What you need to know:

Strategy’s new “Bitcoin Ratings” show that the company’s $BTC stack covers convertibles by approximately 5.9x on average entry and remains close to 2x even during big crashes, highlighting how leveraged the company is against long-term $BTC upside. Despite that cushion, financial institutions are bailing out the stock and moving to spot Bitcoin ETFs instead, leaving the strategy off the S&P 500 and trading below the value of its $BTC holdings. Bitcoin Hyper’s pre-sale is building an SVM-based Bitcoin Layer 2 with near-instant, low-fee smart contracts and DeFi settled back in Bitcoin, giving $BTC holders scaling and yield angles rather than just spot exposure. The PEPENODE presale promotes a earn-from-mine meme model where you buy virtual nodes, build a digital mining rig, connect demand to in-game activity by upgrading nodes and burning tokens, and earn $PEPENODE and other meme coins.

A company’s Bitcoin strategy works differently when it’s backed by hard numbers rather than doom-and-gloom threads.

With an asset-to-liability ratio of 5.9x based on average BTC cost, and a coverage ratio of 2x if Bitcoin rises to $25,000, this is exactly the kind of balance sheet resilience that big capital values.

When the top assets on a company’s books comfortably cover its debts even after a major crash, the signal isn’t that it’s “risk-off,” but rather that Bitcoin is growing into collateral that financial institutions actually rely on.

That trust is not just stored in a cold wallet. It provides the backdrop for the next wave of risk-on bets.

Historically, once the market accepts Bitcoin as sound collateral, the next move is usually a high-beta play that rides on the same long-term conviction and delivers much greater upside.

There, we see an explosion of presales, aggressive layer 2, and high-throughput chains that tend to turn BTC strength into altcoin momentum.

Below are three projects positioned to benefit from this environment. Led by Bitcoin Hyper ($HYPER), it is a Bitcoin Layer 2 that seeks to do for $BTC what high-performance chains have done for other DeFi, alongside Solana-style execution and Tron stablecoin machines.

1. Bitcoin Hyper ($HYPER): Bitcoin Layer 2 SVM Speed

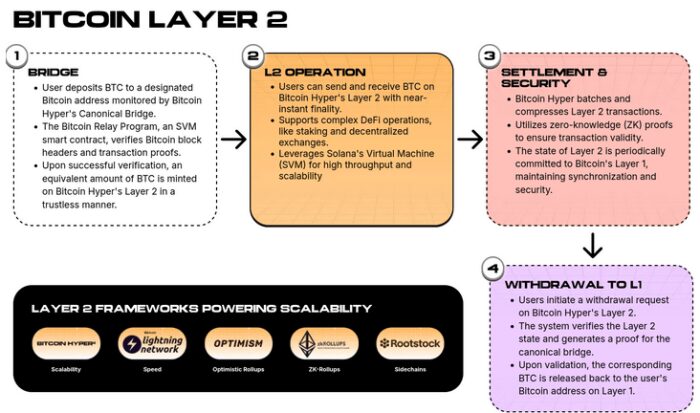

Bitcoin Hyper touts the “fastest Bitcoin Layer 2 chain” with an integrated Solana virtual machine (SVM), aiming to deliver faster performance than Solana itself while pegging payments to Bitcoin.

The idea is simple. Keep Bitcoin as the base layer of trust and outsource speed and programmability to a dedicated layer 2.

Bitcoin Hyper uses a modular design internally. It uses Bitcoin L1 for payments and real-time SVM Layer 2 for high-throughput execution.

A single trusted sequencer batches transactions and periodically anchors state back to Bitcoin, enabling low-cost sub-second confirmations instead of waiting for slow on-chain $BTC finality and paying full L1 fees.

This architecture simultaneously attacks three major limitations of Bitcoin: slow transactions, high fees, and lack of native smart contracts.

Bitcoin Hyper offers extremely low-latency processing, SVM-based smart contracts, and L2-adapted SPL-compatible tokens.

This opens the door to wrapped $BTC payments, AMM, lending markets, staking protocols, NFTs, and gaming dApps built on Rust using SDKs and APIs developers already know.

The pre-sale raised $28.58 million at a token price of $0.013335, and staking is set at 40%, allowing for long-term profits as the price increases.

Join the $HYPER presale now.

2. PEPENODE ($PEPENODE): Mining meme using node economy

If Bitcoin Hyper is a bet on infrastructure, PEPENODE ($PEPENODE) is a speculative meme play wrapped in a pseudo-mining economy.

Branded as the world’s first mine-to-earn meme coin, it trades hash rates and ASICs into a virtual mining system where users deploy “nodes” through a gamified dashboard to earn token emissions.

PEPENODE uses graduated node rewards to simulate miner economics instead of proof-of-work. Upper tier nodes are designed to get a bigger slice of the emissions, encouraging early participation and laddering to the entire system.

Eventually, you will be able to receive rewards in popular meme coins such as Fartcoin and Pepe.

This is a familiar pattern in DeFi node projects, but reskinned for meme traders who want something more interactive than just buy and wait.

Despite the playful branding, real money is flowing in. PEPENODE’s presale raised $2.2 million for $0.0011685 tokens, putting it firmly in microcap territory where order book depth is important, but the upside could be steep if the story catches bids.

Since staking is not specified yet, the current earnings are focused on the virtual mining mechanism and node tier.

In a market where Bitcoin is proving to be a durable financial asset, memes like PEPENODE sit at the other end of the risk curve: pure beta with a gamified wrapper.

If you’re looking for exposure that can move multiple amounts faster than $BTC on narrative alone, the mine-to-earn angle targets that demand directly.

Join the PEPENODE presale now.

3. Tron (TRX): flagship stablecoin with large USDT flows

Tron (TRX) remains one of the purest expressions of “blockchain as payment rail” in the market.

It’s a high-throughput network designed for fast, low-cost transactions and dApp deployments, but its real strength today is stablecoins. Tron has become the primary hub for $USDT transfers across exchanges and payment platforms.

With its high TPS and small fees, Tron has quietly become the default settlement layer for the majority of crypto dollar liquidity.

Recently, USDT’s total circulation exceeded Ethereum, reaching approximately $73.8 billion. This highlights how real-world transaction flows favor Tron’s cost structure over more expensive chains for everyday transportation.

Its stablecoin gravity impacts the growing DeFi and cross-chain ecosystem, allowing users to leverage lending, swap, and yield strategies without abandoning the payment rails they already use.

In a market where Bitcoin is the collateral anchor, Tron provides exposure to the transactional layer of crypto dollars.

And the token is showing signs of recovery from the recent market sell-off, rising 1% the previous day.

Tron is available from Binance.

Summary: If a company’s treasury shows that its Bitcoin reserves still comfortably cover its debt even during a major crash, it sets the stage for a high-beta strategy. Bitcoin Hyper ($HYPER) and PepeNode ($PEPENODE) stand out as the most direct bets on the market today.

This content is for educational and informational purposes only and does not constitute financial, investment, or trading advice.

NewsBTC, by Aaron Walker – https://www.newsbtc.com/next-crypto-to-explode-strategy-proves-bitcoin-reserve-covers-debts