond savings only matter when it comes to producing predictable and enforceable execution results in applications like high-frequency trading and centralized limit order books.

At its heart is Alpenglow, a consensus redesign that the company called “the most significant protocol-level change in Solana’s history,” according to Delphi. The company says Alpenglow is introducing a new architecture built around Votor and Rotor, which changes the way validators reach consensus. Rather than “chaining multiple voting rounds,” validators aggregate votes off-chain and “commit to finality in one or two rounds,” yielding “theoretical finality in the 100-150 millisecond range from the original 12.8 seconds.”

Related books

Delphi emphasized that Vortor’s parallel finalization passes are a function of resilience, not just a speed play. If a block receives “overwhelming support” (over 80% stake), it will be finalized immediately. If the support is between 60% and 80%, a second round will be triggered, followed by finality if it also clears 60%. Delphi claims that the goal is to maintain finality even in the presence of unresponsive segments of the network.

Alpenglow also introduces what Delphi called the “20+20” restoration model. This means it remains secure as long as the malicious stake does not exceed 20%, but remains live even if the remaining 20% is offline, “tolerating up to 40% of malicious or inactive networks while maintaining finality.” In this design, Proof of History is “effectively deprecated” and replaced with deterministic slot scheduling and local timers. The upgrade is expected to be rolled out in early to mid-2026, Delphi said.

Delphi also pointed to Firedancer, Jump’s C++ validator client, as a structural upgrade aimed at mitigating long-standing operational risks. Solana has historically relied on a single client, now known as Agave. Delphi described its “monoculture” as a key weakness, as client-level failures can cascade into broader network outages.

According to Delphi, Firedancer aims to be a deterministic, high-throughput engine that can handle “millions of TPS with minimal delay variation.” Before it is fully ready, Delphi highlighted “Frankendancer,” a transitional build that combines Firedancer’s networking and block generation modules with Agave’s runtime and consensus components, as a bridge to “significantly” increase client diversity.

In terms of infrastructure, Delphi focused on DoubleZero as a private fiber overlay for validators, likening its transmission profile to traditional exchange connectivity. “It’s the same infrastructure that traditional exchanges like Nasdaq and CME rely on for microsecond-level transmissions.” The argument is that as the validator set grows, propagation variance becomes the enemy of tight finality windows. Delphi said that by routing messages along “optimal paths” and supporting multicast delivery, DoubleZero is able to narrow the delay gap between validators, which is what enables both Votor’s quorum formation and Rotor’s propagation design.

Related books

Delphi also framed Solana’s block-building roadmap as a market structure project. Jito’s BAM (Block Assembly Marketplace) separates orders and execution through a marketplace and privacy layer, and because transactions are ingested into TEE, “neither validators nor builders can see the raw transaction content before an order takes effect,” mitigating pre-execution behavior such as front-running.

Harmonic, on the other hand, targets builder competition by introducing an open aggregation layer, allowing validators to accept proposals from “multiple competing builders” in real-time, as Delphi summarizes: “Think of Harmonic as a metamarket and BAM as a micromarket.”

Raiku completes the thesis by adding deterministic latency and programmable execution guarantees adjacent to Solana’s validator set, using Ahead-of-Time (AOT) transactions for pre-committed workflows and Just-in-Time (JIT) transactions for real-time needs, without changing L1 consensus.

Delphi ultimately tied its technology roadmap to market demands, including the importance of Solana’s spot trading, the integration of on-chain Perp into a small number of venues, and the need to achieve performance on par with centralized platforms. Citing expectations that “new Solana-specific criminals like Bulk Trade will emerge early next year,” the magazine noted that products like xStocks “bring on-chain equity directly to Solana,” and argued that liquidity and attention are becoming concentrated on chains with faster settlements, better UX, and denser capital.

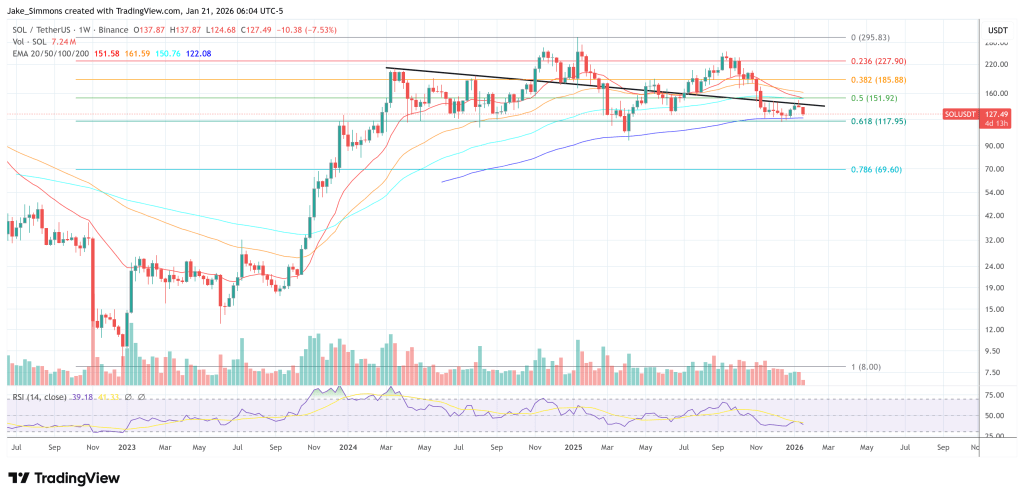

At the time of writing, SOL was trading at $127.

Featured image created with DALL.E, chart on TradingView.com