SBI Holdings has quietly rolled out a new on-chain bond designed to give retail investors direct exposure to XRP, while keeping the product within Japan’s regulated market.

According to reports, the total amount issued by the Japan-headquartered financial group is 10 billion yen, and is recorded, issued and managed using a blockchain system rather than regular securities infrastructure.

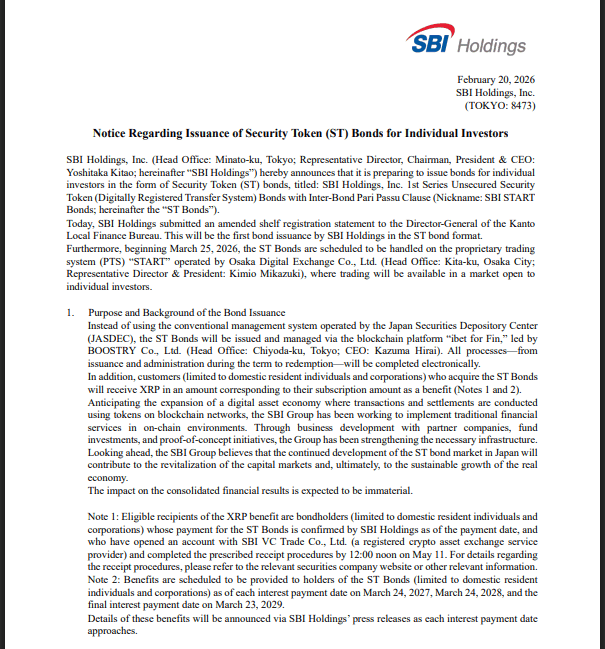

SBI launches new type of bond

The bond, referred to in some reports as the “SBI Start Bond,” is being tokenized on a platform called ibet for Fin, a system built by BoosTry to register and manage securities on-chain, according to reports.

Investors who purchase into this offering will receive XRP approximately upon completion of their purchase. The company will also receive additional XRP benefits with interest through 2029.

How the transaction works

Trading of these security tokens will take place on a proprietary system operated by Osaka Digital Exchange, with secondary market activity scheduled to begin on March 25, 2026.

The bond reportedly has a moderate yield range, with some media outlets pointing to a low-single-digit coupon band, a feature that combines bond payments with crypto rewards.

Japan’s SBI Holdings has launched a 10 billion yen ($64.5 million) on-chain bond issue that will return XRP to investors. https://t.co/X9U0nW3sd2 pic.twitter.com/b7hwHJTiEG

— 𝗕𝗮𝗻𝗸XRP (@BankXRP) February 21, 2026

Who can obtain XRP

Eligibility rules are strict. According to the report, holders must be domestic residents and have an account with SBI VC Trade to receive XRP benefits. There is a procedural deadline to complete the receipt process by mid-May.

So this is not a public worldwide benefit. This benefit is aimed at land-based retail investors in Japan and is tied to local account requirements.

Market reaction and possible impact

Based on reports and market commentary, this structure could drive demand for XRP as issuers will need to supply tokens for distribution and future payments.

Some market watchers say that while the initial amount (roughly translated to around $64.5 million) is limited relative to the size of the global crypto market, the product is more important for what it represents: a mainstream financial group packaging digital assets into regulated debt products. If that happens, other Japanese companies may consider making similar moves.

Trade Brains Featured Images, TradingView Charts