Bitcoin is Trading in a vulnerable state After dropping below $90,000, it’s now in the mid-$80,000 range. This price move has some analysts wondering about the possibility of the next big rally. It’s further away than many people expect.

A recent technical outlook from prominent crypto analyst Tony “The Bull” Severino lends further weight to this concern. his focus on analysis The six-week LMACD momentum indicator has just crossed bearish territory for the first time in years.

Related books

Momentum falls back to Bitcoin after 6 weeks of LMACD

The technical outlook underscores Severino’s strong warning that Bitcoin is dangerous. Far from staging This is an explosive recovery that many people have been waiting for.

Severino’s message revolves around momentum. I’m looking down firmly now.. This momentum is cited using the recent crossover of the 6-week LMACD, which is known for definitive crossovers that confirm changes in long-term trends.

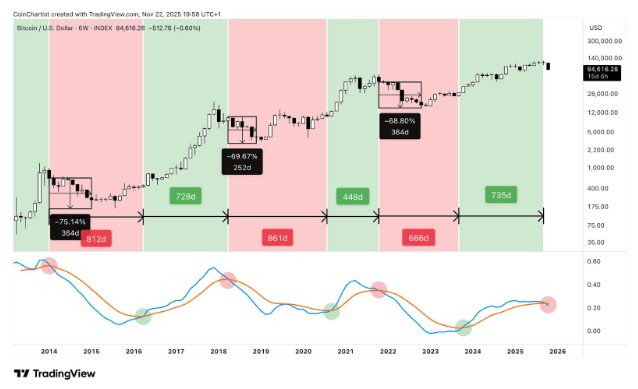

The 6-week LMACD is a lagging signal, meaning that by the time it turns bearish, Bitcoin is already in a downtrend. The chart confirms this in multiple examples. Bitcoin entered an extended red phase lasting 812 days, 861 days, and 686 days after previous bearish crossovers.

Because signals lag price movements, Bitcoin typically bottoms out long after the crossover occurs. Severino pointed out that bear market lows always occur between 250 and 365 days after a bearish reversal, and not within a few weeks. Therefore, traders expecting a bottom just 40 days after a new signal are ignoring how consistently slow this indicator has been.

This chart highlights how deep each economic downturn becomes when the LMACD turns bearish. Previous cycles saw drawdowns of around 69% to 75% from the moment the cross occurred, even though Bitcoin had already fallen significantly before the indicator flashed.

If you want to understand why it is highly unlikely that Bitcoin will suddenly return to a bull market, keep an eye on this post.

One word: momentum

The 6-week LMACD has some of the cleanest crossovers that represent important trend change confirmation points. The signal is delayed… pic.twitter.com/mq9uR2Fqec

— Tony “The Bull” Severino, CMT (@TonyTheBullCMT) November 22, 2025

It is expected to be a long road to a significant recovery.

LMACD, but The signal just passed bearish, The current crossover remains unconfirmed for another 15 days, and the similarities to past cycles are something to keep in mind.

While Severino said he is not predicting the end of Bitcoin’s long-term outlook, he recommends that traders: Don’t expect a sudden rise. Past actions do not guarantee the same outcome, and there is no certainty that Bitcoin will fall another 70% from here like in previous cycles.

Related books

The 6-week LMACD is a high timeframe signal, and the changes it captures reflect deep structural trends rather than short-term fluctuations. This means Bitcoin may still exist We are just a few months away from the true bottom of the cycle.

At the time of writing, Bitcoin is trading at $85,670, down 11% and 23% over the past 7 and 30 days, respectively. Severino’s analysis means Bitcoin prices could remain at or near these levels for an extended period of time. experience further decline before any meaningful recovery into a new bullish phase begins.

Featured images from See The Wild, charts from TradingView