Crypto Markets increased volatility on Wednesday as Federal Reserve Chair Jerome Powell’s Hawkish remarks rattled leveraged traders.

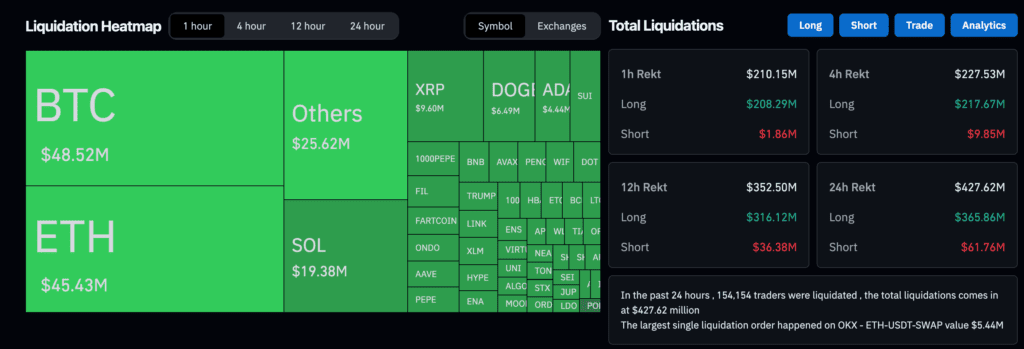

While Powell spoke, Bitcoin (BTC) fell below $116,000, causing liquidation to surge in over $200 million in an hour on all digital assets, Coinglas data shows.

The central bank did not change interest rates, Powell argued potential inflationary pressure from tariffs, with two officials opposed in favor of the cuts.

Read more: Bitcoin falls below $116K for under 116K as Jerome Powell makes Hawkish’s remarks

Later in the session, BTC bouncing above $117,000, down 0.8% until the day, trading at the bottom of the tight range for three weeks. Ether (ETH) slipped by 3% and then recovered to $3,750, a modest low (-0.6%) over the past 24 hours.

Altcoins was first declined by Steeper, but quickly recovered. The hype tokens for Solana’s Sol (Sol), Avalanche’s Avax (Avax) and Hyperliquid fell 4%-5% before reducing losses, while Bonk and Pengu fell 10% each before bouncing off.

In traditional market checks, Meta (META) and Microsoft (MSFT) posted strong quarterly revenues, up 10% and 6%, respectively, after normal trading hours.

“The market is increasingly beginning to believe that the Fed may be behind the curve,” said Matt Mena, an analyst at Digital Asset Issuer 21 Shares, in a market note.

“Last week’s PCE print marked a second soft reading, and consumer spending is weakening,” he wrote. “With high unemployment and actual yields still limited, we are nervous about maintaining such harsh policy risks and wider slowdowns.”

The current setup is reminiscent of the last quarter of 2023, calling it a “Fed constrained by softening inflation, increasing political volatility and lagging indicators.”

He said the Fed can drive BTC to $150,000 each year, so the Fed “stage is set up” for them to pivot.