Macro trader Plur Papa (@plur_daddy) argues that Bitcoin’s 2026 setup is less about crypto-specific catalysts and more about whether U.S. liquidity conditions normalize after what he described as an unusually risky few months.

His central thesis is that as leverage in the economy expanded faster than the Fed’s balance sheet, repo “plumbing” was strained by a lack of bank reserves, and the resulting stress manifested itself in the broader market in “a very unfavorable environment for cryptocurrencies” as well as “very volatile and rotating dynamics in the stock market.” Looking ahead to the new year, he foresees a series of gradual changes that could bring the situation back from tight to neutral, even if no new “mitigation” regime is established.

Four macro themes important for Bitcoin

The first tool is the Fed’s Reserve Management Purchases (RMP). “This liquidity has been flowing in since we announced at the December FOMC meeting that the three-month RMP would be $40 billion a month (undefined reductions thereafter). The Fed has already purchased $38 billion of the first month’s allocation,” he said. “So far we have not seen a significant impact as this is offset by year-end liquidity factors as broker-dealers close their books and reduce risk towards the end of the year, but this should change.”

Related books

He emphasizes that the program is aimed at easing funding pressures, not fueling a risk-on melt-up. “Just as a disclaimer, this is not quantitative easing. This is a targeted tool to unclog the financial plumbing matrix, so don’t get too carried away with the impact this will have,” he said. “It can help turn a harsh environment back into a normal environment, but it can’t turn a normal environment into a relaxed environment.”

He said the size decision was imprecise but meaningful. “Measuring the deficit is more of an art than a science, but my intuition is that it’s probably around $100 billion to $200 billion (consistent with the announced RMP size), so a one-month RMP won’t solve everything, but it should have a meaningful impact.”

The second is fiscal progressivity. He expects the budget deficit to widen slightly again, saying, “My research is that it will increase by $12 billion to $15 billion a month starting January 1st due to the impact of OBBBA,” adding, “We are in a position of fiscal advantage.”

The analyst linked the recent weakness to the opposite movement, arguing that deficit reduction (which he blames on tariffs) is weighing on the market and that even a partial reversal is important: “$12 billion to $15 billion per month is not enough to overcome the impact of tariffs, but it’s up compared to November and December, so we believe the increase is what matters.” He also warned that the eSLR changes, which come into force from January 1 for early adopters, are a small tailwind as broader banking deregulation is “on the way to 2026”.

Third is disinflation and policy direction. He frames the mix as a “Goldilocks setup,” citing one-year inflation swaps and pointing to a decline in market-based inflation expectations. “A disinflationary environment creates a Goldilocks situation,” he wrote. “The economy is weak, but not too weak. Slowing inflation allows the Fed to continue reducing air cover.” He noted that markets are currently conservative, saying that “January rate cuts will be only 13%,” and that “the annual “A total of two interest rate cuts have been factored in,” he said, setting out his own criteria: “Assuming orthodox policy, we would expect a value close to four interest rate cuts, but if Trump takes over, it will likely be more.”

Related books

Finally, he argues that politics could become important through the Fed chairman. “Trump will ultimately value loyalty above all else,” he wrote, because he believes Trump feels “betrayed by Powell.” “The Fed chair is particularly important in this regard because, unlike other positions, President Trump does not have the power to remove the Fed chair,” he added. In his view, Kevin Hassett’s chances are “very likely” given that relationship. He also commented on market sensitivity: “Gold in particular will benefit from Hassett’s appointment. I also think equities may experience some initial heartburn, but will ultimately rally.”

Regarding Bitcoin, his conclusions are cautious, but if these macro parts align, the direction is constructive. “When it comes to cryptocurrencies, in theory all of this should benefit cryptocurrencies,” he wrote. “I prefer gold here, so I probably won’t play it. Given the exodus of spiritual capital, cryptocurrencies are an increasingly tough bet.” Still, he says, “If you’re going to be bullish, there’s an argument that this is the time. Rather than being a hero, look for a change in character and a positive reaction as the liquidity situation improves.”

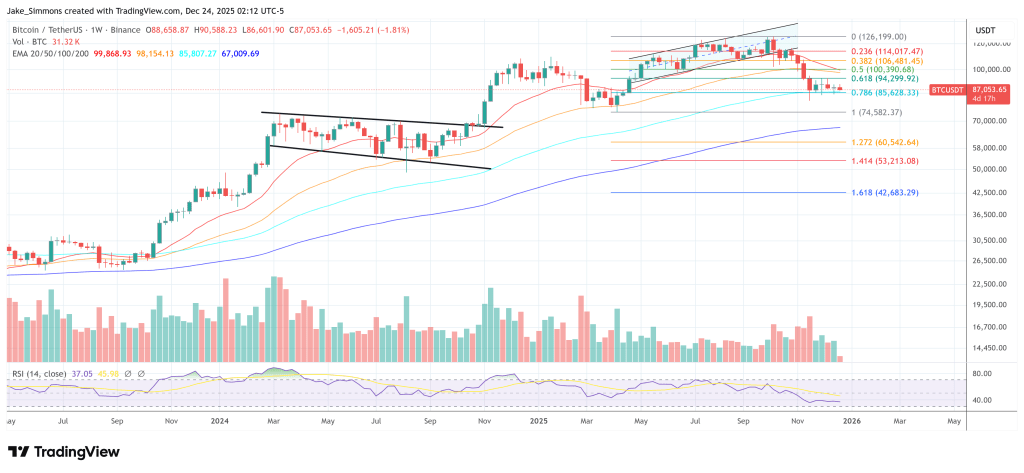

At the time of writing, BTC was trading at $87,053.

Featured image created with DALL.E, chart on TradingView.com