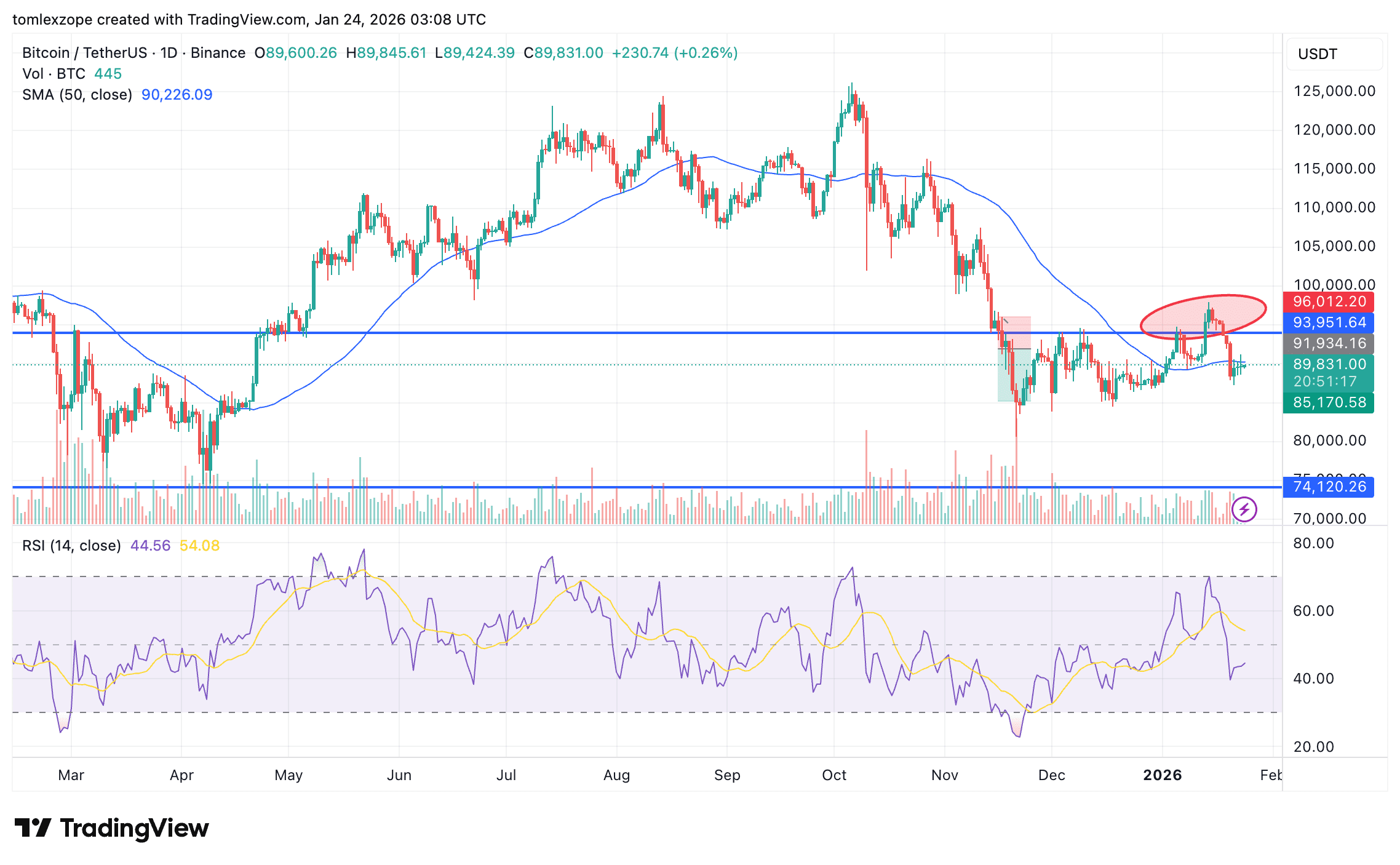

Last week, Bitcoin price faced a significant setback in its goal of regaining the six-digit threshold. The flagship cryptocurrency is hovering around $90,000 as the market appears undecided on its next price direction.

As Bitcoin faced a gradual decline, resulting in its price falling from recent highs, certain market participants, including miners, were under severe pressure. Interestingly, recent on-chain evaluations raise the possibility that miner stress will soon be lifted.

Miners’ financial health flashes classic reversal signs

Market expert Axel Adler Jr. highlighted in a January 23 post on social media platform The relevant indicator here is the Miner Financial Health Index (7D-SMA).

Related books

For context, this metric tracks the balance between miner revenue and miner selling pressure. Therefore, it reflects whether a miner is a pure BTC distributor or an accumulator. Simply put, this indicator shows whether Bitcoin miners are under pressure, stable, or even profitable.

Surrender events are often reflected as negative values in the Miner Health Index because the amount of BTC spent exceeds the amount of BTC earned. On the other hand, miners are typically said to be in a recovery phase where the balance between revenue and expenses begins to move away from negative.

From the chart shared by the analyst, it is clear that the index is trending up and targeting the neutral level on the chart of the indicator. History has shown us that the index does not simply target the neutral mark when it is trending up.

So, if history repeats itself, Bitcoin miners may survive the most recent capitulation event and end up with a rewarding journey. Interestingly, the price of Bitcoin seems to have a direct proportional relationship with the Miner Health Index.

Bitcoin price gains momentum as market conditions change

In a separate post on X, Bitcoin Vector highlighted that Bitcoin may be gaining momentum for a big move in the short term. According to the analytics platform, this development coincides with the market exiting what was previously a “high-risk environment.”

Bitcoin Vector explained that the last time this exit from a risky market environment was seen was in April 2025, just before the bull market resumed. The on-chain analytics firm explained that we may be witnessing the late stages of a classic momentum bottoming pattern that historically leads to a large-scale pullback.

Basically, for a bullish signal to fully form, the price needs to be pushed down one last time, while at the same time gaining upward momentum. At the time of this writing, Bitcoin is worth around $89,830, but there has been no significant movement in the past 24 hours.

Related books

Featured image from iStock, chart from TradingView