Bitcoin recalls important levels above the $118,000 mark and after weeks of uncertainty, it changed momentum in the bull’s favor. The breakout is revitalizing emotions across the market, and traders are confident that BTC is on a major crisis of movement. Historically, October has been one of the strongest months for Bitcoin’s performance, with some analysts already hoping for a massive impulse that can turn their assets to new highs.

Related readings

What is particularly noteworthy about this rally is the fundamental stability reflected in market data. Top analyst Axel Adler shared insights showing that Bitcoin is currently in equilibrium. This condition often presents a healthy market structure and creates a strong foundation for potential benefits. If momentum is the case, a combination of bullish seasonal patterns and stable equilibrium may promote positive continuity of the cycle.

Still, analysts warn that the next few days will be important. Recovering $118,000 is a powerful first step, but Bitcoin needs to build support beyond this threshold to see breakouts and maintain its trajectory. With volatility back, October proves once again a decisive month for Bitcoin.

Bitcoin dynamics match the key indicator

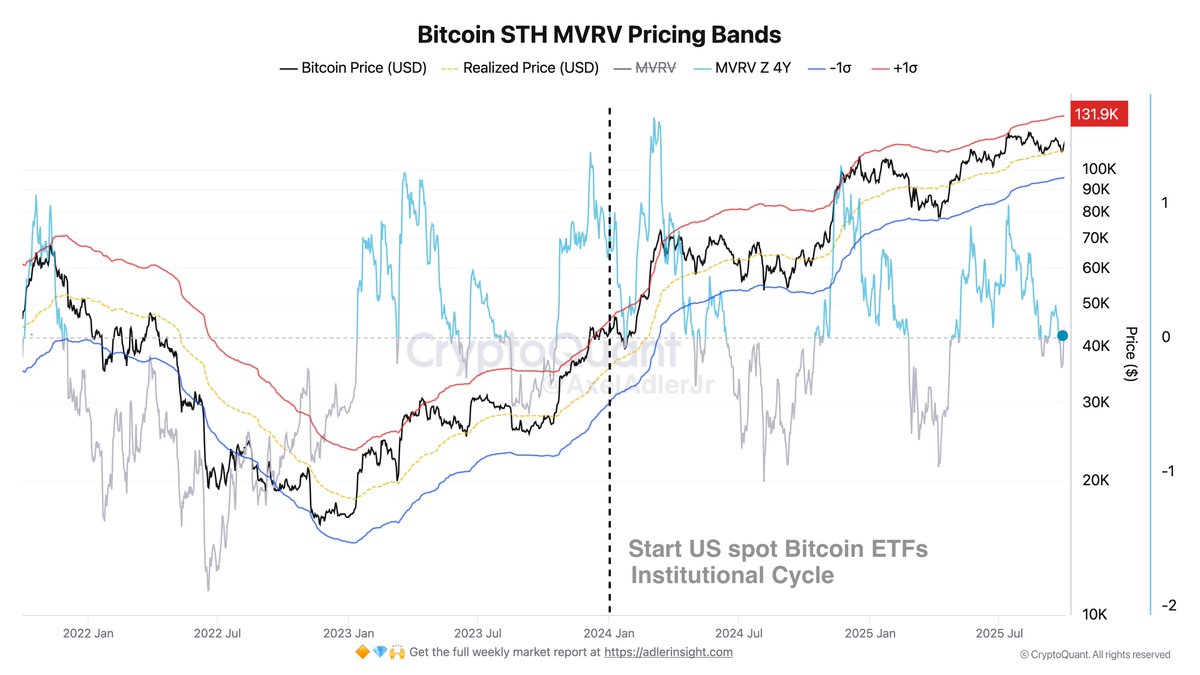

In the Cryptoquant report, Adler explains that Bitcoin’s current price behavior is closely in line with the STH-MVRV pricing corridor, a metric designed to reflect the average profitability of recent buyers. This corridor provides a framework for assessing cases where short-term holders are profitable and are more likely to lose and surrender than when they are more likely to sell. Currently, Bitcoin sits comfortably within this range, suggesting a healthy balance of market dynamics.

The corridor cap, defined as +1σ, currently holds approximately $130,000. Adler notes that this level represents a zone in which short-term holders usually begin to lock their profits more aggressively. Historically, this price approach to boundaries has caused a wave of sales and provides a natural cap until stronger demand arises. Nevertheless, the existence of this cap gives the market a clear target, and if the current dynamics persist, the move to $130,000 appears increasingly realistic.

Equally important is the corridor baseline, reflecting the average realized price of short-term holders. Since the beginning of 2024, Bitcoin has been consistently held above this level (marked by the yellow line on the chart). This sustained intensity maintained bullish sentiment as a short-term decline under the baseline was quickly acquired and quickly acquired, reflecting robust demand.

In effect, Bitcoin remains in equilibrium, with its established volatile corridor. This balance, coupled with the historic seasonality of October assembly and strong institutional flows, places the market favorably for potential benefits. If purchasing pressure continues and volatility contracts continue, the odds of moving towards the $130,000 zone will be a concrete scenario in the coming weeks.

Related readings

After the rally, Bitcoin faces resistance

Bitcoin has traded around $118,800 on its 12-hour chart, extending its breakout since the beginning of this week. Price has skyrocketed beyond the key $117,500 resistance, the level that closes the rally during September, and is currently testing the $119,000-$120,000 area. The zone represents the final hurdle before a potential retest with a summer high of nearly $125,000.

Moving averages show improvement in momentum. BTC has recovered the 50th (blue) and 100th (green) moving averages with strong follow-throughs and converted them to a short-term support zone of around $114,000-$115,000. Meanwhile, the 200-period (red) moving average continues to rise from the bottom, strengthening the long-term bullish trend. The decisive break, which exceeds multiple averages in just a few sessions, highlights the strength of the buyer’s conviction.

Related readings

However, the chart also suggests that Bitcoin is in over-expanded territory in the short term. After four consecutive bullish candles, the consolidation period of around $118,000-119,000 is no surprise. It could be attracted to $115,000 because it couldn’t exceed $117,500, but a sustained purchase could potentially confirm a pass of $120,000 or more.

Chatgpt featured images, charts on tradingview.com