The Sheeva Inu (Shiv) fell sharply early on Friday as President Donald Trump’s new tariffs heavier on market leader Bitcoin and strengthened the US dollar. The price chart still offers bullish tips.

Shib crashed 6% on a brutal 24-hour sale from 13:00 on July 31 to 12:00, plunging from $0.000013 to $0.000012. Prices have reached lows since July 9th, bringing the downtrend closer to $0.00001600 from the highs on July 21st.

The decline follows a surge in the number of SHIBs held in central exchanges. According to Coindesk’s Market Insights model, the tally surged to 84.9 trillion tokens on July 28, indicating the distribution of potential whales despite a $63.7 million accumulation of 4.66 trillion Syb. Meanwhile, the burn rate explodes 16,700% as 62 million shiv tokens destroyed in a regulated transaction.

Important AI insights from the past 24 hours

Price rejection at the $0.000013 resistance caused a massive distribution stage. The support base was solidified at $0.000012.

What’s next?

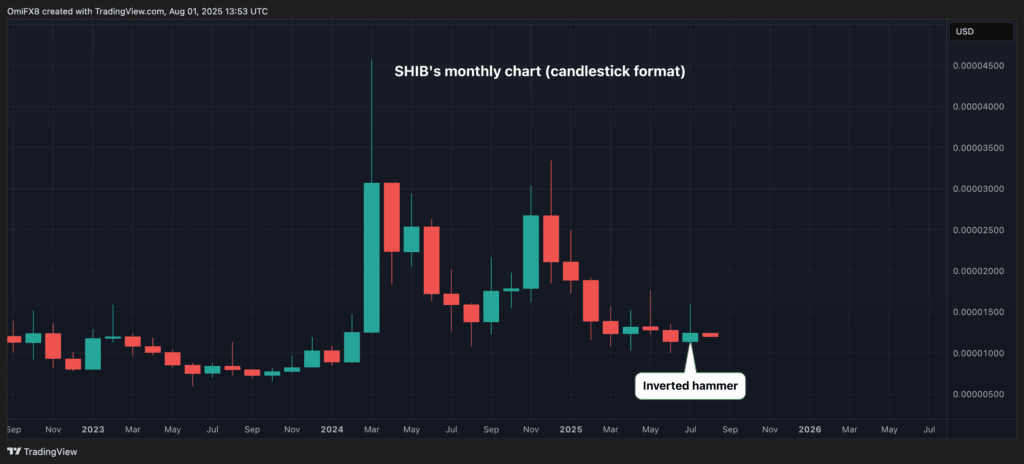

Despite the recent slides, the technical outlook appears constructive, but I would like to thank the “Reverse Bull Hammer” candle in July.

The reverse hammer features a long upper core, a small body, and almost no lower core. This shape shows that while the Bulls first raised the price, the sellers were ultimately overwhelmed, and the price has almost returned to its starting point for the period.

As with Shib, the pattern appears after a notable downtrend, indicating that the Bulls are trying to reaffirm themselves in the market. This pattern therefore represents an early indication of an immediate reversal of bullish trends.

However, SHIB traders should be aware that if they fall below the July low of 0.00001108, they will disable bullish candlestick patterns.

Disclaimer: Some of this article was generated with the support of AI tools and reviewed by our editorial team to ensure accuracy and compliance with the standards. For more information, see Coindesk’s complete AI policy.