Bitcoin price plummets towards $100,000 amid intense selling pressure

Bitcoin ($BTC) has fallen near a key point $100,000 Mark – the most important psychological and technical level of this quarter. Over the past 48 hours, BTC has fallen from around $107,000 to just over $100,000, falling below major supports near $104,000 and $106,000.

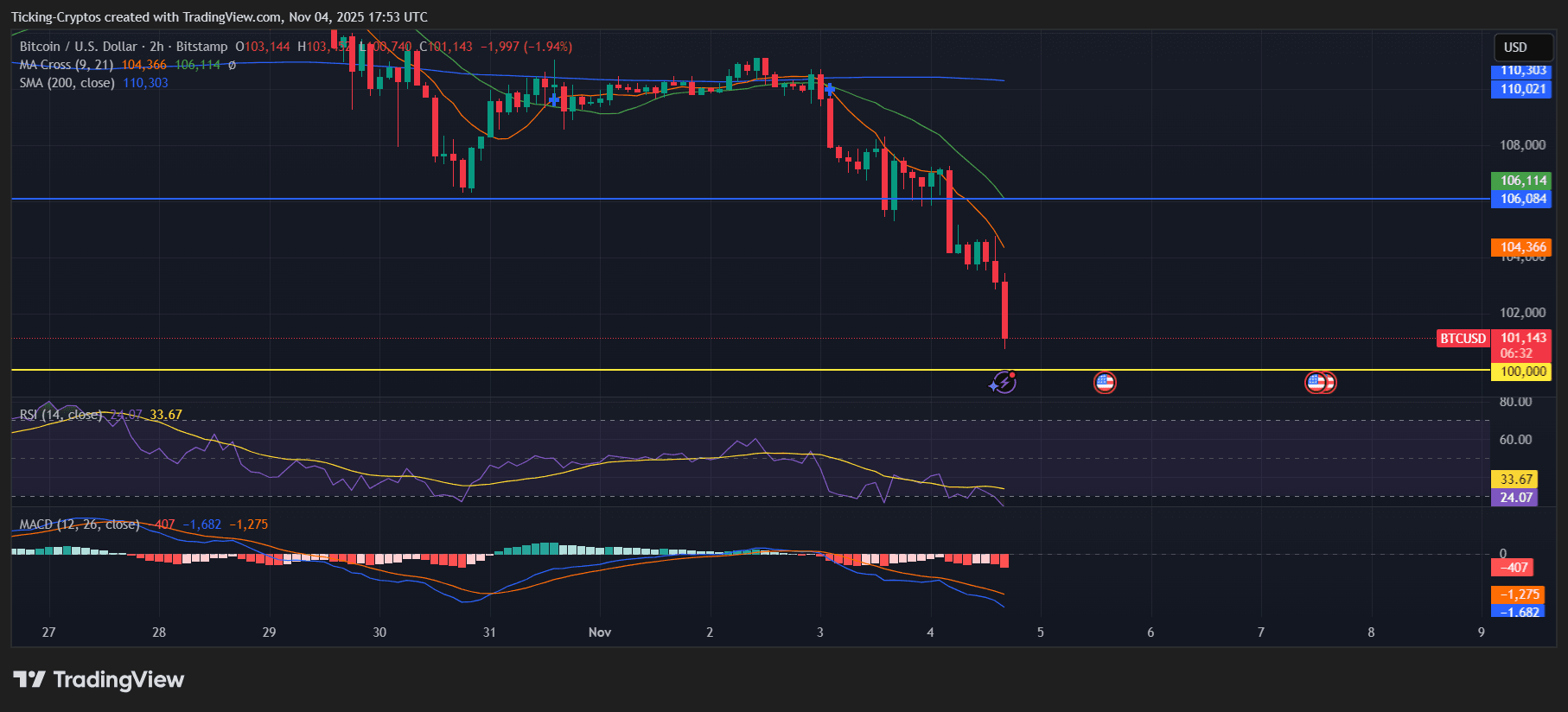

BTC/USD 2 hour chart – TradingView

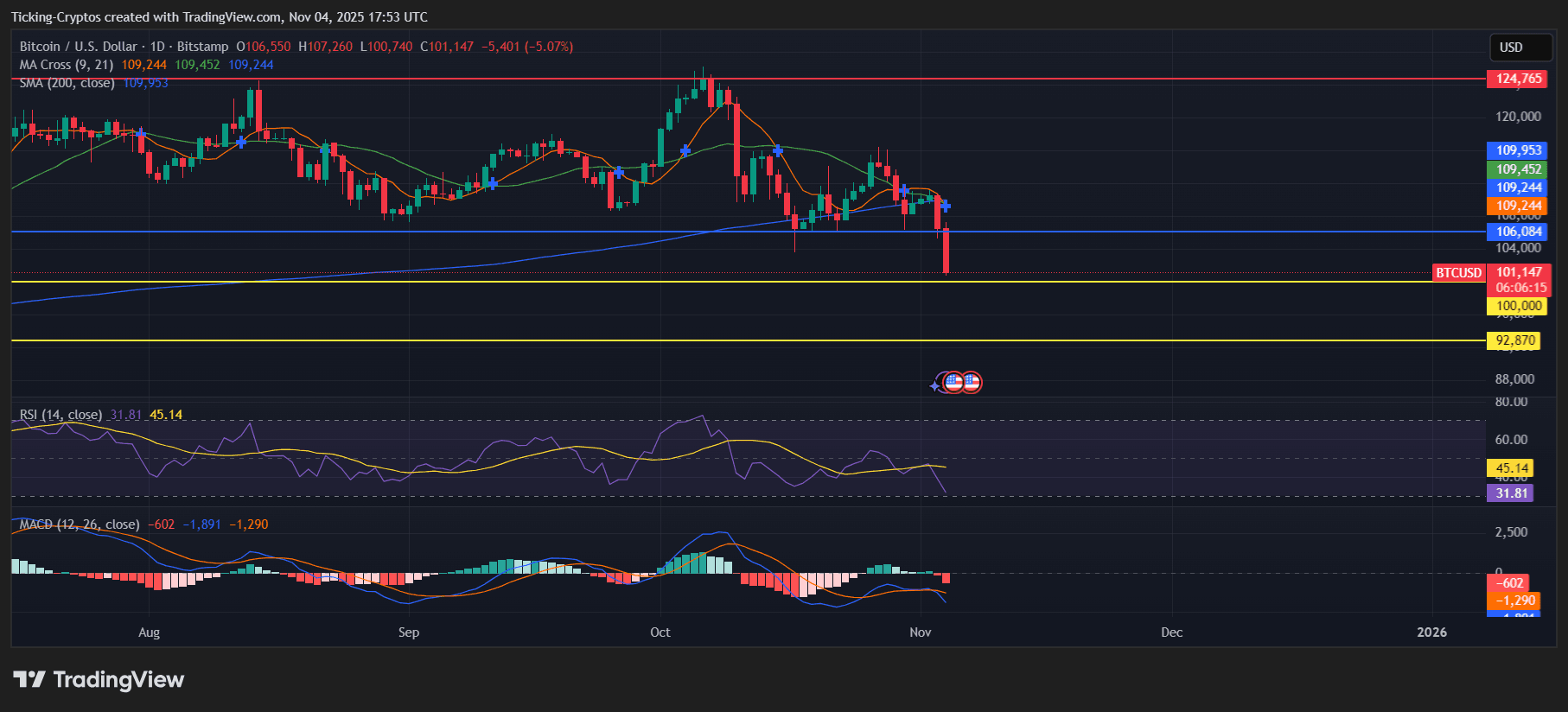

of daily chart indicates that a bearish crossover between the 9-day moving average and the 21-day moving average is confirmed. Both are currently trending below their 200-day SMAs. $109,000. This agreement confirms that short-term momentum was strong. started to decline steadily.

Today’s Bitcoin price analysis: depletion but no reversal yet

RSI (Relative Strength Index):

in 2 hour chartRSI is sitting around 33.6approaching an oversold level, often resulting in a short-term rescue rebound. On the daily time frame, the RSI fell below. 31.8indicating that BTC is in oversold territory but has not yet shown a bullish divergence.

BTC/USD 1 day chart – TradingView

MACD (Moving Average Convergence Divergence):

The MACD line remains well below zero on both short and long time frames, and the bars on the histogram are widening. This reflects strengthening bearish momentum and indicates that the downtrend could extend if volume remains high.

Next downside price target if correction continues

If $Bitcoin fails to defend, $100,000 The next potential downside targets in this space are:

- $97,000 – $95,000: Initial liquidity pocket that can cause a short bounce.

- $92,870: Historical support from previous accumulation phases.

- $90,000 – $88,000: A strong demand zone where buyers can aggressively re-enter.

Continuous closing price below $100,000 Perhaps a deeper corrective leg will be confirmed, potentially extending to $85,000marking a 50% retracement from the $125,000 high.

Rising scenario if BTC holds the line

If Bitcoin somehow stabilizes at an upward price $100,000a short-term rebound may form.

Resistance level to monitor:

- $104,000: What was once support turned into resistance.

- $106,000 to $109,000: Confluence zone with major moving averages.

- $112,000 – $114,000: If we can regain this area, the medium-term bullish structure will be restored.

Breakout and closing price for the day $110,000 Sentiment may turn bullish $120,000 There is also the possibility of re-examination. $124,000 – $125,000the previous highest value area.