Bitcoin has fallen sharply this month, on track for its worst November in years, with traders and fund managers weighing whether to buy or hold.

Related books

According to the report, the token was down about 18% in November, trading below $91,000 as the market calmed down heading into the weekend.

Market cleansing opens doors for buyers

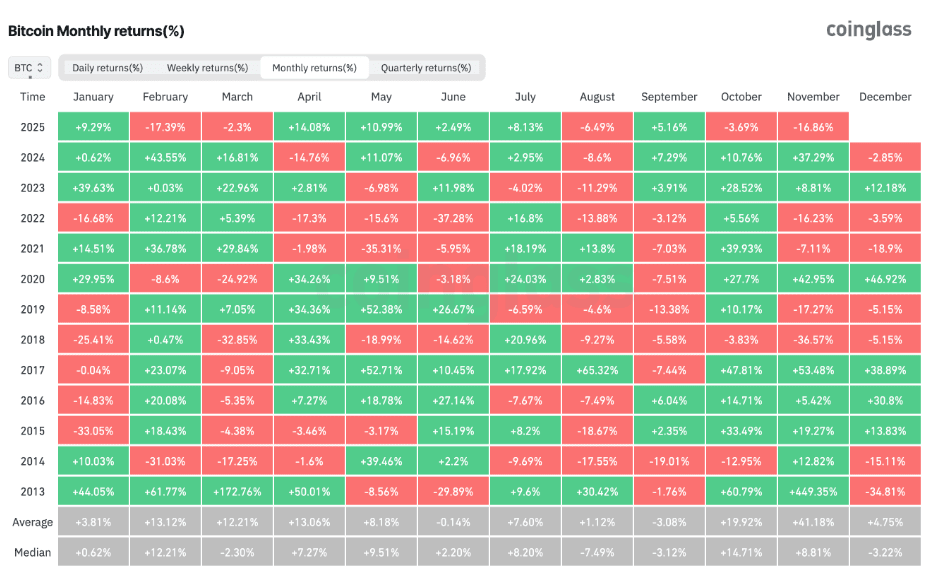

According to CoinGlass, this decline is close to the size of the losses seen in November 2019, when Bitcoin fell by about 17%, but far from the severe 35% crash in November 2018.

Reports have revealed that some analysts see this decline as a market reset. Nick Luck, research director at LVRG, said overleveraged positions and weak projects have largely been resolved, allowing long-term holders to add exposure at lower prices.

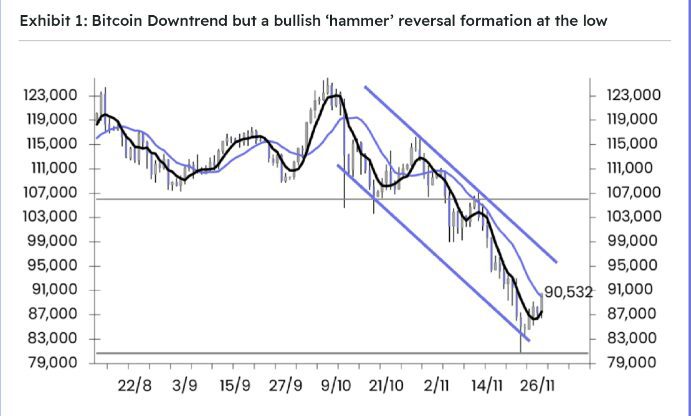

Focus on technical level

Traders are closely monitoring the monthly closing price pairs. An analyst using the handle CrediBull Crypto identified $93,400 and $102,400 as the two most relevant thresholds.

The analyst said a close above $93,000 would be interpreted as a moderately positive sign, while a monthly close above $102,000 would be interpreted as very bullish, although that could take another month.

Bitcoin traded around $91,450 in mid-week trading, failing to break through resistance below $92,000.

Cycle changes and institutional flows

Based on reports from industry participants, some market watchers believe that the rhythm of the rally has changed since the introduction of spot Bitcoin ETFs in early 2024.

Some analysts say the timing and scope of the move has changed due to the participation of institutional investors. This means that gains concentrated at the end of the year may appear sooner.

Market experts noted that November is typically a strong month for Bitcoin, and in past years, a November deficit was often followed by a December deficit.

Stalemate between bulls and bears

Matrixport said the market is a rare deadlock zone where sentiment, positioning and macro indicators all converge. According to reports, Bitcoin rallied above $91,800 during the Thanksgiving period, but the move did little to resolve the divide between bullish and bearish forecasts.

📃#MatrixOnTarget Report – November 28, 2025 ⬇️

Is Bitcoin’s Thanksgiving tailwind enough for Christmas? #Matrixport #Bitcoin #BTC #CryptoMarkets #MarketSentiment #Volatility #OnchainData #FedWatch #Seasonality #ThanksgivingRally pic.twitter.com/CH39quX6Aa

— Matrixport Official (@Matrixport_EN) November 28, 2025

Liquidity has thinned, volatility has declined, and the desire to prevent a crash has diminished. Glassnode added that realized losses are increasing and the futures market is deleveraging, a sign of weak near-term confidence. This combination has left the market stuck between a rise to $100,000 and a fall to $80,000.

Related books

Signs of major movement, direction unknown

A bullish hammer reversal appeared as Bitcoin briefly reached the $80,000 region, giving some traders hope for a rally heading into the holiday season.

Some say weak demand and thin liquidity could cause prices to fall before confidence returns. In each case, the market is quietly poised for a major directional move, even if no one can be sure which direction the move will go.

For now, Bitcoin is in a cautious position. Investors and traders will be watching monthly closing prices, liquidity indicators and option flows for clues.

The next clear signal could determine whether late buyers are rewarded or whether sellers set a new range.

Featured images from Gemini, charts from TradingView