Bitcoin (BTC) is trading in an unbearably tough range just under $120,000, but the rally quickly lost momentum as the market was a historically soft month for crypto.

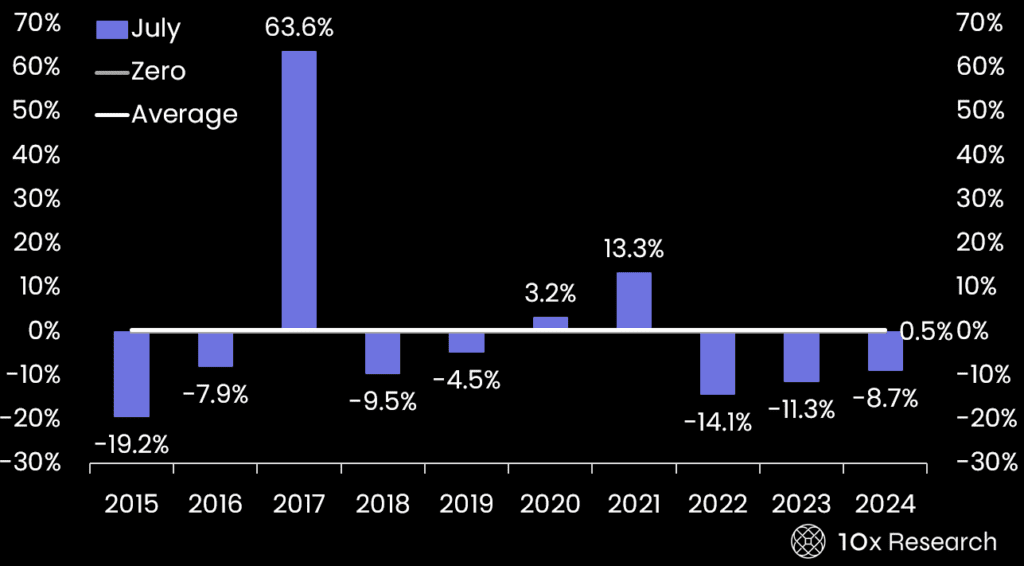

August has been Bitcoin’s weakest month in the last decade, with three years only three years, with others having lost between 5 and 20%, the report says.

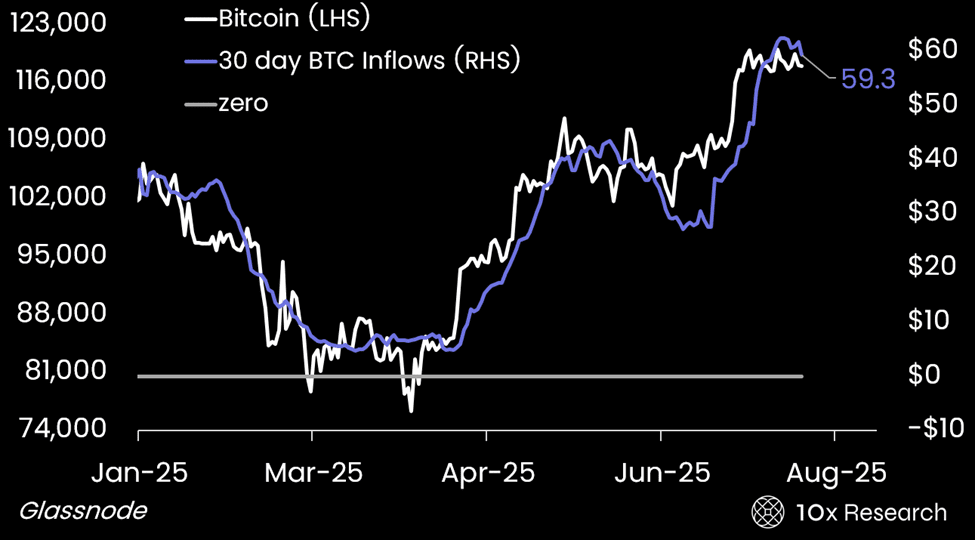

The report also flagged the slowdown in capital flow to the Bitcoin network, a key factor in price action this year. The total cumulative inflow into the network is currently over $1 trillion, with $206 billion arriving in 2025.

However, the 30-day rolling average slid from $62.4 billion to $59.3 billion. This could mark the start of the integration phase, the report said.

“Even though time is shorter and the billions of capital inflows from the corporate Treasury Department have led to the impact on actual prices being surprisingly calm,” writes Markus Thielen, co-founder and lead analyst of 10x. “This increases the likelihood that even with continued support, the market hasn’t reached the point of offering the kind of upside down that many people want.”

The report predicts it is likely to fall below $117,000, with support at $112,000, exceeding the $106,000-$110,000 threshold.

Still, the BTC Bulls could stick to hopes that they had occurred during the post-harving Bitcoin period in 2013, 2017 and 2021, during the post-harving years of Bitcoin harning.

And 2025 may be just like those years.

Read more: BTC faces Golden Fibonacci hurdles at $122,000, while XRP holds support for $3