TLDR

Grayscale is launching the first US spot Chainlink ETF on December 2, converting its private LINK trust that started in 2020

Bloomberg Intelligence analyst Eric Balchunas predicts over 100 crypto ETFs could launch in the next six months

The ETF will track LINK’s spot price and include staking returns for investors

Bitwise is preparing a competing Chainlink ETF to launch soon after Grayscale’s product

Recent altcoin ETFs for Solana, XRP, and Dogecoin have seen strong demand, with Canary Capital’s XRP ETF pulling in $58 million on day one

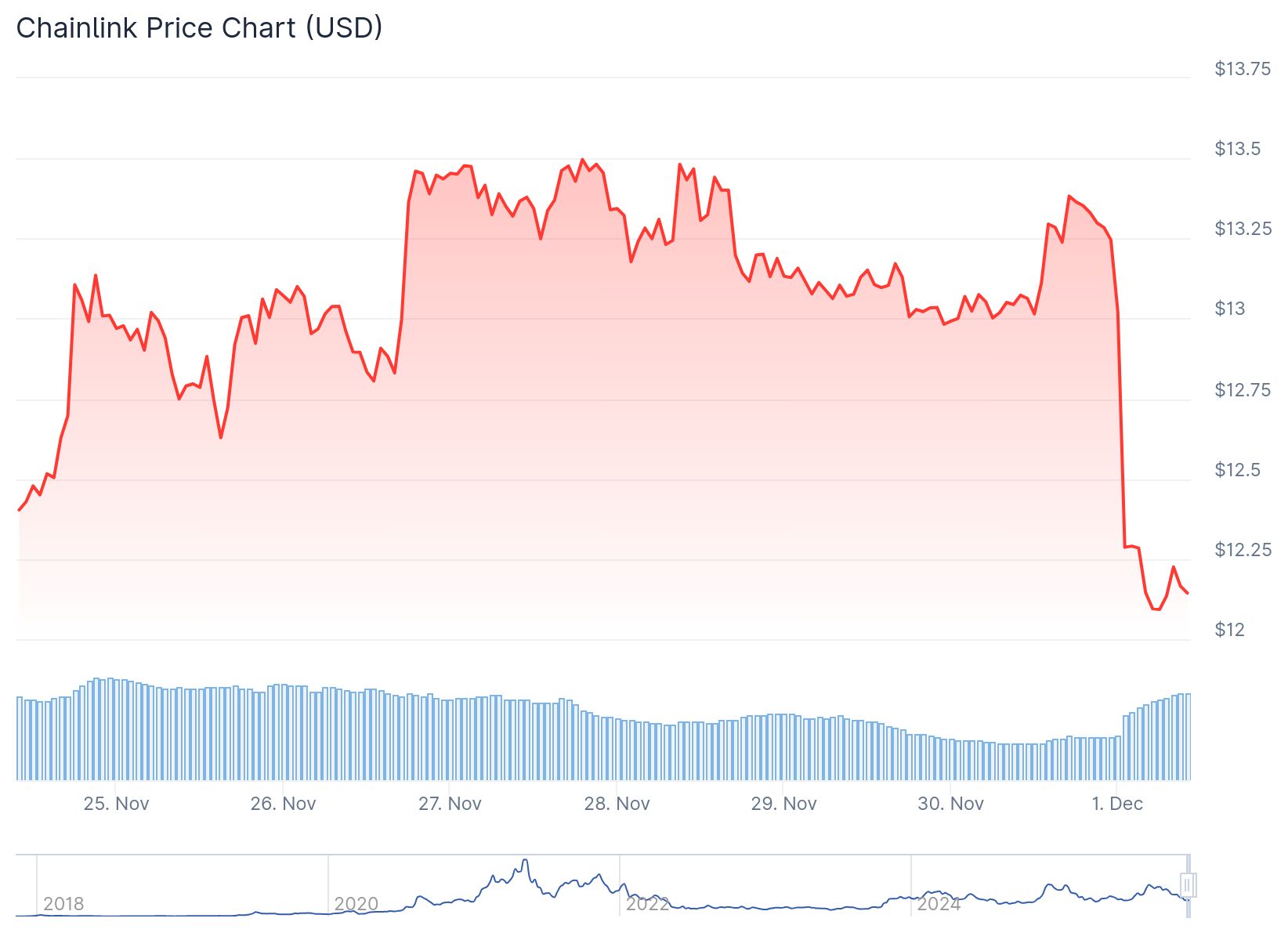

Grayscale is preparing to launch the first spot Chainlink exchange-traded fund in the United States. The product is expected to begin trading on December 2, according to Nate Geraci, co-founder of ETF Institute.

Set to launch this week…

First spot link ETF.

Grayscale will be able to uplist/convert Chainlink private trust to ETF. pic.twitter.com/i7z0WAKKvC

— Nate Geraci (@NateGeraci) December 1, 2025

The new ETF will convert Grayscale’s existing Chainlink private trust into a publicly traded fund. The trust was originally formed in late 2020.

This marks the first time US investors can access spot LINK exposure through a regulated ETF structure. The fund will track the spot price of Chainlink tokens and generate returns from staking LINK where allowed.

Bloomberg Intelligence senior ETF analyst Eric Balchunas confirmed the December 2 timeline. He shared internal listings data showing Grayscale’s product queued for launch this week.

There are 5 spot crypto ETFs launching over next 6 days. Beyond that we don’t have exact but we expect a steady supply of them (likely over 100 in next six months). Nice chart showing what’s launched and what’s on deck from @JSeyff pic.twitter.com/eArnDUN5JH

— Eric Balchunas (@EricBalchunas) November 24, 2025

Balchunas also stated that the US market could see more than 100 new crypto ETFs over the next six months. He said at least five spot crypto funds are scheduled to launch within the next six days.

The regulatory environment for crypto ETFs has shifted this year under new SEC leadership. Products tied to Solana, XRP, and Dogecoin have all received approval in recent months.

Competition Heats Up

Bitwise Asset Management is also preparing its own Chainlink ETF. The competing product is waiting for approval and could launch shortly after Grayscale’s fund.

This sets up a race between the two asset managers to capture institutional and retail investment flows. Both firms are targeting investors who want exposure to Chainlink’s oracle network.

Grayscale has described Chainlink as critical infrastructure connecting blockchain networks to traditional financial systems. The protocol provides data feeds, pricing information, and settlement triggers to both crypto and conventional platforms.

Altcoin ETF Wave Continues

The Chainlink ETF launch follows a busy period for altcoin investment products. Issuers have rolled out funds for several cryptocurrencies beyond Bitcoin and Ethereum in recent weeks.

Canary Capital’s XRP ETF debuted with $58 million in net inflows on its first day. This was the highest opening-day total for any ETF in 2025.

Bitwise’s Solana Staking ETF has accumulated over $660 million in assets within three weeks of launching. The fund has not recorded a single day of outflows since its debut.

Grayscale also launched spot XRP and Dogecoin ETFs last month. The New York Stock Exchange approved both products for trading, with shares beginning to trade on the exchange’s Arca platform.

The surge in altcoin ETF launches reflects growing investor appetite for crypto exposure beyond Bitcoin. Asset managers are racing to bring new products to market while regulatory conditions remain favorable.

Grayscale’s Chainlink Trust will be the latest in a series of conversions from private trusts to public ETFs. The firm has used this approach with several of its other crypto products over the past year.