$Ethereum has followed a very different path than Bitcoin. More volatile, more story-driven, and often more aggressive on both upside and downside. As 2026 approaches, $ETH once again finds itself in a technically important area, leading to frequently asked questions. Is Ethereum gearing up for another big cycle move, or is it entering a longer consolidation phase?

To answer that, we need to look at Ethereum’s long-term price trend, not just short-term noise.

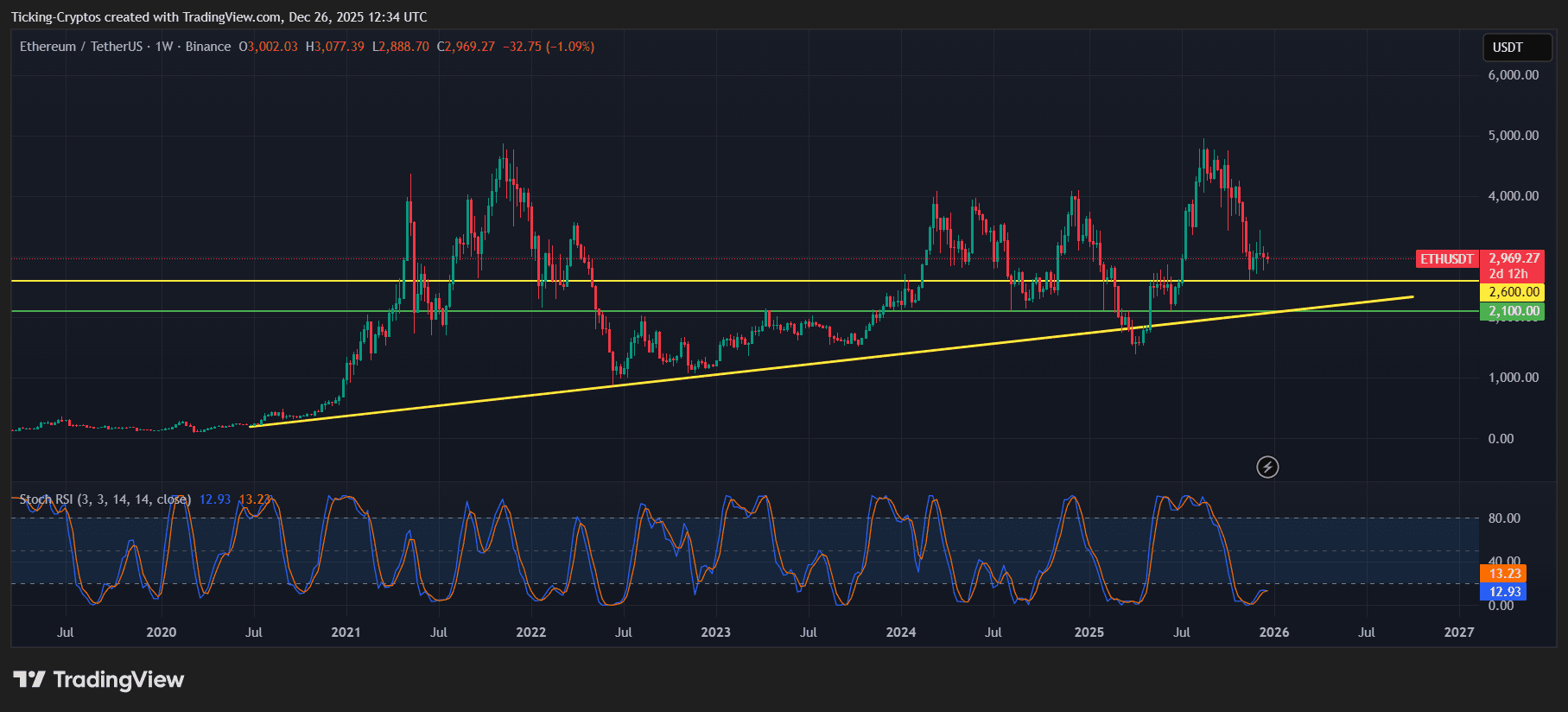

Ethereum’s long-term price structure: respecting trends

in Weekly ETH chartone thing clearly stands out. Ethereum continues to respect long-term uptrend lineDespite several major crashes over the years.

Historically:

- ETH rallies tend to be steeper than Bitcoin

- Deeper and faster corrections

- Long-term trend lines have repeatedly functioned as accumulation zones.

ETH/USDT 1W – TradingView

Every time Ethereum reassesses its long-term support structure, Ethereum either rallies strongly or enters an extended consolidation before entering the next expansion phase.

Ethereum goes through bullish and bearish cycles

Ethereum’s cyclical behavior shows a clear pattern.

- Bull markets see explosive uptrends, often outperforming Bitcoin.

- Significant drawdowns occur during bear markets, and drawdowns can exceed 70%

- Long recovery phase as ETH builds structure before breaking out again

This makes Ethereum more sensitive to changes in market sentiment, liquidity, and especially the narrative regarding upgrades, scaling, and ecosystem growth.

What will happen to Ethereum towards 2026?

Technically, Ethereum is close to 2026 at this point.

- Near the long-term upward support line

- Below the main historical resistance zones

- In an environment where momentum slows down after a strong expansion phase

This combination often gives a signal. decision zoneprices either regain higher levels or drift into a wider range.

Volatility compression at these levels has historically preceded large ETH moves.

Ethereum Price Prediction for 2026: Bullish vs Bearish Scenario

bullish scenario

If liquidity improves and risk appetite returns:

- Ethereum could regain key resistance levels

- A break above the long-term range could trigger a new rally.

- ETH could once again outperform Bitcoin in a risk-on environment

In this scenario, 2026 would be more like a continuation of a larger cycle than a market high.

bearish scenario

If macro pressures and liquidity tightening continue:

- Ethereum could remain range bound for much of this year

- Long-term support zones are tested more frequently

- Sideways price movements may prevail before a subsequent breakout

Historically, Ethereum has spent years consolidating before making a big move.

What history suggests about Ethereum in 2026

Looking back at previous cycles, we see:

- Ethereum is unlikely to collapse without destroying its long-term structure

- Most of the big ETH rallies started after long periods of setbacks.

- Long-term holders typically accumulate during the lateral boring phase.

This suggests that 2026 could be the year of doing more than chasing hype. Positioning ahead of the next tectonic move.