Hidden costs taxing fantastic profits

You may already be familiar with the concept of inflation: the steady erosion of the purchasing power of a currency due to rising prices. But one of the most underestimated sided consequences of inflation is how it interacts with tax law.

They effectively impose two forms of taxation on citizens, as governments are taxed on nominal profits (denominations in Fiat) rather than actual (inflation-adjusted) benefits. Many tax credits, brackets, and benefits thresholds are not adjusted completely or frequently for inflation. That is, even when taxpayers’ true economic status has not improved, taxpayers often face a higher effective burden. This collection of effects constitutes a systematic, silent double (or triple) taxation on citizens.

Capital Gain’s Miracle

Consider a basic example to illustrate how inflation can lead to phantom benefits. Investors buy stocks or products for $1,000. Over time, the price of the asset will rise to $1,100 only due to 10% inflation. This increase will only maintain assets that correspond to the devaluation of money. Investors are not making a real profit from purchasing power. It is merely a nominal increase reflecting inflation. However, under tax law, selling assets for $1,100 will result in $100 in capital gains. Investors currently owe taxes on “income” that doesn’t actually exist.

Note that this example is not merely theoretical. At the time of writing, mid-year, the US dollar lost nearly 10% of its value in 2025.

Stealth sneaking with the benefits of bracket creep and reduction

Fraud can’t stop at capital gains. The broader, more insidious effect of inflation lies in how tax brackets, deductions, credits, and instrumental tested benefits are treated. Only some of these thresholds are adjusted automatically or periodically for inflation, and even those adjusted in questionable ways. This phenomenon is known as bracket creep.

As wages and assets value nominally rise and respond to inflation, taxpayers could be pushed into the higher tax band even if actual income is not increasing. For example, workers who receive a 5% salary increase in one year with 5% inflation are virtually not good, but may end up in a higher tax range and lose more income from taxes. This effect is subtle, but it is popular.

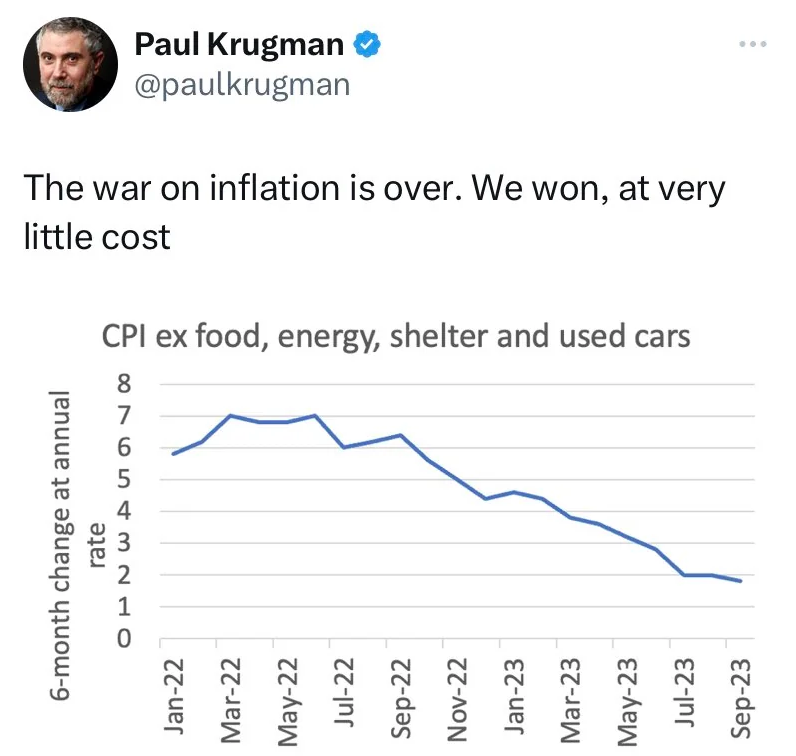

Each year, the IRS adjusts more than 40 tax provisions relating to inflation. The IRS uses the Consumer Price Index (CPI) to adjust the values of the parameters. This does this by getting the basic value of the tax parameters, multiplying it by this year’s CPI and dividing it by the base year’s CPI. But there’s a catch. CPI is a hilarious operation metric that is regularly changed. It makes me wonder: Who will benefit from these changes?

Mortgage costs were in CPI, as were car payments before 1983 and before 1998. Currently, the price index does not include borrowing costs. So, when interest rates jumped last year, official inflation didn’t fully capture the impact on consumer well-being. 4/n pic.twitter.com/xqc2bvpdyi

– Lawrence H. Summers (@lhsummers) February 27, 2024

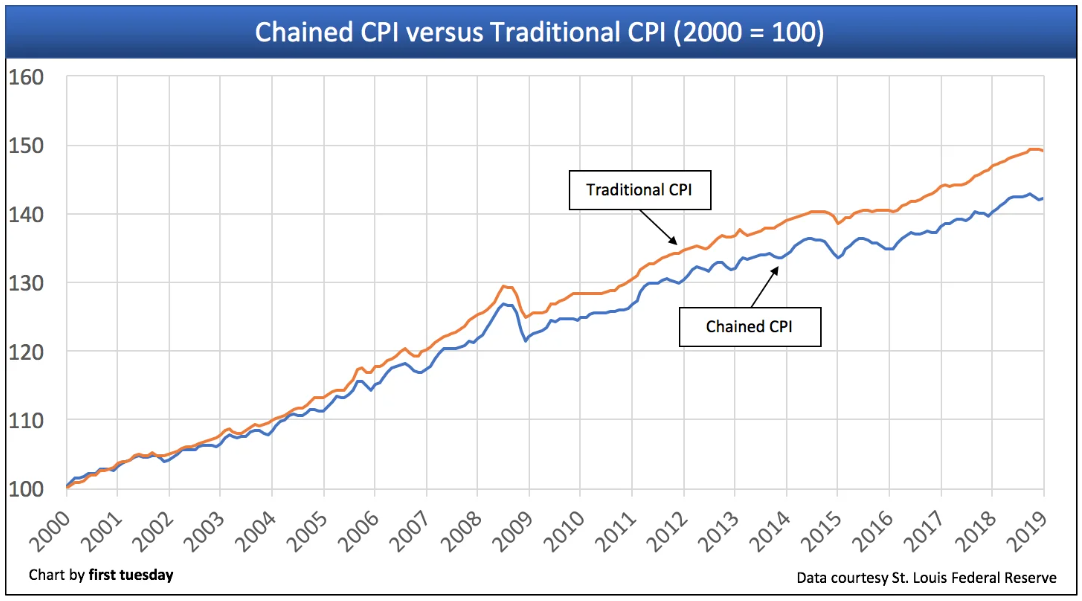

CPI is not the only way to adjust tax parameters. Taxes can be adjusted in a variety of ways, such as average wage growth (because social security coverage is currently being adjusted) or chain CPI. This is another way to measure inflation.

Though it is an obscure public policy, choice of adjustment affects taxpayers. That could mean a higher or lower tax burden over the long term. The US federal law passed in 2017 applied chain-weighted CPIs in place of the major CPIs to adjust for incremental increases in income tax ranges. However, switching to this metric results in relatively small adjustments in tax brackets each year, resulting in a wider gap between actual value and nominal value taxation.

This move towards chain-weighted CPI is expected to ultimately push more citizens into a higher tax range, thereby increasing the taxes that this gap compound has an impact over time.

Additionally, deductions such as tax credits, child tax credits, earned income tax credits, and medical expenses deductions often fall behind or capped without adjusting inflation. Over time, the true value of these credits will shrink, and profits will be reduced even if the cost of living increases. Similarly, income thresholds for benefits such as food aid, housing subsidies, and educational subsidies remain fixed for years, resulting in people losing eligibility simply due to increased wages adjusted.

This means that inflation does not only erode the true value of what individuals earn or save. They can also strip them of tax cuts and government support, even if their standard of living has not changed.

Composite loss

Together, these effects exacerbate the burden on responsible financial actions. For a long time, citizens face:

Silent taxes via inflation that underestimates cash and fixed assets. Even if there is no actual profit, it will still be taxed as capital gains. Without actual wage increases, the marginal tax rate via bracket creep will be higher.

The system punishes not only investors, but also wage workers, retirees, and those who rely on fixed income and government assistance. For decades, these distortions lead to massive transfer of wealth from the public to the government without the explicit law of raising taxes.

Cases for Reform: Indexing Tax Laws Realistically

To address these distortions, tax policies need to provide a more rigorous and comprehensive explanation of inflation. Capital gains should be indexed on an accurate measure of inflation, so that only the actual increase in wealth is taxed. Additionally, accurate and responsive metrics should be used to adjust tax, deductions, and benefits thresholds annually along inflation. There is indeed a great reason for concern that the US government’s way of measuring inflation is becoming increasingly unreliable. These inaccuracies will have many downstream influences based on all agencies making decisions based on them, and therefore all citizens affected by the institutional policies.

Call for Clarity: Open Letter to Truflation’s US Leader

At Truflation, our mission is to bring transparency, accuracy and independence to economic data when it matters most. Today we share a formal letter sent to the leadership of the US government, proposing proven real-time inflation tracking solutions to support national decision-making during the structural data challenges.

Some jurisdictions attempt to create partial inflation indexes, but these efforts are often incomplete or politically manipulated. A principled and consistent approach restores fairness by ensuring that taxation is targeted at actual income and wealth rather than statistical illusions.

In summary

Inflation is more than a macroeconomic challenge. A multiplier for stealth taxation. Inflation becomes a double tax tool by eroding the value of money while tax law continues to assess nominal income and profits. When this is combined with taxes, credits and profits that cannot be adjusted accordingly, the outcome is a system that disproportionately narrows citizens from every step. It is a slow and quiet betrayal of financial prudence and long-term planning. Reforming tax systems to explain inflation is necessary to maintain fairness, transparency and economic integrity in an era of sustained currency devaluation.