Arthur Hayes believes Bitcoin could double by the end of the year, citing the White House’s blueprint for seizing the levers of US monetary policy as a catalyst. Appearing on The Rollup, BitMEX’s co-founder charted a path to $250,000 per coin, premised on what he calls “secret weapons”: aggressive credit creation, yield curve engineering, and a rapid tightening of control over the Federal Reserve that will ultimately pave the way for an influx of fiat liquidity into digital assets.

President Trump’s Fed plan could send Bitcoin soaring to $250,000

Hayes’ $250,000 year-end Bitcoin request is based on a limited but explosive theory. Within months, Donald Trump could seize functional control of the Federal Reserve System, trigger yield curve control through executive pressure and personnel power, and unleash a credit impulse that spills directly into cryptocurrencies via stablecoins. The BitMEX co-founder framed this path as an institutional dynamic rather than a speculation. “It’s just math. I love math,” he said.

At the heart of this is the Fed’s architecture. That means two institutions, two voting criteria, and one chokepoint. Hayes crisply recited plumbing. “There is a Fed Board of Governors. This board has seven members, all of whom are presidential appointees confirmed by the Senate, and a simple majority wins. That means you need four votes out of seven to control the board.”

That majority gives the White House three tools at once. Supervisory stance on banking regulation. And it has decisive influence over who runs the 12 regional reserve banks. This is because these presidents require approval from the governor.

Related books

The second body, the FOMC, has 12 votes. seven governors and five district presidents. If you gather sympathetic leaders in your district, the count will continue. “By having four people as governor and seven people on the FOMC, you effectively control the central bank,” Hayes argued.

So why is Governor Lisa Cook the “last domino”? Hayes links the timing to Stephen Millan’s recent opposition to interest rate policy among sitting governors. He argues that Trump already has two tie votes and a third plausible vote. Cook is the fourth hinge.

In his view, increased legal and political pressure could force him to step down on a shorter schedule than planned. “I think it will be before the end of the year,” he said of “imminent” court decisions related to mortgage and bank fraud issues and the possibility of a negotiated exit, whether guilty or not.

“This is all about politics… What is she going to get for a promise on the back end to resign and step off stage left?” If Cook resigns while the Senate number still supports confirmation and a replacement passes, the board’s majority will flip. A four-out-of-seven vote would allow the administration to approve or block the rotation of two-year and four-year district presidents — “in years one and five, all 12 district bank presidents will be re-elected,” he noted, giving them a path to seven of the 12 on the FOMC.

Yield curve control and liquidity

The policy intent is clear. Steep the curve and stimulate the economy through local banks. This is what Hayes calls “quantitative easing for the poor.” Operational tools start at the short end. The Governing Council, in conjunction with the Governor, could lower the interest rate paid on excess reserves, reduce front-end indicators, make funding cheaper for banks and reinstate discount lines on more friendly terms.

Supervision could also be relaxed to encourage more lending outside the financial center complex. In parallel, a majority of the FOMC could direct system open market accounts to expand on classical balance sheet policies while rhetorically promising a pin on the curve. Hayes said the template is from the 1940s.

“Politicians can declare a state of emergency… There are many excuses[they can]make… so the Fed is justified in working with the Treasury to adjust the money supply.”

The impact is not just a rate cut, but curve management. “The yield curve will steepen. So a steepening of the yield curve will lower short-term interest rates,” while longer maturities reprice based on higher nominal growth and inflation expectations. Even if long-term interest rates fall from their peak levels with policy easing, the slope will widen, repairing banks’ net interest margins and pushing credit creation into America’s heartland.

Related books

This is the bridge to Bitcoin. The steeper curve and less supervision will induce new lending through local banks, raising the money multiplier and nominal GDP, and boosting inflation. “When local banks are making loans…creating new loans…they need to hire more workers…and obviously inflation goes up with that,” Hayes said.

Liquidity will then flow into Bitcoin through stablecoins, which we expect to proliferate under a dollar hegemony strategy. First, T-bills are carried in tokenized dollars. Next comes on-chain yield. Finally, speculation comes into play. “Once I have a stablecoin…I now have a dollar bank account…I make 10-15%…I’m still broke…I’m going to speculate,” he said, noting that perpetual trading venues are the ultimate release valve for global retail leverage.

The price call continues from the plumbing. Hayes reiterated that if Cook resigns, a replacement is confirmed, district personnel shake up, the Fed’s balance sheet and short-end levers tilt, and the personnel puzzle goes well, it will “double by the end of the year” toward $250,000.

He also warned of narrow Senate margins and the political clock that confirmation could be blocked by Congress in 2026. “If there’s someone President Trump needs to approve…it better be done by then,” he cautioned, adding that early preparations could complicate the restructuring even further, as Powell’s term as chairman ends in May 2026.

Hayes’ macrocoda is crystal clear. Debt calculations force either inflation or explicit restructuring, both of which are bullish on scarce assets. He even entertained a multitrillion-dollar profit from revaluing U.S. gold, which he said would be an acknowledgment of a devaluation of the dollar, which would have unknown effects on the U.S. Treasury market. Both routes are hostile to bonds and favor Bitcoin, he argues. “At the end of the day, you don’t want to own bonds; you want to sell dollars and own real assets like Bitcoin or gold.”

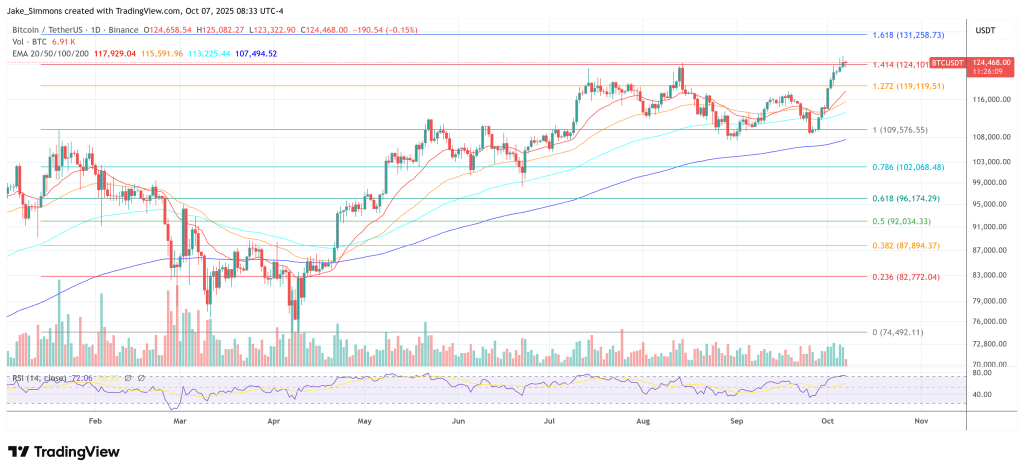

At the time of writing, BTC was trading at $124.468.

Featured image created with DALL.E, chart on TradingView.com