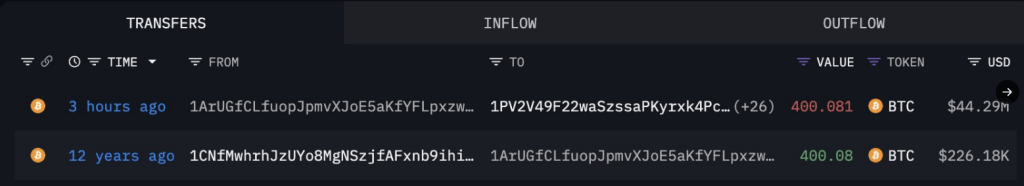

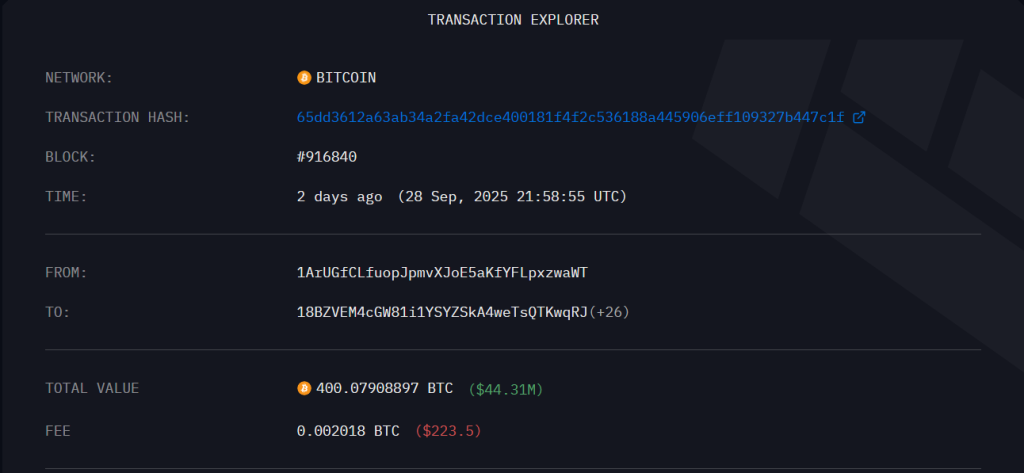

I woke up this week and emptyed around 400 btc to some new addresses. According to the Blockchain Tracker, addresses send coins in multiple transactions, mostly divided into batches of 15 BTC. The total amount to travel is approximately $44 million based on current prices.

Related readings

Wallets linked to early mining

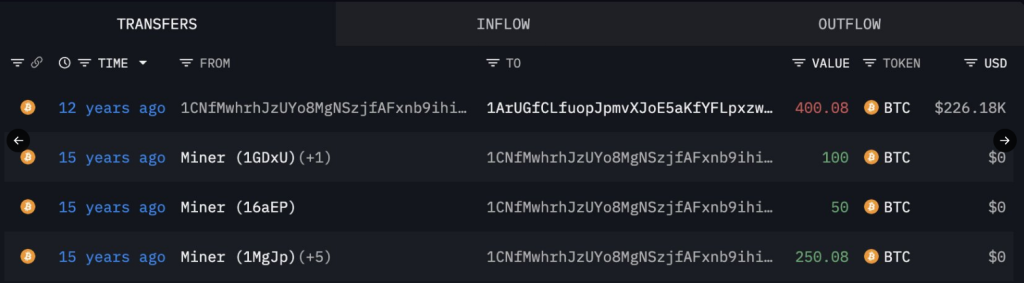

Reports say the coins date back to mining activities almost 15 years ago. Lookonchain linked the funds to the early days of Bitcoin. Records show the last wallet moved in 2013, when Bitcoin traded nearly $135 per unit.

In that case, that price means that retention has risen by about 830 times as it has become quieter compared to today’s levels, which is around $111,763 per BTC.

My dormant wallet woke up 12 years later and moved $400.08 BTC (44.29m) three hours ago to multiple new wallets.

400.08 $ btc was received from the miner 15 years ago. https://t.co/aem7whbkou pic.twitter.com/3m4xsbnxfo

– lookonchain (@lookonchain) September 29, 2025

Arkham Intelligence discovered distribution patterns, noting the 15 repeated BTC transfers that ejected addresses. Even if all transactions on the blockchain are fully visible, the owner’s identity remains unknown.

Patterns – chopping large amounts into small repetitive amounts – is a common way for your wallet to move a coin without dumping everything at once.

Some of the waves of old addresses become active

This activation comes in a series of movements from the so-called atoshi-era wallet. Based on the report, institutions and private holdings linked to early investors have recently moved. In July, Galaxy Digital sold over 80,000 BTC linked to real estate, a sale worth nearly $10 billion.

Another dormant address holding 444 BTC was active in September 2025 and moved around $50 million. Recently, one major holder is said to have circulated over $5 billion in Bitcoin to Ethereum, and has since approached a $4 billion ETH.

Market signals remain mixed

October has traditionally been a good month for Bitcoin, with previous meetings at 40-45% in certain years, but current signs indicate that there is less belief. Holder retention levels have been reduced to 80%, suggesting that chain derivative flow and whale outflow are weak.

Bitcoin is trading at one point at some point today, with 2.05% reported per day, but analysts are closely watching the risk level. Continuous selling could push prices up to $107,000. Updated purchase pressure could potentially turn it back to $119,000.

Related readings

What does this mean in the future?

Movement from Satoshi-era’s address carries a symbolic weight. Because they still come from groups that held Bitcoin when they were experimental and very cheap.

It is still unclear whether this 400 BTC transfer will cause wider sales or simply mark reallocation. For now, the market has a clear record of this move, but the reasons behind it — real estate settlements, profit acquisitions, or internal modifications — are unknown.

Pexels featured images, TradingView charts