Cryptocurrency markets faced an overnight plunge as concerns about trade tensions between the United States and the European Union resurfaced, shaking global risk sentiment. Bitcoin and major altcoins have reversed recent gains, with traders reacting to headlines of new tariffs and the possibility of escalating economic retaliation on both sides of the Atlantic. While cryptocurrencies are often viewed as a separate market, this move once again demonstrated how digital assets can quickly behave like high-beta risk trades when macro uncertainty spikes.

Related books

Analyst Dirkforst said the impact of the liquidation was immediate and powerful. More than $800 million worth of leveraged positions were wiped out in a matter of hours, including approximately $768 million in long-term liquidations. The size of the extended trade suggests that traders were poised for a continuation of the rally, but the sharp reversal in price pushed them offside.

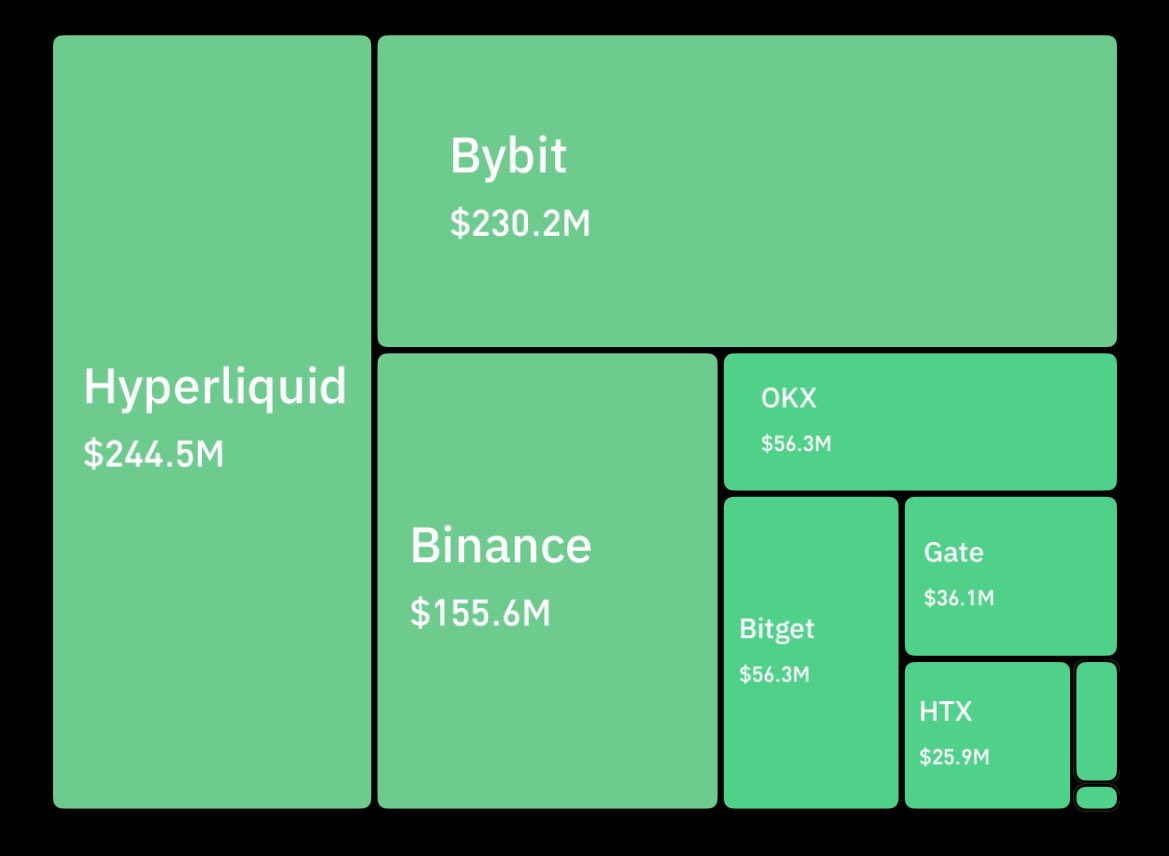

What was most noticeable was where the damage occurred. Dirkforst pointed out that Hyperliquid had the largest share in forced liquidations with $241 million, followed closely by Bybit with $220 million. The wave of liquidations appears to be partly related to the announcement of new tariffs targeting Europe, which prompted a similarly swift reaction from EU policymakers and reignited talk of a broader “trade war” across markets.

CME opens the door to new volatility

Dirkforst cautions that the timing of this selloff is just as important as the size of liquidations. Bitcoin fell sharply as soon as CME trading began, suggesting that institutional flows and macro-linked positioning played a direct role in the shakeout. In past risk-off episodes, the CME open has often acted like a trigger for volatility, especially when markets are already fragile and leverage is rising across major exchanges.

That’s why the next few hours are so important. The same type of movement could easily be repeated at the start of US markets, where reactions tend to be amplified by liquidity conditions and headline sensitivity. If sellers apply pressure again, we could see another chain of forced closures in the market, especially in high-beta altcoins that remain vulnerable even after an overnight wipeout.

Related books

The message is simple and clear. Take advantage of macro backgrounds by being careful and avoiding overexposure while they remain unstable. Liquidations can cause a sharp rebound, but momentum can also quickly reset as fear spreads across risk assets.

Dirkforst added that people should continue to pay attention to the latest political information coming in. The market now trades stories, not just charts. Further statements could be released at any time, and as history has shown, Trump often hits market-moving headlines in the middle of the weekend.

Bitcoin maintains fragile rebound as cryptocurrencies test macro nerves

Bitcoin is trading around $93,100 after a sharp rejection from the $96,000 to $97,000 supply zone. The chart shows that BTC is still struggling below the major moving averages, with momentum being limited by the decreasing overhead of the blue trendline. This supports the idea that the recent rally attempt was more of a rebound than a clean trend reversal.

Structurally, the price is forming a higher low after a sharp decline from the $110,000 area. However, unless Bitcoin gets trapped below resistance and can confidently reclaim the mid-$90,000s, a rebound remains vulnerable. Recent candlesticks also highlight hesitation, with the wick suggesting an aggressive sell on strength.

Related books

The red long-term moving average is rising near the low $90,000 level, acting as a potential dynamic support zone. If Bitcoin sustains above that level, the recovery structure remains intact and a deeper reset to previous liquidity pockets is prevented.

This is important for the broader cryptocurrency market. If BTC stays range-bound below resistance, altcoins typically struggle to sustain gains and become more susceptible to volatility from liquidations. Risk appetite could bounce back soon, but that would require Bitcoin to sustain above resistance. Until then, cryptocurrencies are still in a fragile stabilization phase, with no confirmation of continued bullishness.

Featured image from ChatGPT, chart from TradingView.com