Bitcoin (BTC) is currently consolidating in the low $120,000 range after hitting a new all-time high (ATH) of $126,199 on Binance. The latest exchange data, including the Cumulative Volume Delta (CVD) confirmation score, suggests that BTC is benefiting from strong pent-up demand.

CVD Confirmation Shows Strong Demand for Bitcoin

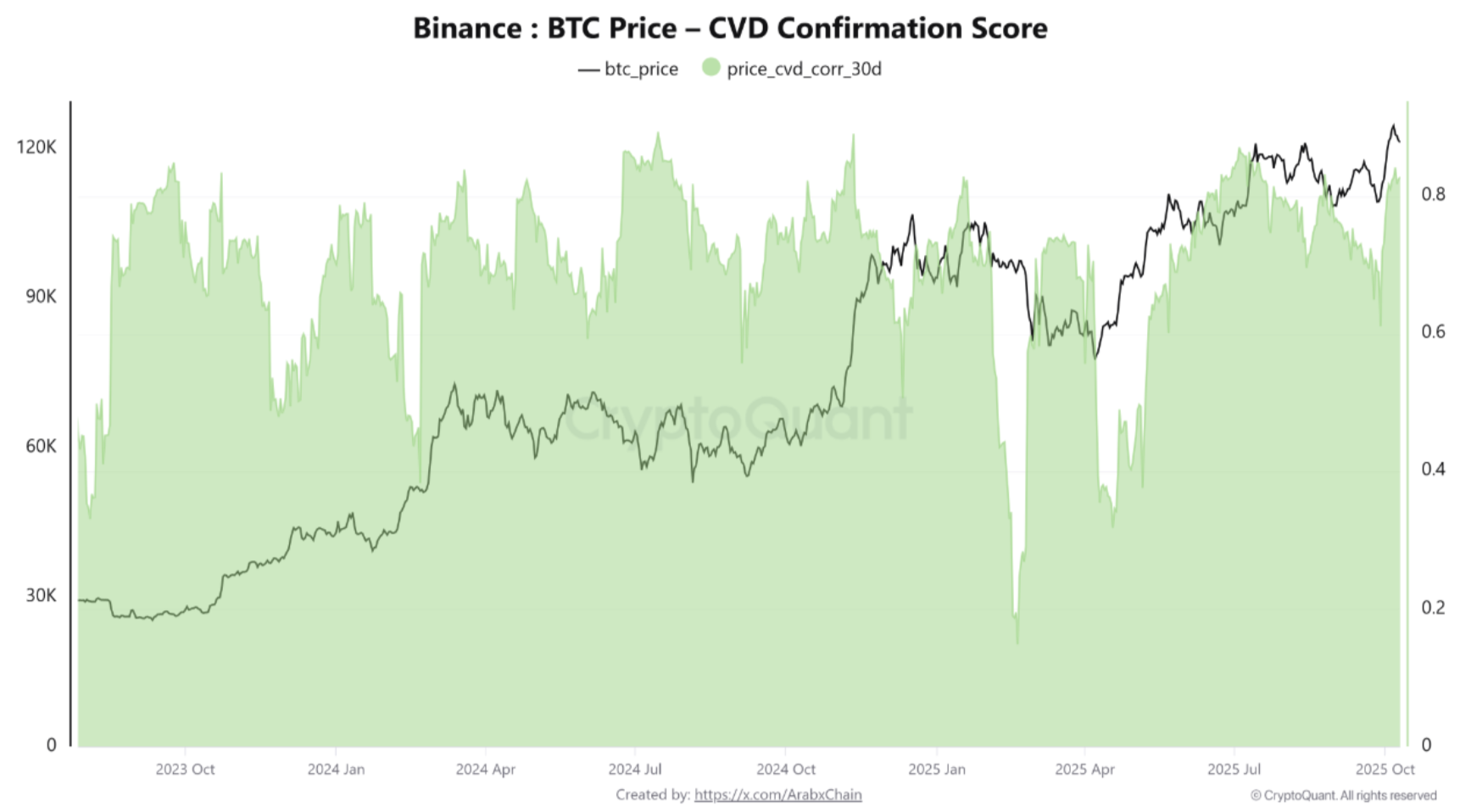

According to a CryptoQuant Quicktake post by contributor Arab Chain, Bitcoin’s CVD Confirmation Score (30-day rolling correlation between Bitcoin price and CVD) suggests a strong resynchronization of the trend.

Related books

For the uninitiated, the CVD Confirmation Score measures the 30-day correlation between Bitcoin price and CVD, tracking the net difference between taker buy and sell volumes on an exchange. A high score (above 0.7) indicates that the price increase is backed by real buying pressure, while a low or negative score indicates weak or speculative momentum.

According to the latest data from Binance, the CVD Confirmation Score is currently hovering around 0.8-0.9, indicating that the current price rally is primarily driven by pure taker buying rather than a technical pullback or short squeeze.

Historical data also suggests that whenever this data point stays around 0.7 for an extended period of time, price corrections tend to be relatively shallow and short-lived. This is because the new liquidity in the market will quickly absorb the supply of BTC.

Analysts at CryptoQuant said that if the CVD Confirmation Score continues to hover above 0.7 and there is another definitive breakout above the $124,000 to $126,000 resistance zone, we could be headed for a downside. potential target Up to $135,000.

However, an increase in BTC price and a negative divergence of CVD confirmation score below 0.4 should be considered as a warning sign as distribution or liquidation pressure is more likely.

Conversely, $112,000-115,000 and $108,000-110,000 stand out as strong support levels for BTC. At these price levels, the CVD confirmation score should remain stable so that the upward trend remains intact. Arab Chain added:

The underlying trend is bullish, supported by real inflows to Binance, the world’s busiest exchange. Watch for three confirmation signals. CVD confirmations should remain high, open interest should remain moderate, and funds should not be excessive. A clear imbalance between these indicators is the first warning of a change in momentum.

Is BTC due for a correction?

While bulls expect Bitcoin’s rally to be prolonged, some analysts believe I’m not very convinced About digital assets surging to new highs in the short term. For example, crypto analyst ZVN recently said BTC may witness a decline before the next surge to $150,000.

Related books

Similarly, fellow cryptocurrency analyst Dick Dandy recently said: predicted BTC may witness a massive 60% price correction and drop to $43,900. At the time of writing, BTC is trading at $118,791, down 1.8% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com