Bitcoin is showing a modest rebound after several days of intense selling pressure and fear across markets. Major cryptocurrencies have struggled to establish stable support, and volatile fluctuations have made it difficult for traders to maneuver. Despite the uncertainty, some market participants continue to act strategically, and one of the most famous whales has made a big comeback.

Related books

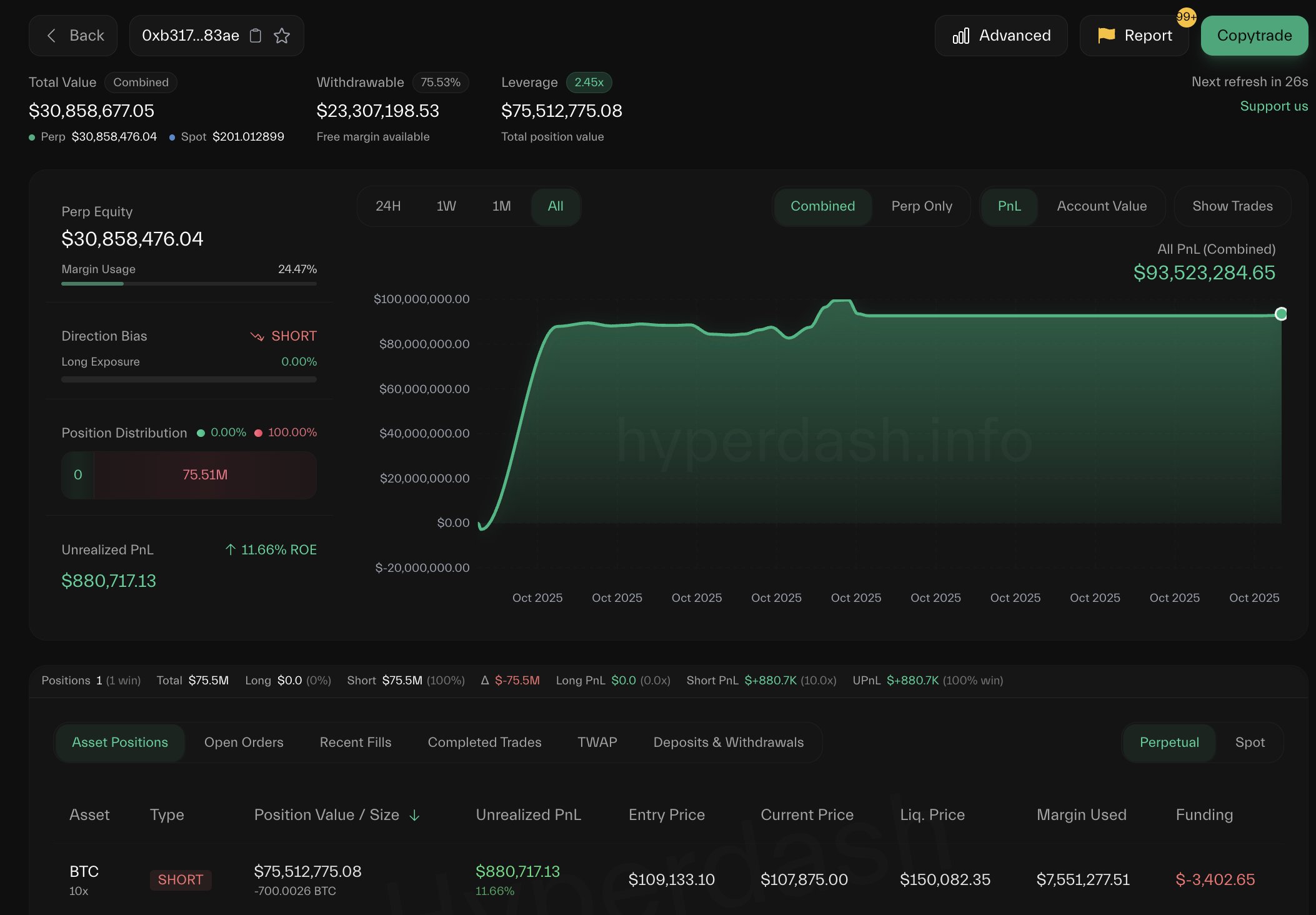

The trader known as BitcoinOG (1011short) — who rose to fame after making more than $197 million in last week’s Flash Crash — is back in action. On-chain data shows that he deposited $30 million in USDC into Hyperliquid and opened a 10x short position of 700 BTC (worth about $75.5 million).

The move has caught the attention of the market, reigniting speculation about whether whales are expecting further declines in Bitcoin. While BTC is attempting to recover above $110,000, the existence of such large short positions highlights the persistent bearish sentiment and lack of belief among traders. For now, bulls are fighting to stabilize price momentum, but with whales like 1011short coming back into the game, the volatility is likely far from over and the market may soon see another sharp move.

Whale lacks profits as market tensions rise

According to Lookonchain, the whale known as BitcoinOG (1011short) currently holds approximately $880,000, or approximately 11%, in unrealized gains on the most recent $75.5 million short position opened on Hyperliquid. This trade came during a Bitcoin pullback and quickly gained momentum as BTC struggled to maintain momentum above the $111,000 level. The move has caused anxiety among investors and traders alike, many of whom see it as a potential warning sign that major companies may be bracing for fresh downside pressure.

Still, analysts warn that this may not tell the whole story. While the 1011short address has a reputation for accuracy, especially during the October 10th Flash Crash where it netted $197 million, there are limits to the transparency of its on-chain data. It is unclear how many positions this whale currently holds on other exchanges or what the exact strategy behind his trades is. Therefore, reading his move as a simple bearish bet may be an oversimplification.

The next few days will be crucial for Bitcoin’s trajectory. If the whales decide to extend their short interest further, the selling pressure could intensify and push BTC closer to a major support level. Conversely, if he closes out his position or pivots to long, it could signal a near-term market bottom. Either way, traders are bracing for sharp price changes as the market digests this high-profile activity, signaling more volatility ahead.

Related books

Bitcoin maintains weekly support, but resistance looms

Bitcoin is showing early signs of stabilization on the weekly chart, recovering from its October 10 flash crash lows of around $103,000 and trading around $111,200. The candlestick structure suggests that buyers are holding to the 50-week moving average (blue line), which has served as reliable mid-cycle support throughout the current bullish phase.

However, the broader structure shows that Bitcoin is still holding firm below the $117,500 resistance, a level that has repeatedly capped gains since mid-2025. Until BTC breaks out of this zone on strong volume, the market will remain trapped in a sideways range, with traders cautiously positioning themselves amid high volatility and uncertain macro environment.

Related books

Momentum indicators are showing neutral to bearish sentiment, reflecting hesitation among bulls after weeks of massive liquidations. Still, the presence of higher lows on the weekly chart continues to support the long-term bullish structure as long as BTC sustains above $106,000-$107,000.

If the price manages to recover and close at $117,500, consistent with the pocket of liquidity from the previous upside, it could pave the way for $125,000 to $130,000. Conversely, a weekly close below $106,000 would change the outlook to bearish, suggesting a more severe correction ahead.

Featured image from ChatGPT, chart from TradingView.com