Debate in the US Senate over a bill called the Clarity Act has reignited debate about XRP and other crypto products and how they would be treated under US rules.

Related books

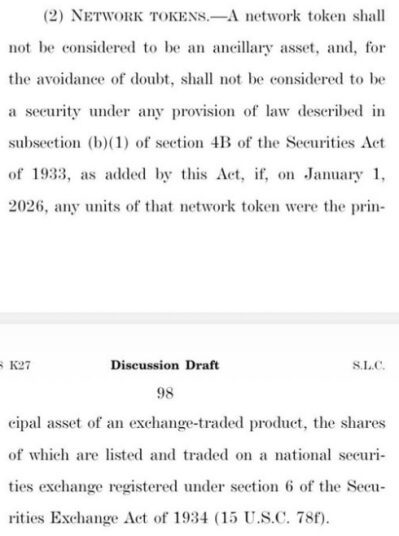

According to reports, the bill could give tokens that back U.S.-listed ETFs distinct status, bringing them closer to commodity-type treatment.

The XRP Spot ETF has also attracted a large amount of money, with inflows reaching approximately $1.37 billion since its establishment in November 2025. The numbers highlight why lawmakers and market watchers are paying attention.

structure

ETF creation and redemption can be done “in-kind.” This means the fund can accept actual assets instead of cash.

Although the mechanism is real, ordinary buyers cannot directly load tokens into the fund. Authorized participants (large broker-dealers and market makers) deliver tokens to the ETF and receive a return of shares.

Investors buy and sell ETF shares on exchanges every day. This gap is at the heart of the debate over whether ETFs can function like banks.

The XRP ETF is also a physical fund, so you can deposit your XRP directly into the fund in exchange for the exact value of the stock.

In general, most people choose this option once the law is enacted. This has many benefits and allows you to use ETFs like a “bank”. https://t.co/2G49kxUpGc pic.twitter.com/4fyeOkEYTC

— Chad Steingraber (@ChadSteingraber) January 13, 2026

community voices

Based on posts by prominent figures in the XRP community, some foresee a future where ETFs act like regulated parking lots for token holders.

Chad Steingraber has been a vocal advocate of the physical spot mechanism, arguing that investors can exchange XRP for corresponding ETF shares and treat their funds as a safer place to hold value until they need to move the tokens again.

These comments helped popularize the idea that ETFs can be used in a bank-like manner.

What is tax?

Reports and investor guides show that ETF structure matters for taxes. ETFs often use in-kind creation and redemption to avoid routine capital gain distributions at the fund level, which often increases the tax efficiency of ETFs.

However, the tax implications for token holders will vary depending on how the transaction is performed and the legal structure of the product.

Under current U.S. rules, transfers that change the form of assets may be taxable to the person transferring the assets, and fund-level distributions may also result in tax consequences for investors.

Related books

According to Chad Steingraber, the physical structure provides XRP holders with a regulated place to store their tokens where safety and oversight are required.

Steingraber believes investors may prefer ETFs if transparency laws clarify the rules. The appeal is not the technical steps, but the confidence of keeping XRP in a regulated and organized product. For him, ETFs offer a more secure way to manage tokens while still maintaining access to them when needed.

Featured image from Unsplash, chart from TradingView