TLDRs;

SoftBank stock drops 6.9% as AI valuations cool, wiping out $50 billion in market value this week.

Arm Holdings and other tech peers follow suit, reflecting investor caution toward overheated AI sector valuations.

Analysts say SoftBank’s NAV remains strong despite the rout, hinting at a potential rebound opportunity.

Cooling GPU demand could benefit enterprise buyers, easing AI compute shortages seen during the 2024 boom

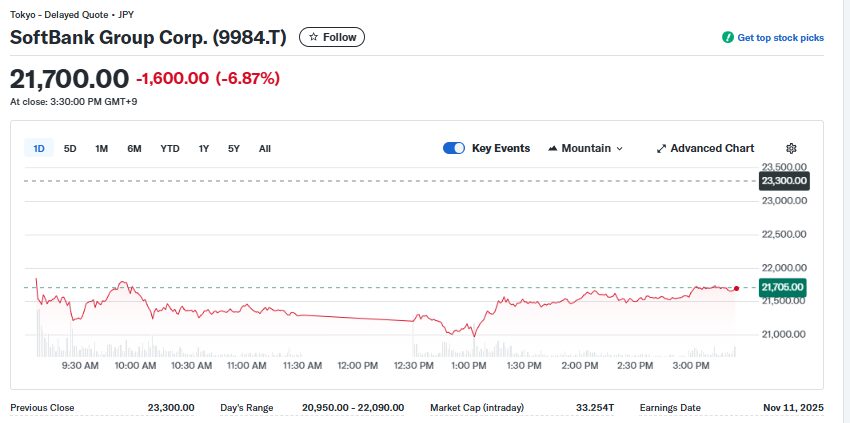

Shares of SoftBank Group Corp. (9984.T) tumbled 6.9% on Thursday, deepening a week-long rout that has erased nearly $50 billion from the Japanese tech giant’s market capitalization.

The drop extends a near-20% slide for the week, as investors retreat from high-flying AI-related stocks that have defined much of the market’s optimism this year.

SoftBank, one of the largest backers of the global artificial intelligence boom, has seen its exposure to Arm Holdings, the UK-based semiconductor firm it controls, amplify volatility amid growing caution over sector valuations. Arm’s US-listed shares fell 1.2% overnight, mirroring the pullback in SoftBank’s Tokyo-listed stock, which closed at ¥21,700 after losing ¥1,600 in a single trading session.

Investors Reassess AI Valuations

Analysts attributed the slide to a mix of macroeconomic caution and fatigue around elevated AI expectations. David Gibson, an analyst at MST Financial, noted that SoftBank’s stock “reflects investor hesitation around inflated AI multiples and lingering questions about strategic deals, including potential partnerships with OpenAI.”

SoftBank, led by Masayoshi Son, has aggressively repositioned itself as a major player in the AI ecosystem. The company tripled its Nvidia stake to $3 billion in early 2025 and maintains a 90% ownership in Arm Holdings, which recently surpassed $120 billion in valuation.

Yet despite Arm’s impressive fundamentals and guidance of 19–31% year-over-year revenue growth for Q2, investors appear unconvinced that the current pricing fully accounts for long-term execution risk.

Sector-Wide Selloff Hits Japanese Tech

SoftBank’s steep losses coincided with a broader AI correction that hit major Japanese semiconductor and hardware firms. Shares of Advantest, Renesas Electronics, and Tokyo Electron each declined sharply, mirroring the downturn in US chipmakers. Market observers pointed to concerns over demand saturation and inventory buildup as AI infrastructure investment cools following months of frenzied growth.

Adding to the unease were reports from Bloomberg that SoftBank had explored acquiring Marvell Technology, a US chipmaker, earlier this year, a move that underscored Son’s ambition to consolidate his company’s grip on the semiconductor supply chain. However, amid the latest market volatility, investors are signaling a preference for profitability and balance sheet discipline over new, high-risk acquisitions.

Valuation Gap May Present Opportunity

Despite the sharp downturn, some analysts argue that the market’s reaction could be overdone. SoftBank’s net asset value (NAV) reached ¥32.4 trillion in Q1 2026, with its NAV discount narrowing to around 40% , a sign that the market had already begun pricing in its AI exposure well before this week’s drop.

The selloff, they say, may represent a pricing gap rather than a deterioration in fundamentals. Arm’s continued growth trajectory and SoftBank’s relatively modest loan-to-value ratio of 17% suggest a balance sheet resilient enough to weather short-term shocks. Still, the mood in global equity markets has clearly shifted from unbridled enthusiasm for AI’s future to pragmatic evaluation of its near-term returns.

GPU Supply Chain Eases as Demand Cools

Interestingly, the AI downturn may create new opportunities for enterprise buyers. With speculative demand easing, GPU supply chains, particularly for Nvidia’s high-end H100 and H200 chips, are loosening. Smaller GPU cloud providers and major hyperscalers such as Amazon Web Services, Microsoft Azure, and Google Cloud could negotiate better long-term deals as supply stabilizes.

For companies building AI models and infrastructure, that could mean lower hardware costs and improved access to computing resources, especially as major investors like SoftBank reassess capital deployment in the AI race.