Bitcoin Zilla in the early 2010s held coins mined or acquired during the early stages of Bitcoin, and recently woke up to sell 80,000 BTC. Sale Processed by Galaxy Digital, I performed a transfer of 80,000 BTC (valued by $9 billion) on behalf of this client. “atshi-era” is described as an investor.

Despite this large sales And the volatility that came after thatBitcoin is stable and subsequent price action shows that the Bulls are ready to absorb the sales shock.

Related readings

Bitcoin was soaked at $115,000 and the Bulls quickly bought a dip

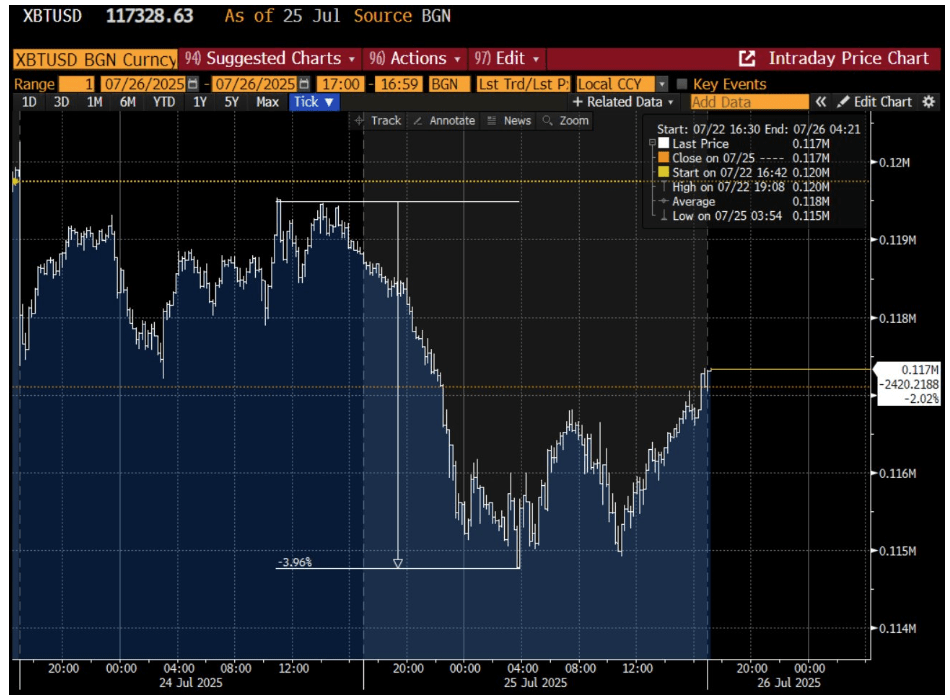

9 Billion Bitcoin News The sale initially caused price volatility. Bitcoin prices have recently traded around $119,000, resulting in a short-lived pullback due to a sudden influx of sales orders. On July 25th, BTC/USD quickly fell from $114,000 to $115,000 as reports of Galaxy whale sales spread.

The size of 80,000 BTC (over 0.4% of total supply) that hit the market could cause panic. Certainly, on the days surrounding sales there were signs of profit-making and higher exchange inflows. This caused a 3.5% drop. I will temporarily destroy the bottom Support level of $115,000.

However, it soon became clear that the Bitcoin bull was ready to absorb the shock. Prices will fall I drew the bottom in just a few hours. By the end of the same day, Bitcoin had rebounded over $117,000 and was trading in the middle of $117,000.

This rapid recovery showed significant liquidity and depth in the Bitcoin market. “Over $9 billion, 80,000 BTC was sold in open market order books, with little bitcoin moving.” observation Crypto analyst Joe Consorti shows how quickly the buyers stepped in to counter sales pressure.

X Image: Joe Consorti

Back in early years, sell orders of this size could have caused a double-digit percentage price crash. In contrast, the 2025 ecosystem handled it surprisingly easily. “Overall sales have been fully absorbed into the market.” Notable Bitcoin Analyst Jason Williams.

What’s next for Bitcoin price?

With 80,000 BTC sales for Whale are mainly sold in the rearview mirror, the next step is looking at where Bitcoin goes from here. The fact that the market has consumed $9 billion in sales with only a small turbulence makes many observers even more bullish about Bitcoin’s trajectory. “We’re going very high,” Jason Williams pointed out.

This is a sentiment shared by several X’s crypto analysts, viewing a rapid recovery as evidence of a strong upward momentum. The consensus among the bulls is that new all-time highs may be on the horizon in the coming months. Bitcoin already hit around $123,000 on July 14th, but analysts are still sought a new high of $130,000 and over $150,000. Or even higher.

Related readings

At the time of writing, Bitcoin is trading at $118,063, an increase of 0.5% over the past 24 hours.

Unsplash featured images, TradingView charts