Bitcoin is trading at key level after regaining the $115,000 mark, and despite the ongoing integration below the $120,000 threshold, Bull is in solid control. This trend remains bullish and is supported by a stable purchasing interest and strong technical positioning.

Related readings

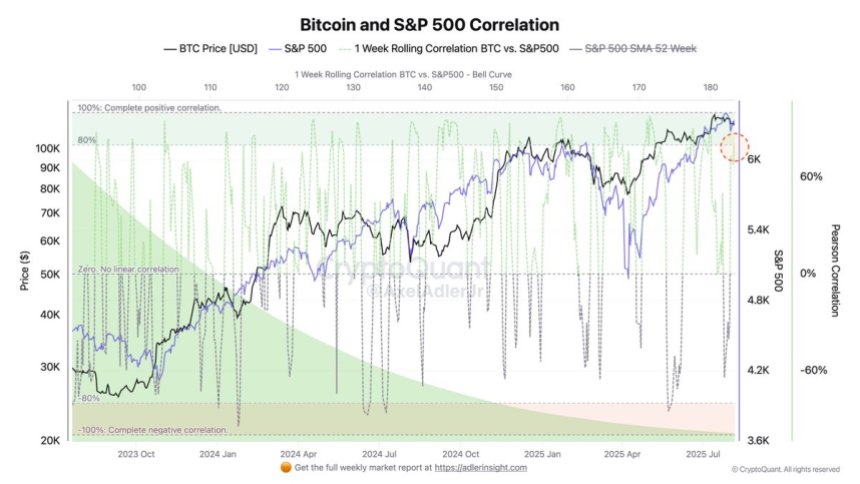

Important data shows that the correlation between Bitcoin and the S&P 500 has skyrocketed to 80%. With this high-correlation regime, continuous gatherings in US stocks can provide a tailwind for Bitcoin towards new highs, and stock pullbacks could amplify downside volatility.

The S&P 500 is currently in bullish stages, so it appears that BTC is tracking the same trajectory. Still, market watchers warn that such high correlation levels are often short-lived and prone to sharp reversals. For now, traders are closely monitoring both equity and crypto charts, knowing that changes in traditional market-wide risk appetite can quickly ripple over Bitcoin’s price action.

S&P 500 correlation enhances Bitcoin macro links

According to top analyst Axel Adler, the recent 80% correlation between Bitcoin and the S&P 500 highlights how deeply the power of the macroeconomics is affecting the crypto market. In this environment, key drivers such as interest rate expectations, liquidity conditions, and broader risk-on/risk-off sentiment are sent directly to BTC price action.

Under this regime, a sustained recovery in US stocks could provide a supportive background for Bitcoin. Conversely, if the stock market experiences a recession, negative sentiment can quickly spread into the crypto space, amplifying sales and causing wider market weakness.

Adler notes that the current reading is based on a one-week rolling correlation metric and is inherently volatile. Historically, such correlation spikes are rarely maintained for long periods of time. Current levels are important, but unlikely to hold for more than a few weeks before returning to average.

Despite the short-term nature of this spike, analysts emphasize the growth of crypto adoption in the US, namely setting bullish long-term outlook phases, from institutional products such as ETFs to corporate Treasury allocations. Still, traders must keep in mind that macroeconomic slump, liquidity tightening, or changes in Federal Reserve policy could quickly reverse market sentiment.

Related readings

Bitcoin Price Analysis: Bulls defend key support

Bitcoin (BTC) trades around $116,565 and is stable after recovering a support level of $115,724, which coincides with the key horizontal zone from late July. On the four-hour chart, BTC has recently broken beyond the 50, 100 and 200 days of SMA, signaling its short-term bullish momentum. These moving averages, which currently converge near $116,000, could serve as a strong support cluster if tested again.

The immediate upward target remains the $122,077 resistance, which was last tested in mid-July. However, BTC faces sales pressure of nearly $117,000, indicating a short-term consolidation before it rises. The volume tapers slightly after the breakout, suggesting that buyers may need new momentum to keep moving.

Related readings

If BTC is above $115,724 and has a moving average cluster, the Bulls can try a breakout towards the $118,000-$122,000 zone. However, a rejection could cause a retest of $115,724, with a deeper pullback.

Dall-E special images, TradingView chart