Cryptocurrencies entered 2026 with a sharp rally, but Bitwise CIO Matt Hogan said whether the next level is higher depends less on chart patterns and more on three checkpoints that have more to do with market plumbing, Washington, and the broader risk context.

In a Jan. 6 note, Hogan wrote that as of Monday, Jan. 5, Bitcoin and Ethereum are each up 7% year-to-date, while high-beta stocks have moved faster, with Dogecoin up 29% over the same period. The question, he argued, is whether that initial strength can translate into something lasting rather than a temporary January pop.

Three hurdles for Bitcoin, ETH, and Dogecoin to overcome

Hogan’s framework begins with a memory that the market would rather bury. On October 10, 2025, the crypto industry experienced what he calls the “largest liquidation event in history,” with “$19 billion in futures positions disappearing in a single day.” Mechanical damage was important, but psychological overhang may have been more important. In the weeks that followed, investors worried that the chain had “perhaps fatally damaged major market makers and hedge funds,” raising fears of forced sales as major companies unwinded, he wrote.

“One reason cryptocurrencies struggled to rally in the fourth quarter was that investors feared one of these large companies would have to wind down operations, a process that typically requires a forced sale of assets,” Hogan wrote. “These potential sales were hovering over the market like a thick fog.”

Related books

His first hurdle, therefore, is simply that another explosion with similar systemic effects does not occur. On this point, he spoke in a very confident tone. “Good news. If it was going to happen, it probably would have happened by now,” he wrote, adding that while there are “no guarantees,” business closures are likely to “tend to end by the end of the year.” In his reading, part of the rally in early 2026 reflects a market that has “postponed October 10.” He named that hurdle the “green light.”

The second checkpoint is legislative and much less within the control of the market. That is the passage of the virtual currency market structure bill known as the CLARITY Act. Hogan wrote that the bill has been “meandering through Congress” and that the Senate is “targeting a Jan. 15 markup.” At this stage, committees are adjusting the draft and moving the final bill forward for a vote.

He didn’t present it as a clean glide path. “Hurdles remain,” he wrote, citing “competing visions for how to regulate DeFi, stablecoin rewards, and political conflicts of interest.” Still, he sees markup as an extremely important hurdle, and if CLARITY can pass that process, it would be a “huge step toward approval.”

Related books

Hogan’s main argument is around durability. “Passage of the CLARITY Act is key to the long-term future of cryptocurrencies in the United States,” he wrote. “Without the law, the current regulatory tilt of crypto regulation at the SEC, CFTC, and other agencies could be reversed under the new administration. Passage of the law will codify core principles and provide a strong foundation for future growth.”

He pointed to signals from both politics and prediction markets. White House crypto mogul David Sachs is “closer than ever” to passing the bill, Hogan wrote. Kalsi added that the probability would be 46% by May and 82% by the end of the year. Hogan’s own take: “I’m cautiously optimistic.” He tagged the hurdle a “yellow light.”

The third checkpoint is one that crypto traders often like to ignore until it becomes important: stock market stability. Hogan argued that the market does not need strong stock price increases to support cryptocurrencies, noting that “cryptocurrencies are not highly correlated with stocks.” But he drew a hard line on drawdowns that force widespread deleveraging and risk-off positioning. “A sharp selloff, such as a 20% decline in the S&P 500, would take the shine off all risk assets, including cryptocurrencies, in the short term,” he wrote.

Here, he made clear his limitations, saying, “I cannot claim any special expertise in the stock market.” While he noted that some investors are concerned about an AI bubble, he pointed to prediction markets that see “a relatively low probability of a recession in 2026 and an approximately 80% probability that the S&P 500 will rise.” Similar to the CLARITY Act, he labeled the stock background a “yellow flag.”

Hougan concluded by arguing that the setup is constructive if the remaining yellow turns green. “There’s a lot to be excited about in the crypto market right now,” he said, noting growing adoption by institutional investors, a proliferation of real-world use cases “such as stablecoins and tokenization,” and that the market is “starting to feel the benefits of the pro-crypto regulatory push that began in January 2025.” He added that if the three milestones are successfully achieved, “early momentum in 2026 will be in full swing.”

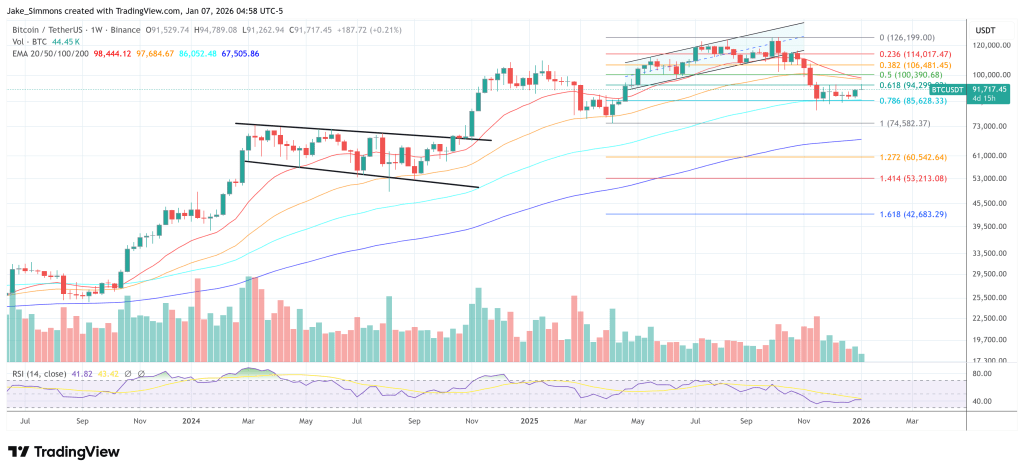

At the time of writing, Bitcoin was trading at $91,717.

Featured image created with DALL.E, chart on TradingView.com