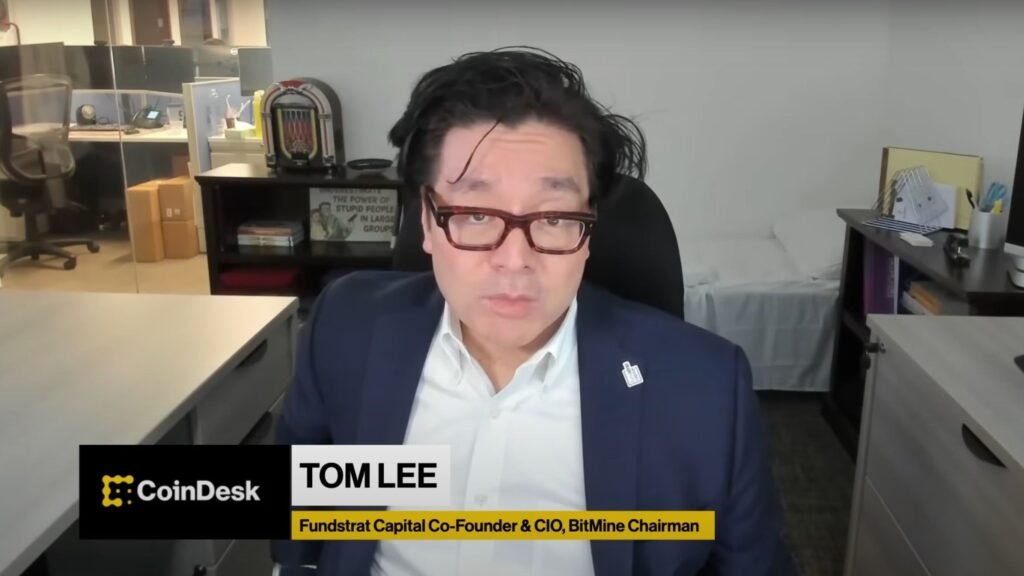

Crypto Markets may be climbing, but some investors don’t believe the rally is authentic. That’s exactly why it can be much higher, according to Tom Lee, co-founder of FundStrat and chairman of the Ethereum Treasury Firm Bitmine Immersion (BMNR).

Speaking to Coindesktv, Lee explained why he called the rebound across Crypto and stocks that began in April “the most hated V-shaped bounce in history.”

That’s because when the market plunged after President Donald Trump’s tariff announcement at the beginning of the month, economists predicted a recession, and many investors shunned high-risk assets. The rebound caught them off guard.

“Since 2020, investors have underestimated all recovery,” he said. “This is the same.”

Traditional finance is increasingly being acquired by crypto – steadily and quietly, Lee said. Ethereum Blockchain’s Ether (ETH) benefits from the push tokenization of Wall Street, selecting the network for legal clarity and technical reliability. “Ethereum had no downtime. That’s important to the bank,” he pointed out.

Lee’s company, Bitmine, bets on it.

The company currently holds 625,000 ETH and nearly $2.8 billion in assets, with virtually no liability. Lee also confirmed the $1 billion share buyback, reaffirming the company’s goal of accumulating 5% of its ETH supply.

Bitcoin

Meanwhile, it is becoming a recurring purchase for institutional investors. Lee said he believes that changes in the Federal Reserve policy, particularly the shift to fee reductions in the coming months, could cause BTC to surge to $250,000.

The Lee Values ETH is currently priced at $3,700 and costs $15,000 based on the network basis. He argues that the true story is an underrated institutional adoption.

“We’re not on top,” he said. “We’re just a cycle.”