What you need to know:

Strategy’s purchase of $836 million in Bitcoin during the drawdown strengthens institutional investor confidence in the Bitcoin dollar, even as volatility spikes and macro signals remain loud. Renewed expectations that the Fed will cut rates further in 2025 support the broader risk assets case and could extend the current crypto cycle into next year. Wallet infrastructure, Bitcoin scaling, and stablecoin payment rails are positioned as structural winners if on-chain activity and ETF-driven adoption continue to grow. Best Wallet Token, Bitcoin Hyper, and Tron each utilize narratives with different risk profiles. One is high-yield pre-sales and the other is layer 1 that generates revenue.

Cryptocurrency markets have just completed their most volatile week in months. Bitcoin fell sharply early, dragging altcoins with it as risk assets reacted to volatile macro signals and confidence in the Fed’s further interest rate cuts this year waned.

The tone changed midweek. The strategy revealed $836 million in Bitcoin purchases and added $8,178 BTC, bringing its treasury to $649,870 BTC, which is over 3% of Bitcoin’s total supply.

This is a serious “buy on the buy” statement by the largest corporate dollar BTC holder, and a clear indication that institutional investor belief is not going anywhere, even though spot prices are under pressure.

On the macro front, the odds of a rate cut have started to solidify again, as traders repriced the possibility of further Fed rate cuts.

Combined with continued ETF inflows and corporate accumulation, the narrative in December is changing from “Is the bull market dead?” “How much risk do you want to take on your next step up?”

That’s where Best Wallet Token ($BEST), Bitcoin Hyper ($HYPER), and Tron ($TRX) enter the conversation.

1. Best Wallet Token ($BEST) – Self-custody super app with yield

Best Wallet Token ($BEST) sits at the intersection of two major trends: self-custody and “all-in-one” Web3 super apps. The project’s wallet is built as a non-custodial hub where users can store assets, exchange across dozens of networks, and connect to staking and DeFi without leaving a single interface.

Unique to the Best Wallet app is the upcoming token option. This is a carefully selected and vetted selection of the best cryptocurrency presales available for direct purchase. This means you won’t have to scour countless sites for new pre-sale opportunities and most importantly, you won’t be a victim of rug pulls or other scams.

The team’s ambition is aggressive: to capture a 40% share of the fast-growing crypto wallet market by the end of 2026.

💰 $BEST’s presale numbers suggest the vision is resonating. The current pre-sale price is $0.025995 per $BEST and staking rewards are 75% APY, raising over $17.3 million.

Please consider this. According to the Best Wallet Token price prediction, $BEST could reach $0.07 by 2030. This means an ROI of 169.3%.

You don’t need to hold $BEST to enjoy the unique features of the Best Wallet app. But if you like higher staking rewards, lower trading fees, and governance rights over the direction of your project, now is the time to invest in $BEST.

Because with only four days left until the end of the $BEST presale, the opportunity to participate in this year’s most popular presale is quickly closing.

🚀 Participate in the Best Wallet Token Presale now!

2. Bitcoin Hyper ($HYPER) – Bitcoin Layer-2 with Solana-like performance

If Bitcoin remains an asset that financial institutions want to own, then scaling solutions around it will be the role of leverage.

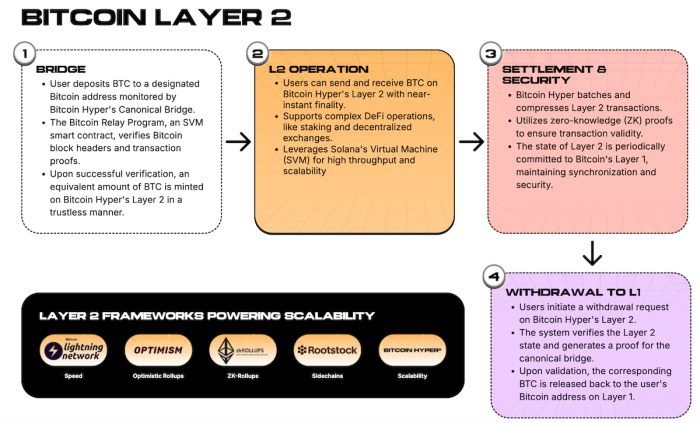

Bitcoin Hyper ($HYPER) focuses on exactly that. A Bitcoin Layer 2 that uses standard bridges and Solana Virtual Machine (SVM) integration to provide fast, low-fee $BTC transactions and smart contracts while keeping Bitcoin as the payment anchor.

This bridge connects Bitcoin Layer 1 to Hyper’s Layer 2, locks $BTC to the base chain, and mints Bitcoin equivalent to the wrapped $BTC into Layer 2.

SVM, on the other hand, provides a high-performance execution environment that brings Solana-style parallel transaction processing, fast confirmations, and scalable smart contract capabilities.

This also means that developers can deploy fast dApps (unprecedented on the Bitcoin blockchain) at layer 2 while inheriting the efficiencies and tools of the Solana ecosystem.

💰 Funding momentum is strong, with over $28.37 million raised in the pre-sale, and the staking yield offered to early buyers is approximately 41%. This places Bitcoin Hyper firmly in the “high-priced” presale category for 2025.

Our Bitcoin hyper price prediction suggests that if Layer 2 launches on time and gets listed on major exchanges, it could reach a high of around $0.08625 by the end of 2026. From the current pre-sale price of $0.013,325, that means a huge ROI of 547%.

In a week where a single corporate treasury just added $836 million to Bitcoin in drawdowns, the dollar BTC-centric Layer 2, which promises faster payments and smart contract flexibility, offers a way to lean into the same theory with bigger upside and more risk.

🚀 Join the Bitcoin Hyper Presale now.

3. Tron ($TRX) – Stablecoin rail with real returns and deflation

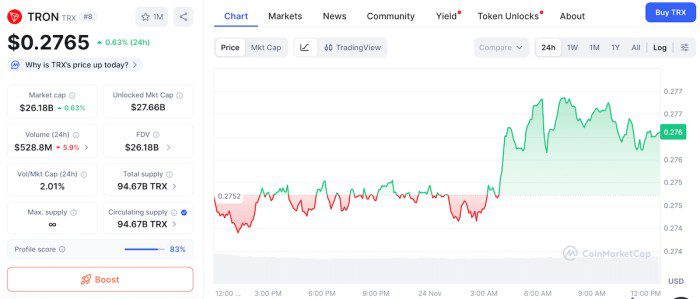

While pre-sales chase future narratives, Tron ($TRX) is already one of the most used blockchains in the world. This network consistently processes thousands of transactions per second with negligible fees, making it the primary rail for USDT remittances.

💰 Tron holds over $80 billion in $USDT, more than half of the world’s supply, and regularly settles tens of billions of dollars in stablecoins per day.

Its usage appears in the basics of tokens. Tron’s Delegated Proof-of-Stake design directs all transaction fees to burn, giving $TRX a net deflationary profile when on-chain activity is strong.

Recent analysis shows deflation of several percentage points per year as burn fees outpace new issuance, while Tron ranks among the most profitable chains on fee and revenue metrics.

In parallel, the community recently approved a significant reduction in network fees to keep $USDT transfers cheap and protect its lead as a payments rail.

At around $0.28 per token and a market cap of nearly $26.2 billion, $TRX is no microcap moonshot, but it offers what many layer 1s lack: clear product market fit around stablecoin payments and a business model that undermines real protocol revenue.

In a world where interest rate cut optimism and institutional Bitcoin purchases draw liquidity back into cryptocurrencies, rails that move retail user liquidity (often stablecoins) could benefit in a quieter, more compounding way.

🚀 Trade $TRX on Binance and other major exchanges.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptoassets and presales are highly volatile and you may lose your capital.

NewsBTC, by Aaron Walker – https://www.newsbtc.com/news/best-crypto-to-buy-after-836m-btc-strategy-bet-and-fed-cut-hints