TLDR

Bitcoin’s Fear and Greed Index dropped to 22, marking the lowest investor sentiment since March despite this being the smallest price correction of the cycle at 25%

Over 70% of Polymarket traders expect Bitcoin to fall below $90,000 as long-term holders sold more than 400,000 BTC in October

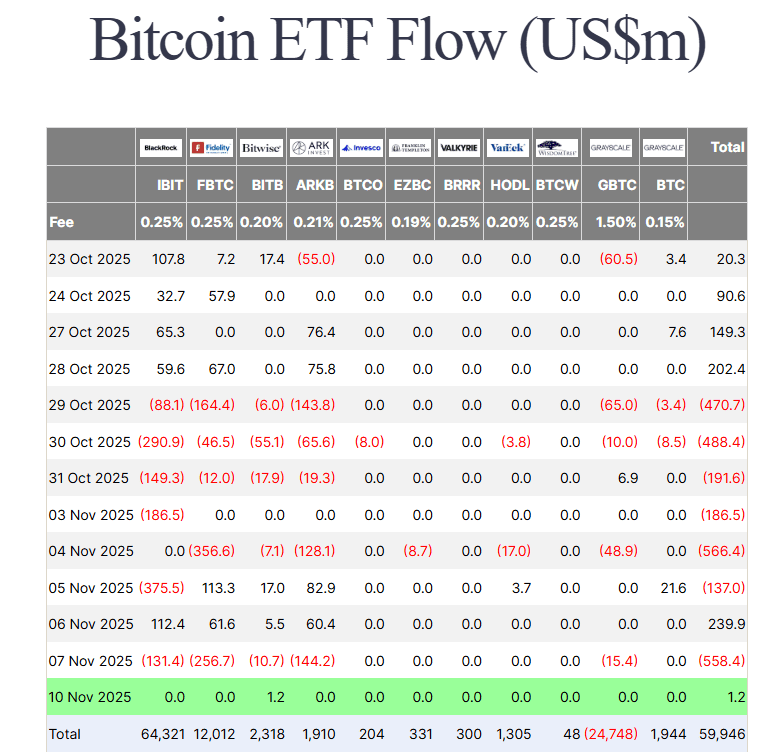

Bitcoin spot ETF inflows stalled with only $1.2 million recorded on Monday, raising concerns about momentum for the rest of the year

Bitcoin dropped below its 365-day moving average multiple times in November, a critical support level for the cryptocurrency

Analysts from Bitfinex view this as mid-cycle consolidation rather than the end of the bull market, with 72% of BTC supply still in profit at $100,000

Bitcoin price has dropped below $100,000 while investor sentiment falls to levels not seen in ten months. The crypto Fear and Greed Index sits at 22, just above extreme fear territory.

This marks the lowest sentiment reading since March. Market analyst Nic Puckrin noted the current dip is only 25% compared to previous corrections of 31% and 32% during this cycle.

Bitcoin traded below its 365-day moving average several times in November. This technical indicator serves as a critical support level for the cryptocurrency. The price continued moving lower on Friday, staying well beneath this average.

More than 70% of traders on Polymarket now predict Bitcoin will drop below $90,000. Long-term Bitcoin holders sold over 400,000 BTC during October. This selling pressure from older whales has contributed to the downward price movement.

BREAKING: 73% chance Bitcoin crashes below $90k this year.https://t.co/wD5GvHgBs6

— Polymarket (@Polymarket) November 14, 2025

ETF Demand Shows Weakness

Bitcoin spot ETF inflows have stalled at a critical time. On Monday, these funds recorded just $1.2 million in new investments according to Farside Investors data.

The US Senate approved a funding package to end the 41-day government shutdown. Despite this positive development, Bitcoin ETFs saw minimal demand. Charles Edwards from Capriole Investments expressed concern about this lack of buying interest.

Bloomberg ETF analyst Eric Balchunas said heavy outflows were not the main cause of price declines. ETFs experienced roughly $1 billion in outflows over the past month. This came after October’s market crash that wiped out $19 billion in leveraged positions within 24 hours.

Somehow the bitcoin ETFs took in cash yest and have seen <$1b in outflows during the 20% drawdown = 99.5% of the assets hung tough. Told y’all the ETF-using boomers are no joke. So who’s been selling? To quote that horror movie, “ma’am, the call is coming from inside the house” pic.twitter.com/1WnSTwkmFG

— Eric Balchunas (@EricBalchunas) November 7, 2025

BlackRock’s Bitcoin ETF remains the only issuer with positive year-to-date inflows. The fund attracted $28.1 billion while other issuers saw $1.27 million in combined outflows.

Market Analysts Debate Bull Market Status

Alex Thorn from Galaxy investment firm lowered his 2025 Bitcoin price target from $180,000 to $120,000. He cited investor rotation into competing assets like gold and AI-related investments.

Thorn also pointed to leveraged liquidations in crypto derivatives markets as a factor behind falling prices. Cathie Wood from ARK Invest suggested stablecoins are taking market share from Bitcoin as stores of value in emerging economies.

Bitfinex analysts view the current situation as mid-cycle consolidation rather than a bear market. They noted the correction structure resembles patterns from June 2024 and February 2025. Both periods became turning points for Bitcoin price recovery.

About 72% of Bitcoin supply remained profitable when the price hit $100,000. The analysts said this indicates healthy market structure for mid-cycle consolidation. However, they noted recovery needs renewed demand from both institutional and retail investors.

Bitcoin spot ETF inflows continued their weak performance with three consecutive days of net outflows totaling $492 million through November 14.