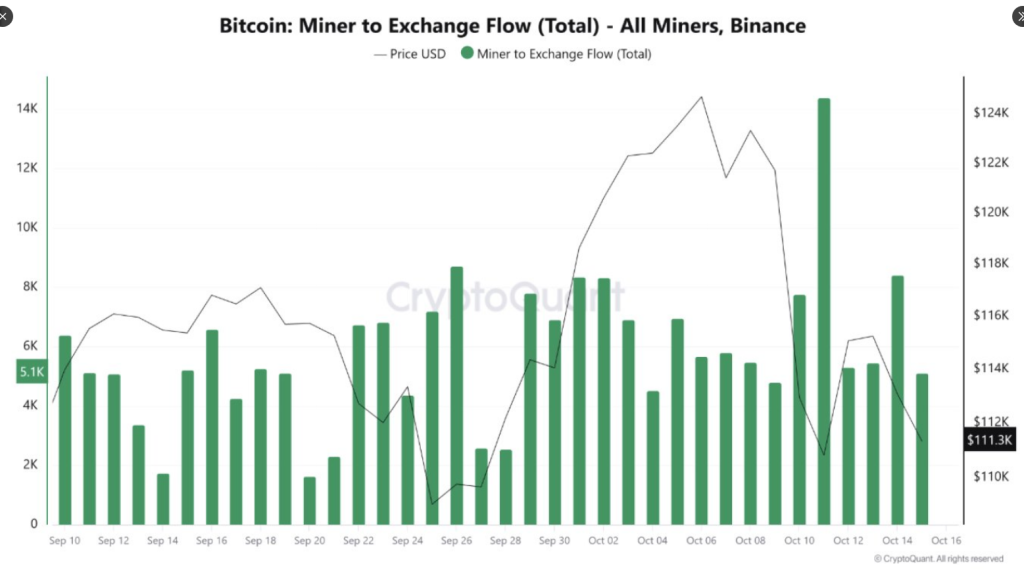

Bitcoin miners have been moving large amounts of coins to major exchanges in recent days, according to on-chain trackers, indicating a clear change in behavior that the market will be watching closely.

The report revealed that miners have transferred a total of 51,000 BTC (equivalent to over $5.7 billion) to Binance since October 9th. This is a very large supply flow to places where coins can be sold immediately.

Miners move large amounts of funds to exchanges

On October 11, a day after the market crashed and Bitcoin briefly fell to $104,000, there was a dramatic spike in miners depositing more than 14,000 BTC into Binance, wiping out nearly $20 billion in leveraged positions.

The day’s outflow was the largest outflow of miners since July last year, data showed. Market participants often interpret these movements as a shift from holding to selling, and that shift can quickly change short-term sentiment.

Binance data shows miners have deposited a total of 51,000 Bitcoins since October 9th.

“51,000 Bitcoins deposited within 7 days represents a clear shift in miner behavior from holding to selling or liquidating.” – via @ArabxChain pic.twitter.com/qSN6WGK5bu

— CryptoQuant.com (@cryptoquant_com) October 16, 2025

CryptoQuant and other analytics firms warn that moving coins to an exchange does not necessarily lead to an immediate sale. Some miners may be pledging Bitcoin as collateral for futures, funding operational needs, or moving reserves between wallets for bookkeeping purposes.

Still, markets tend to react quickly to visible supply flows. Traders can act on that visible movement even if the coin is not sold immediately, increasing price pressure through their trading actions alone.

A fund that buys whales and crashes

According to the report, large buyers are also active at the same time. One new wallet reportedly purchased $110 million worth of BTC from Binance, and another new address purchased 465 BTC (approximately $51 million) from FalconX.

Additionally, the US Spot Bitcoin ETF also recorded inflows. Such buyers could absorb some of the coins supplied by miners, limiting the price decline.

Market momentum remains fragile

After a wild week that wiped out a ton of market value, Bitcoin is struggling to regain any tangible momentum. The coin was trading at nearly $109,000 in Singapore on October 17, according to Bloomberg data.

Bitcoin hit an all-time high of $126,250 on October 6th, so the pullback was sharp and rapid. Bitcoin fell by as much as 6.5% in the week ending October 12, its biggest weekly decline since early March.

Analysts see a major support level near $107,000. They warn that a steady fall below this level could lead to further losses. On the other hand, steady purchases by large holders and continued demand for the ETF could limit a significant market decline. The tug of war is obvious. There are miners who add potential supply, and large buyers who stand on the other side.

Featured image from Unsplash, chart from TradingView