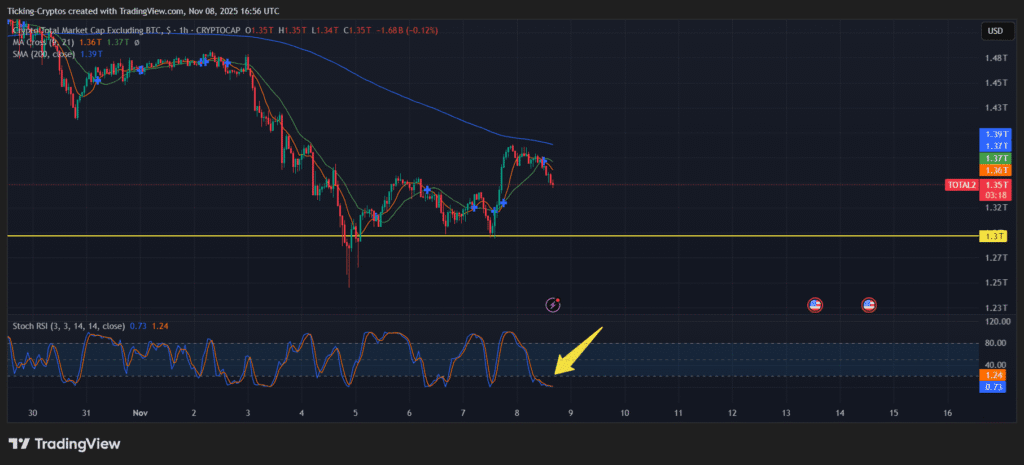

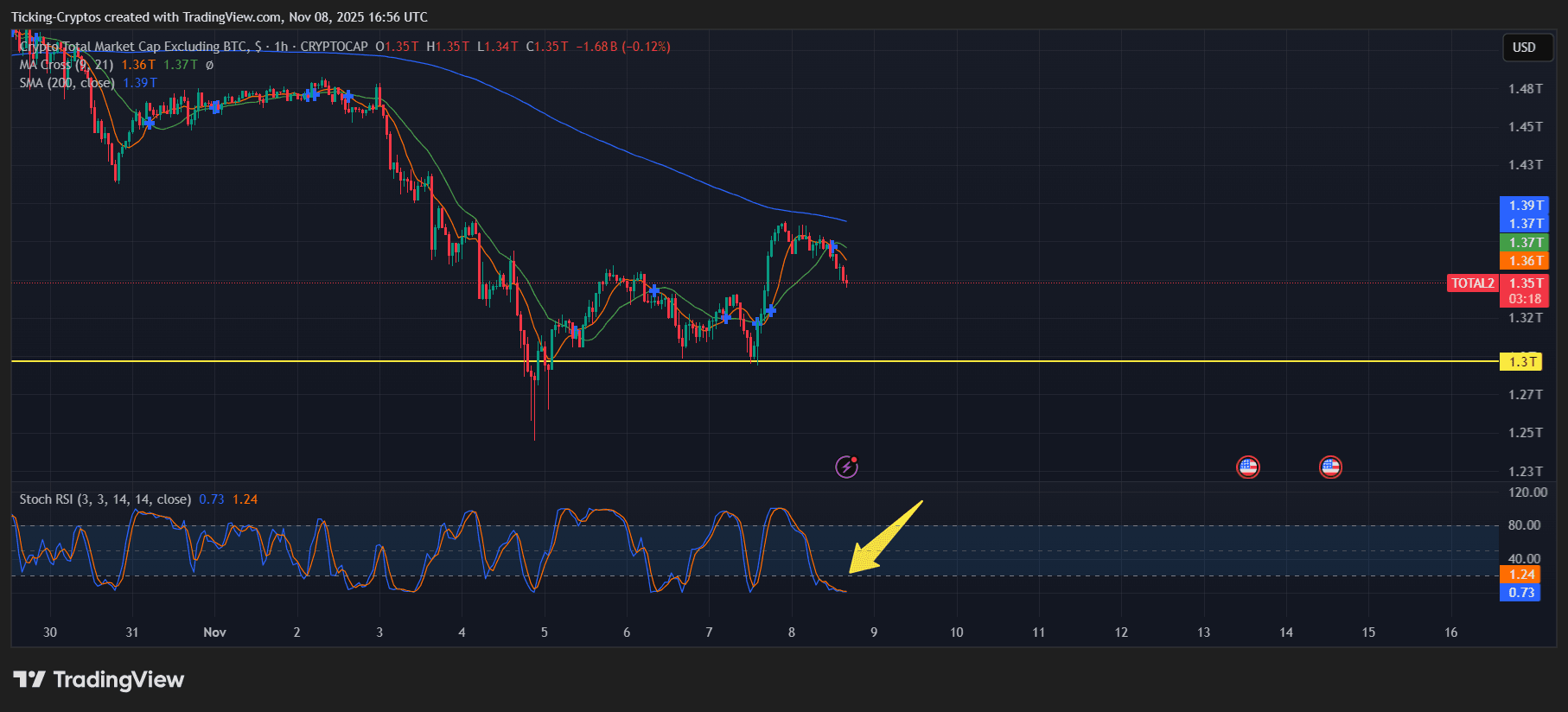

Cryptocurrency markets have been giving off rare oversold signals, but this time it’s not just the Bitcoin dollar that’s showing depletion. of Total virtual currency market capitalization excluding BTC It went down to about $1.31 trillion,and Stochastic RSI has reached extreme oversold territoryindicating that the altcoin may be poised for a rebound.

Despite short-term volatility, such large corrections often precede strong gains. Let’s break down what the chart shows and which top altcoins will see the sharpest recovery when Bitcoin’s next rally begins.

Altcoins are extremely oversold

of Total virtual currency market capitalization excluding Bitcoin I passed and fell 11% this weeksliding from $1.48 trillion to $1.31 trillion. The attached weekly chart shows a clear downward trend and subsequent decline. Stochastic RSI reading less than 10historically marks the bottom of the market.

Total cryptocurrency limit in USD excluding BTC – trading view

This oversold signal typically suggests: Selling pressure has increased excessivelyAnd long-term investors may soon start re-accumulating their positions. This is a pattern we will see from late 2023 to mid-2024 before any major altcoin rally.

So the market is in capitulation mode, but the data suggests that: The bottom may be near.

Bitcoin Analysis: Consolidation Near $100,000

Bitcoin is $100,000 markas shown in the attached TradingView chart. The coin corrected from its highs near $116,000 and formed a lower structure while gaining liquidity below the key support level. If Bitcoin maintains the above $98,000 – $100,000bounce towards $110,000 to $115,000 Could cause significant short-term liquidations – reportedly worth it Over $9.6 billion That will likely fuel a sharp rebound in altcoins.

BTC/USD 1 hour chart – TradingView

However, a break below $98,000 could extend the correction in the short term and delay the next bullish impulse. Traders are watching these levels closely as they will determine whether November ends with a recovery or further decline.

Top altcoins to watch for recovery

The recent decline has hit almost all major altcoins hard, but a few stand out: Plays with high rebound potential As Bitcoin regains momentum,

- Bitensor ($TAO): Down 27% in 7 days. Despite the decline, TAO remains one of the most innovative AI-based blockchain projects with strong fundamentals and developer traction.

- SPX6900 ($SPX): It fell 26% this week, following the overall market trend. Its meme coin-like volatility makes it a likely candidate for a strong rebound.

- Virtual Protocol ($virtual): decreased by 21%. With the ecosystem steadily updating, it is well-positioned to make a comeback once liquidity flows return.

- Ethena ($ENA): 20% off. As a synthetic stablecoin platform, its growing integration with DeFi protocols gives it the potential for recovery.

- Stubby penguin ($pengu): Although down 20%, it remains one of Solana’s most powerful NFT-driven meme coins. If NFT sentiment recovers, it could rise again.

- Pump.fun ($pump): Although down 18%, it remains popular among Solana traders and is likely to quickly regain momentum amid the next wave of market optimism.

- Solana ($SOL): It fell 16% and remained steady around $156. As the go-to chain for token launches, Solana remains a long-term bullish choice even after the market stabilizes.

These assets have absorbed significant selling pressure and are currently trading near key technical support. Setting optimal risk and reward For medium-term investors.

Outlook: Recovery is on the horizon

altcoin cycle Historically, it has lagged behind Bitcoin by several weeks. and Stochastic RSI in oversold region The setup looks similar to the previous cycle’s bottom as support for Bitcoin approaches.

If Bitcoin regains $110,000, the capital turnover could quickly ignite the altcoin market, especially for high-volume tokens such as: SOL, ENA, IMX. Traders may see early signs of recovery Rise in open interest and Positive change in funding rate Across the exchange.

For now, patience is the key. According to technical analysis, we are entering a difficult situation. Final stage of modificationa strong rebound is expected by the end of the year.