A governance vote for World Liberty Financial (WLFI), a DeFi project marketed primarily under the Trump brand, has sparked allegations of “slow” value extraction after a prominent trader claimed that affiliated wallets pushed the proposal through while many public holders remain unable to access or vote on their tokens.

DeFi^2 (@DeFiSquared), who claims to be the No. 1 ranked trader on Bybit in 2023 and 2024, wrote on

World Liberty Fi hit by ‘voter fraud’ claims

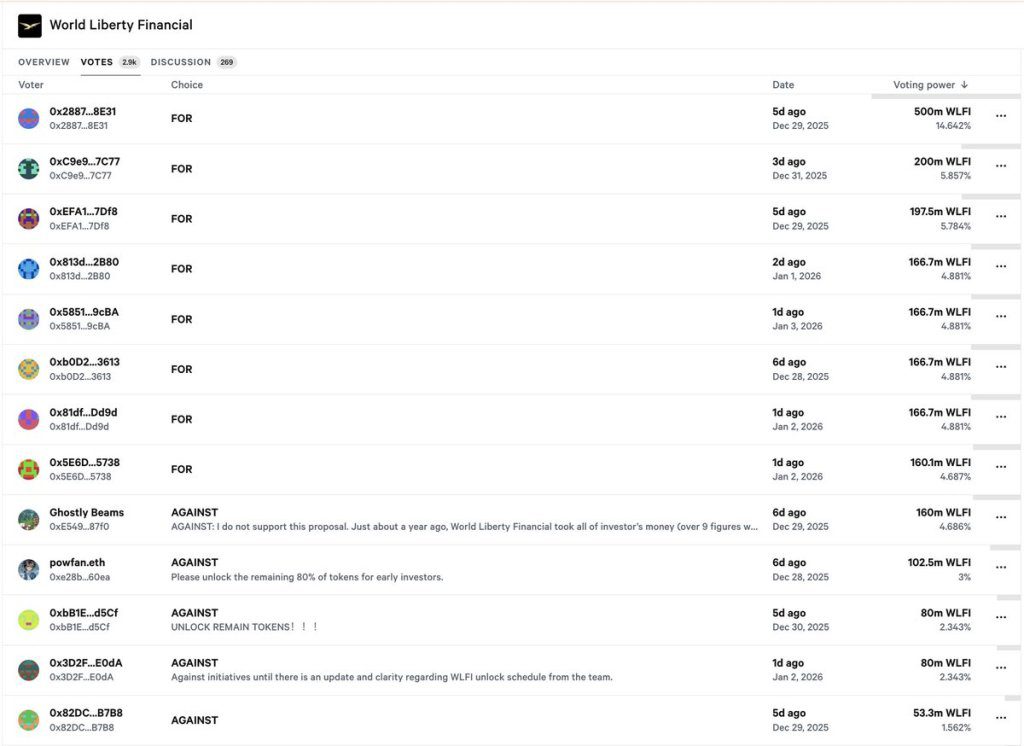

DeFiSquared said: “What you see above appears to be fraudulent voting, with the majority of the top voters shown by the bubble map to be team wallets or strategic partner wallets. This is in contrast to the actual voters shown below in the screenshot. They have all been locked from access to WLFI tokens since TGE and cannot vote to unlock them until the team allows them.”

Related books

The proposal at the center of the thread is what he calls the “USD1 Growth Proposal.” Although he claims it looks “pretty mundane” on the surface, he says the order of governance is important. “Why would the team go to the trouble of forcing this vote instead of voting to unlock the WLFI tokens, which is what the majority of holders want?”

His thesis hinges on the economics of WLFI. DeFiSquared claims that WLFI holders are “not entitled to any protocol revenue,” and that the project’s “gold paper” specifies revenue channels, with “75% of protocol revenue going to the Trump family and 25% going to the Witkoff family.” In his framework, it creates perverse incentives. “In fact, it’s as crazy as it sounds. The team is forcing a vote to sell WLFI tokens at the expense of locked holders in order to fund protocol revenue that only they can earn.”

Related books

He also claims that the voting results were fabricated late in the process. “Until the team and partners forced the vote, this vote actually failed by the time a quorum was reached, with a majority rejecting the proposal,” he added of the background behind the token allocation. “WLFI team is allocated 33.5% of all tokens, strategic partners are allocated an additional 5.85%, while only 20% is allocated for general sale.”

After the vote, he pointed to on-chain flows as evidence, citing “new transfers like this one to Jump Trading of 500 million WLFI tokens,” and said “investors’ WLFI allocations remain mandatorily locked.”

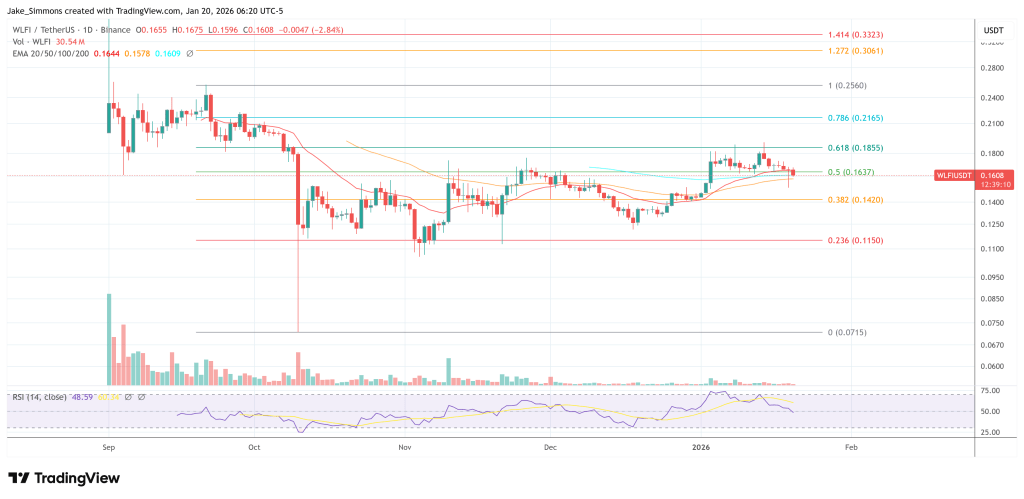

DeFiSquared concludes with a call for valuation and positioning. “It’s hard to see the intrinsic value behind a $17 billion token with no real governance powers, no revenue sharing, and no new foundation selling pressure to generate for its own benefit.” He added that he has shorted WLFI “intermittently since its pre-market price exceeded $0.34,” and expects the decline to continue due to “dilution, deliberate extraction,” and “other factors related to President Trump’s final term.”

At the time of writing, WLFI was trading at $0.1608.

Featured image created with DALL.E, chart on TradingView.com