Public interest in cryptocurrencies is quietly waning. Google search volume for keywords “cryptocurrency” According to Google Trends data, it has fallen to its lowest level in the past 12 months. At the same time, Bitcoin has already experienced a year of volatility, rally, and correction.

This disconnect between Price movements and public attention It’s not new, but it often makes sense.

Google Trends shows interest in cryptocurrencies at the lowest level in a year

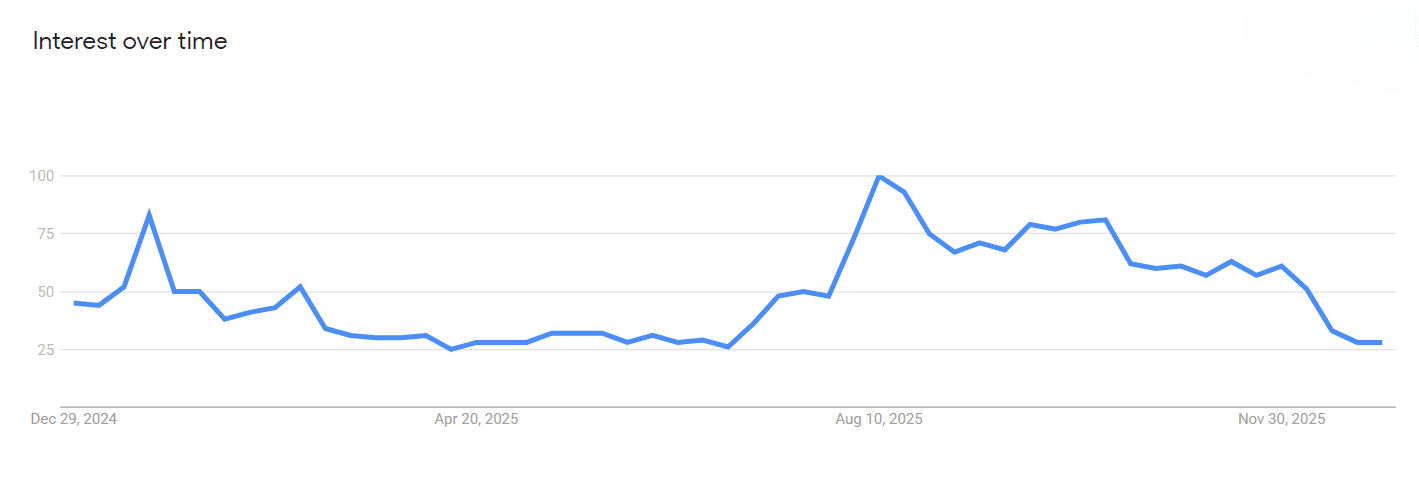

If you look at it, Google Trends Looking at the charts over the past 12 months, interest in the term “cryptocurrency” peaked during the strong market momentum at the beginning of the year. Since then, search volume has steadily declined, recently returning to levels last seen during a quiet period in the market.

Crypto search in 2025 – Google Trends

Key observations from the data:

- Search interest peaked during periods of high volatility

- Interest has waned even as Bitcoin continues to trade at high levels

- BTC Remains Historically Expensive, Current Measures Close to Yearly Lows

This suggests that fewer retail participants are currently actively searching, researching, or entering the market.

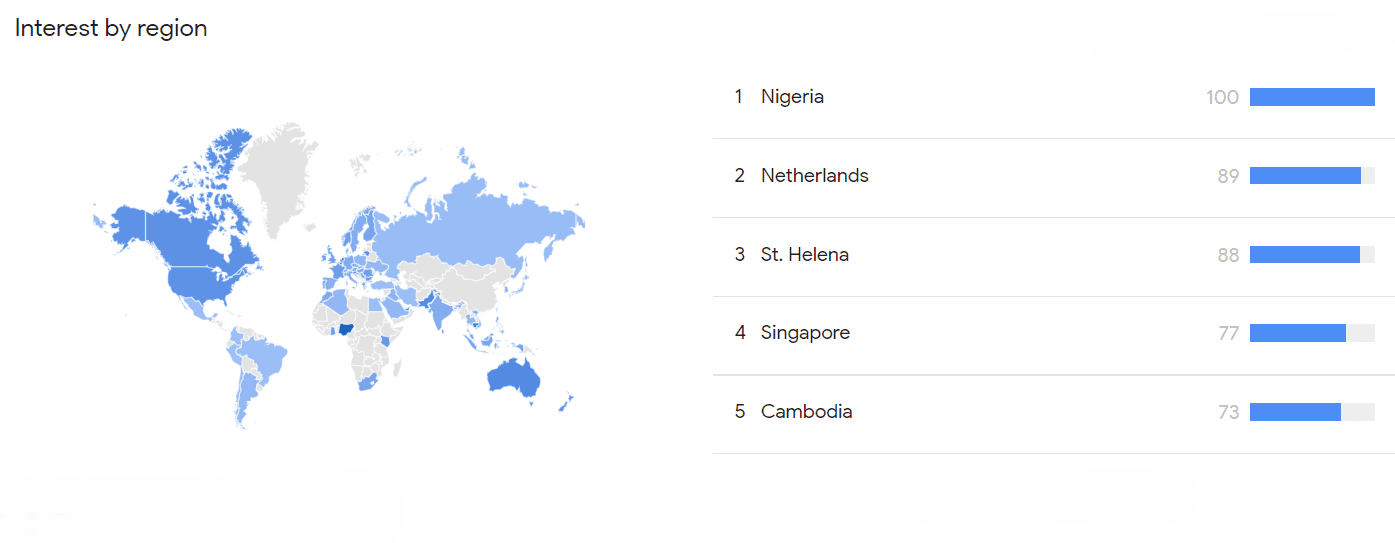

Regional interests remain uneven

The regional breakdown adds another layer to the picture.

country like Nigeria, Netherlands, Singapore, parts of Southeast Asia continues to show relatively high interest compared to the global average. However, engagement is significantly weaker in large developed markets.

Interest in virtual currency by region – Google Trends

This indicates the following changes:

- Interest in $Crypto is becoming more utility-driven in certain regions

- The focus on speculative retail in Western markets appears to be slowing.

- Adoption continues, but hype cycle cools

Bitcoin Price in 2025: Volatility Without the Hype

Bitcoin’s year-to-date price chart tells a completely different story than Google’s search trends.

Bitcoin since 2025:

- Experience strong rallies and deep pullbacks

- Updated local high before adjustment

- Maintained level significantly above past cycle average

Bitcoin price in USD in 2025 – TradingView

Despite these moves, public search interest failed to meaningfully rebound after mid-year. In other words, Prices moved, but attention didn’t..

This divergence often appears in the later stages of the market cycle, such as:

- Early buyers are already in place

- Interest in retail is exhausted

- Volatility is greatly influenced by financial institutions and derivatives

Why low search interest matters

In the past, low Google search volume often occurred in the following situations:

- Stages of market integration

- Decreasing retailer participation

- Accumulation period rather than distribution

When everyone is searching for “cryptocurrency”, the market tends to get overheated. Markets often build silently when almost no one is searching.

This does not guarantee an immediate rise, but it does suggest that the market is trending upwards. Less emotional and less crowded than at its peak due to hype.

Sentiment and Price: Common Patterns

Bitcoin has repeatedly shown that:

- Prices may rise before attention returns

- Attention usually follows performance, not the other way around

- Big trends often start when interest is still low.

The current setup fits that historical pattern. Bitcoin remains volatile, but the lack of widespread hype is changing the market’s risk profile.

Does a drop in search interest indicate an impending crash?

Historically, this is not the case. Big Bitcoin crashes typically occur during periods of heightened enthusiasm, heavy media coverage, and increased retail participation. Decline in interest in Google search often reflects fatigue and lack of motivation, not fear.

In a quiet market, there are fewer emotional participants and less forced selling pressure. While low interest rates do not guarantee upside, they tend to reduce the risk of a crash unless prices themselves break through key long-term support levels.