Bitcoin has struggled to regain the $90,000 level as selling pressure continues to dominate across crypto markets. The sharp decline from all-time highs has fueled speculation that the current economic cycle may have already peaked, with many analysts claiming the beginning of a bear market. Sentiment has changed rapidly, creating uncertainty as traders question whether the bullish structure has broken for good.

Related books

However, not everyone agrees with this bearish outlook. Some market participants still expect a rebound, arguing that the correction is part of a broader continuation pattern rather than the end of the cycle. These optimistic observers believe that high prices could still develop even after the sell-off begins.

Top analyst Dirkforst said recent price movements reflect a significant change in trader behavior. He explains that investors who tried to go long the market during the correction period ended up being shut out.

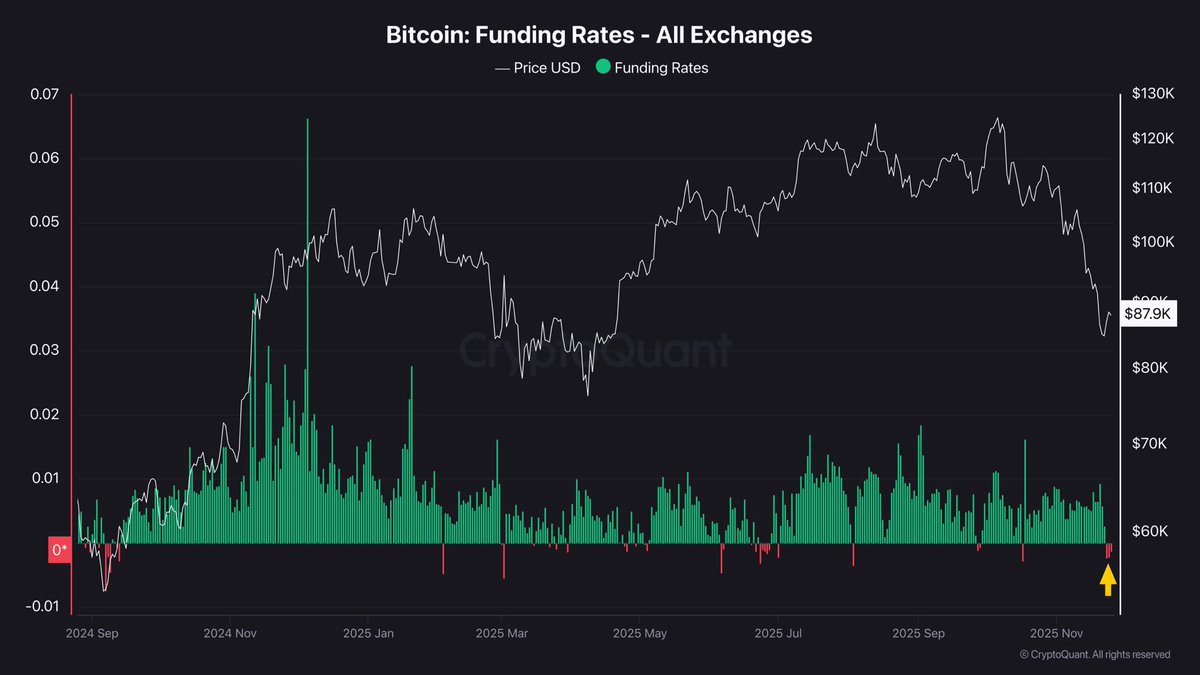

Funding rates, which had remained high during the decline, have now cooled and even turned negative, a strong sign that sentiment is reversing. Dirkforst said traders are waiting for Bitcoin to correct by more than 30% before aggressively shifting into short positions, highlighting the lag in reaction often seen near market inflection points.

Funding interest rates turn negative due to short market dominance

Dirkforst explains that recent changes in funding rates are more significant than they appear on the surface. He points out that traders often assume that the neutral funding level is 0%, but this is not the case. Most exchanges, including Binance, incorporate an interest factor of approximately 0.01% into their funding calculations.

This means that funding below 0.01% already reflects a short-side advantage. Therefore, when funding becomes negative, it signals a stronger inclination towards aggressive short positions. Dirkforst said this marks a clear behavioral shift among derivatives traders, suggesting the market has moved away from forced long unwinding and towards conviction-based short exposure.

Historically, these changes tend to occur only after the adjustment has already reached deep into the progression. Dirkforst emphasizes that such funding developments often reflect trader capitulation, meaning participants who fought the downtrend eventually try to reverse and follow the momentum, but only after most of the move has already played out.

This phenomenon has also appeared in retracements of previous cycles, often coinciding with late-stage bottoms. He added that Bitcoin may now be entering a phase of distrust where the price starts to rise while short selling piles up. If this momentum continues, it could provide fuel for an upward reversal, especially if spot demand wakes up and liquidations put pressure on short sellers instead.

Related books

BTC Price Test Short Term Supply

Bitcoin has been stabilizing after a sharp selloff, with charts showing the price currently trading around $87,000 after rebounding from the recent plunge around $80,000. The downtrend remains clear as BTC continues to trade below its 50-day, 100-day, and 200-day moving averages, indicating sustained bearish momentum.

The slope of these moving averages has turned downward, reinforcing the change in trend structure. Despite the rebound, the recovery lacks strong volume support, suggesting that buyers have not yet returned with conviction.

Related books

The chart shows that previous support levels near $95,000 and $100,000 are now resistance areas, making them important levels to watch for any recovery attempt. Failure to reclaim these zones could create fresh selling pressure and retest recent lows. However, a core below $80,000 indicates aggressive buying at the lows, and if buyers continue to hold on to further lows over the next few days, it could signal that a short-term bottom is forming.

Although market sentiment remains fragile, stabilization above $85,000 suggests a potential correction phase rather than an immediate continuation of the decline. A sustained move above the 100-day moving average would be the first meaningful signal that bullish momentum has returned.

Featured image from ChatGPT, chart from TradingView.com